Question: how do i do this please help me TA. Metro Graphic purchased equipment for $20,000. Metro recorded total depreciation of $12.000 on the equipment. Assume

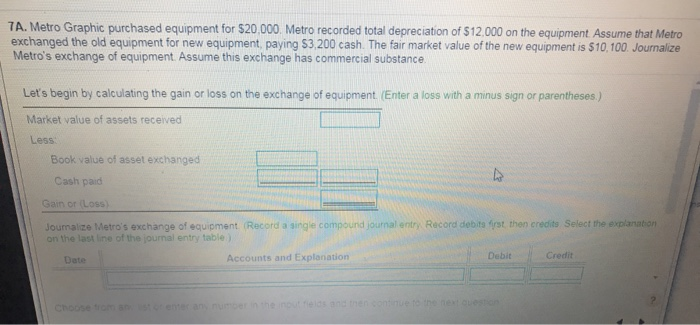

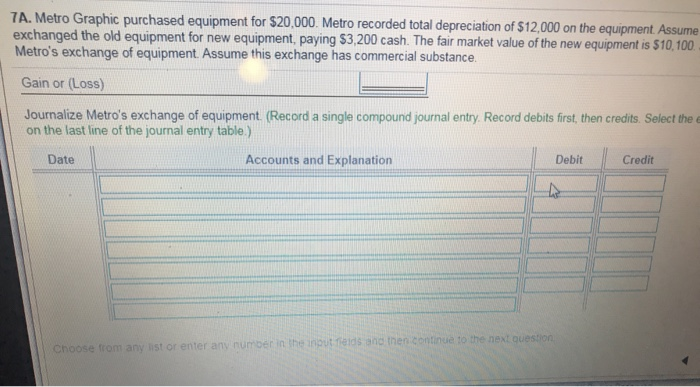

TA. Metro Graphic purchased equipment for $20,000. Metro recorded total depreciation of $12.000 on the equipment. Assume that Metro exchanged the old equipment for new equipment, paying $3.200 cash. The fair market value of the new equipment is $10.100. Journalize Metro's exchange of equipment. Assume this exchange has commercial substance Let's begin by calculating the gain or loss on the exchange of equipment. (Enter a loss with a minus sign or parentheses.) Market value of assets received Less Book value of asset exchanged Cash paid Gain or (Loss) Joumalize Metro's exchange of equipment Record a single compound journal entry Record debit fit then credits Select the explanation on the lastne of the journal entry table Accounts and Explanation Debit Credit TA. Metro Graphic purchased equipment for $20,000. Metro recorded total depreciation of $12,000 on the equipment. Assume exchanged the old equipment for new equipment, paying $3,200 cash. The fair market value of the new equipment is $10,100. Metro's exchange of equipment. Assume this exchange has commercial substance, Gain or (Loss) Journalize Metro's exchange of equipment. (Record a single compound journal entry. Record debits first, then credits. Select the on the last line of the journal entry table.) Accounts and Explanation Debit Date Credit Choose from any list or enter any number in the outfelds and then continue to the next

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts