Question: how do i do this? Elegant Universal uses the balance sheet aging method to account for uncollectible debt on receivables. The following is the past-due

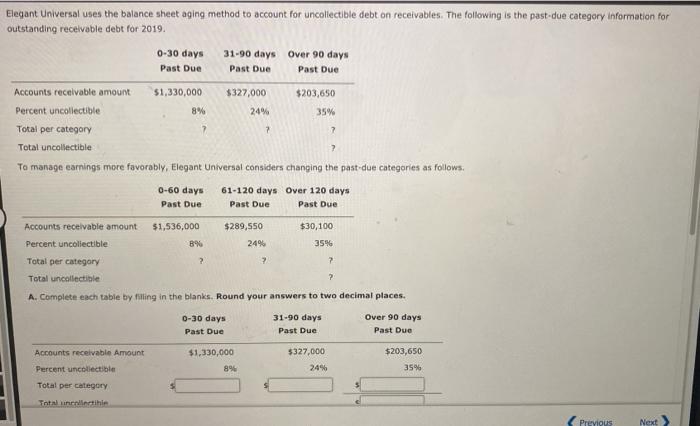

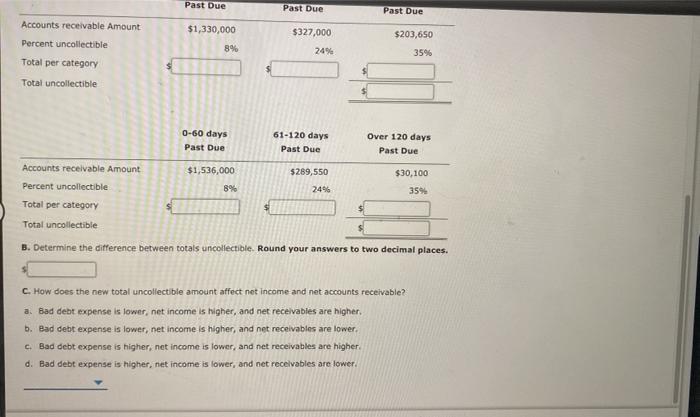

Elegant Universal uses the balance sheet aging method to account for uncollectible debt on receivables. The following is the past-due category Information for outstanding receivable debt for 2019, 0-30 days Past Due 31-90 days over 90 days Past Due Past Due Accounts receivable amount $1,330,000 $327,000 $203,650 Percent uncollectible 8% 24% 35% Total per category 7 Total uncollectible To manage earnings more favorably, Elegant Universal considers changing the past due categories as follows. 0-60 days Past Due 61-120 days Over 120 days Past Due Past Due Accounts receivable amount $1,536,000 $289,550 $30,100 Percent uncollectible B% 24% 35% Total per category ? ? 2 Total uncollectible ? A. Complete each table by filling in the blanks. Round your answers to two decimal places. 0-30 days Past Due 31-90 days Past Due Over 90 days Past Due $1,330,000 Accounts receivable Amount Percent uncollectible Total per category $327,000 24% $203,650 35% 896 Totalthie Previous Next Past Due Past Due Past Due Accounts receivable Amount $1,330,000 $203,650 Percent uncollectible $327,000 24% 8% 35% Total per category Total uncollectible 0-60 days Past Due 61-120 days Past Due Over 120 days Past Due $1,536,000 Accounts receivable Amount Percent uncollectible $30,100 $289,550 24% 8% 359 Total per category Total uncollectible B. Determine the difference between totals uncollectible. Round your answers to two decimal places. C. How does the new total uncollectible amount affect net income and net accounts receivable? a. Bad debt expense is lower, net income is higher, and net receivables are higher. b. Bad debt expense is lower, net income is higher, and net receivables are lower. c. Bad debt expense is higher, net income is lower, and net receivables are higher. d. Bad debt expense is higher, net income is lower, and net receivables are lower

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts