Question: how do i do this labour report? Labour Costing: There are, in fact, two small numbers that cause chefs and food service operators to have

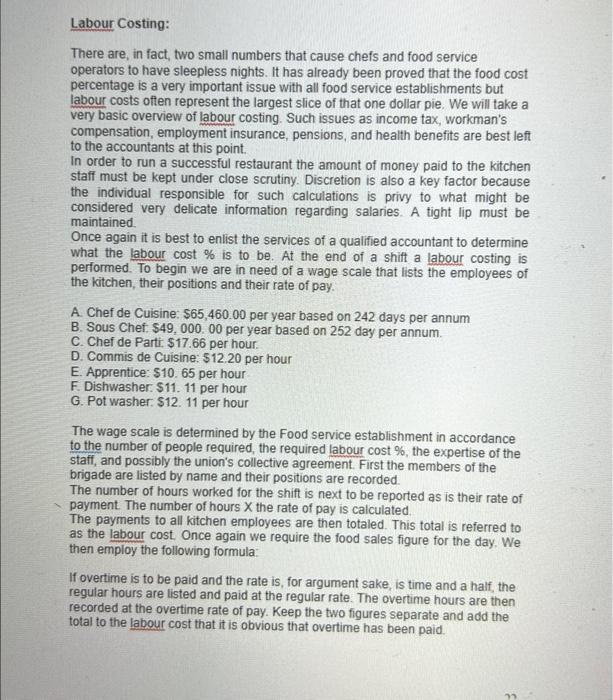

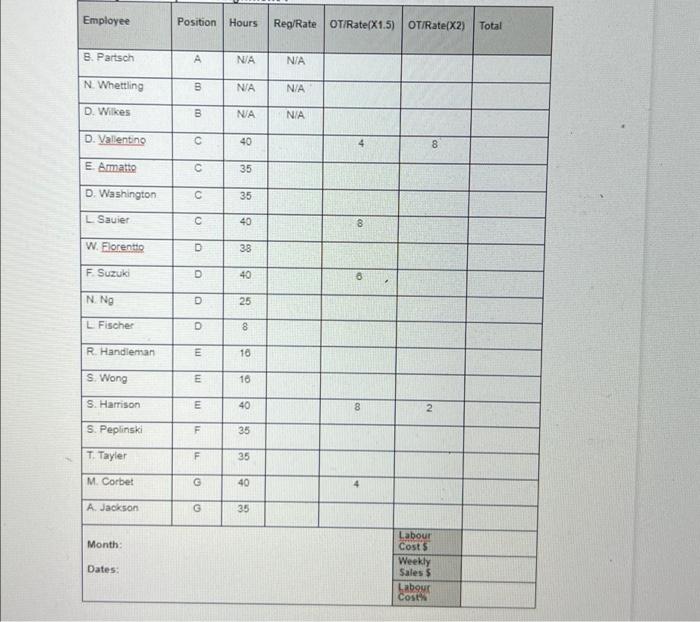

Labour Costing: There are, in fact, two small numbers that cause chefs and food service operators to have sleepless nights. It has already been proved that the food cost percentage is a very important issue with all food service establishments but labour costs often represent the largest slice of that one dollar pie. We will take a very basic overview of labour costing. Such issues as income tax, workman's compensation, employment insurance, pensions, and health benefits are best left to the accountants at this point, In order to run a successful restaurant the amount of money paid to the kitchen staff must be kept under close scrutiny. Discretion is also a key factor because the individual responsible for such calculations is privy to what might be considered very delicate information regarding salaries A tight lip must be maintained Once again it is best to enlist the services of a qualified accountant to determine what the labour cost % is to be. At the end of a shift a labour costing is performed. To begin we are in need of a wage scale that lists the employees of the kitchen, their positions and their rate of pay. A. Chef de Cuisine: $65,460.00 per year based on 242 days per annum B. Sous Chef. $49.000.00 per year based on 252 day per annum. C. Chef de Parti: $17.66 per hour. D. Commis de Cuisine: $12.20 per hour E. Apprentice: $10.65 per hour F. Dishwasher. $11. 11 per hour G. Pot washer. $12. 11 per hour The wage scale is determined by the Food service establishment in accordance to the number of people required, the required labour cost %, the expertise of the staff, and possibly the union's collective agreement. First the members of the brigade are listed by name and their positions are recorded. The number of hours worked for the shift is next to be reported as is their rate of payment. The number of hours X the rate of pay is calculated The payments to all kitchen employees are then totaled. This total is referred to as the labour cost. Once again we require the food sales figure for the day. We then employ the following formula: If overtime is to be paid and the rate is for argument sake, is time and a half the regular hours are listed and paid at the regular rate. The overtime hours are then recorded at the overtime rate of pay. Keep the two figures separate and add the total to the labour cost that it is obvious that overtime has been paid. Employee Position Hours Reg/Rate OT/Rate(X1.5) OT/Rate(X2) Total A B. Partsch NA N/A N. Whettling B NA N/A D. Wilkes B NA D. Valentino c 40 4 8 E Ammatto C 35 D. Washington 35 L Sauer c 40 8 W.Florento D 38 F Suzuki D 40 8 N NO 25 L. Fischer 8 R Handleman E 16 S Wong E 10 S. Harrison ml E 40 8 2 S. Peplinski F 35 T. Tayler F &&&8] 35 M. Corbet G 40 A. Jackson G 35 Month: Dates: Labour Costs Weekly Sales & Labour Cost Labour Costing: There are, in fact, two small numbers that cause chefs and food service operators to have sleepless nights. It has already been proved that the food cost percentage is a very important issue with all food service establishments but labour costs often represent the largest slice of that one dollar pie. We will take a very basic overview of labour costing. Such issues as income tax, workman's compensation, employment insurance, pensions, and health benefits are best left to the accountants at this point, In order to run a successful restaurant the amount of money paid to the kitchen staff must be kept under close scrutiny. Discretion is also a key factor because the individual responsible for such calculations is privy to what might be considered very delicate information regarding salaries A tight lip must be maintained Once again it is best to enlist the services of a qualified accountant to determine what the labour cost % is to be. At the end of a shift a labour costing is performed. To begin we are in need of a wage scale that lists the employees of the kitchen, their positions and their rate of pay. A. Chef de Cuisine: $65,460.00 per year based on 242 days per annum B. Sous Chef. $49.000.00 per year based on 252 day per annum. C. Chef de Parti: $17.66 per hour. D. Commis de Cuisine: $12.20 per hour E. Apprentice: $10.65 per hour F. Dishwasher. $11. 11 per hour G. Pot washer. $12. 11 per hour The wage scale is determined by the Food service establishment in accordance to the number of people required, the required labour cost %, the expertise of the staff, and possibly the union's collective agreement. First the members of the brigade are listed by name and their positions are recorded. The number of hours worked for the shift is next to be reported as is their rate of payment. The number of hours X the rate of pay is calculated The payments to all kitchen employees are then totaled. This total is referred to as the labour cost. Once again we require the food sales figure for the day. We then employ the following formula: If overtime is to be paid and the rate is for argument sake, is time and a half the regular hours are listed and paid at the regular rate. The overtime hours are then recorded at the overtime rate of pay. Keep the two figures separate and add the total to the labour cost that it is obvious that overtime has been paid. Employee Position Hours Reg/Rate OT/Rate(X1.5) OT/Rate(X2) Total A B. Partsch NA N/A N. Whettling B NA N/A D. Wilkes B NA D. Valentino c 40 4 8 E Ammatto C 35 D. Washington 35 L Sauer c 40 8 W.Florento D 38 F Suzuki D 40 8 N NO 25 L. Fischer 8 R Handleman E 16 S Wong E 10 S. Harrison ml E 40 8 2 S. Peplinski F 35 T. Tayler F &&&8] 35 M. Corbet G 40 A. Jackson G 35 Month: Dates: Labour Costs Weekly Sales & Labour Cost

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts