Question: How do I figure the answer for this? How do I figure this out? ACME Distribution, Inc. December 31, 2021 Adjusting Entries Continued 2 3

How do I figure the answer for this?

How do I figure this out?

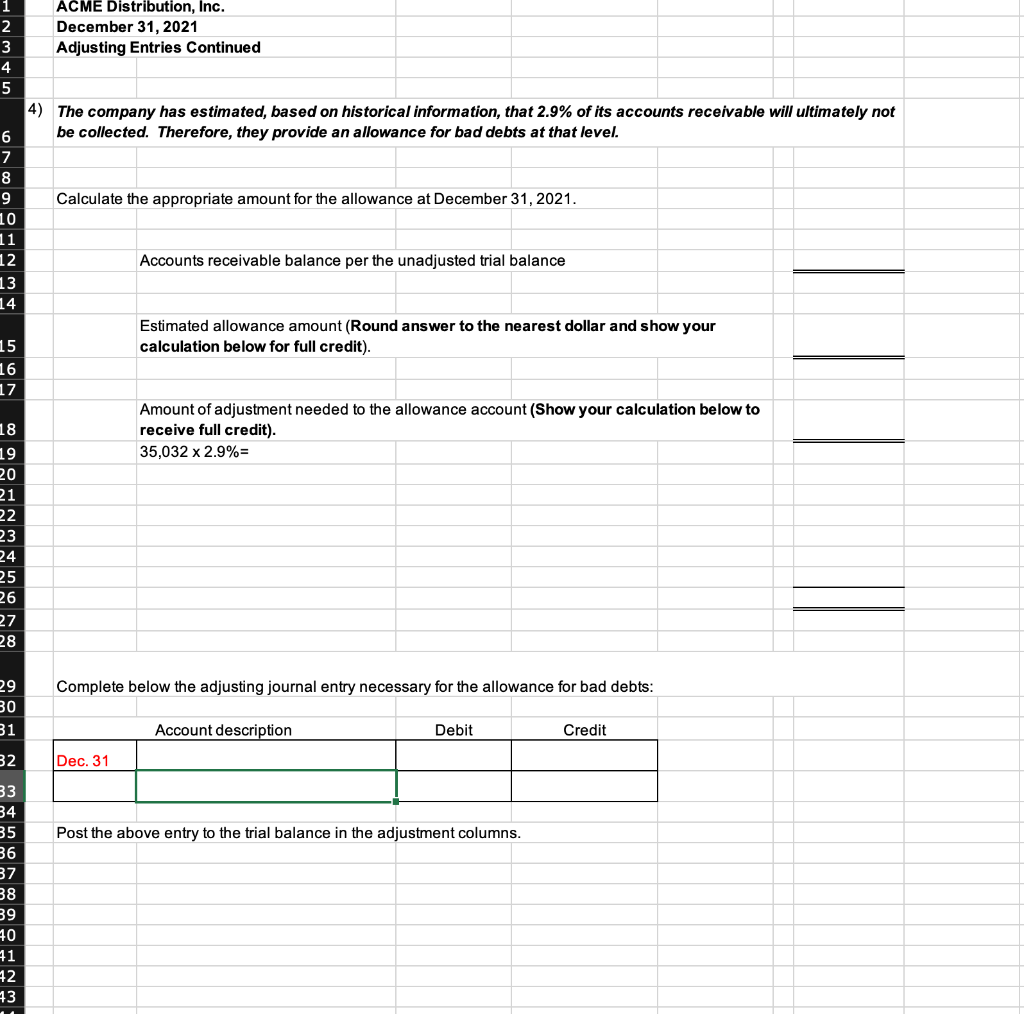

ACME Distribution, Inc. December 31, 2021 Adjusting Entries Continued 2 3 4 5 4) The company has estimated, based on historical information, that 2.9% of its accounts receivable will ultimately not be collected. Therefore, they provide an allowance for bad debts at that level. Calculate the appropriate amount for the allowance at December 31, 2021. 6 7 8 9 10 11 12 13 14 Accounts receivable balance per the unadjusted trial balance Estimated allowance amount (Round answer to the nearest dollar and show your calculation below for full credit). 15 16 17 Amount of adjustment needed to the allowance account (Show your calculation below to receive full credit). 35,032 x 2.9%= 18 19 20 21 22 23 24 25 26 27 28 Complete below the adjusting journal entry necessary for the allowance for bad debts: 29 30 31 Account description Debit Credit 32 Dec. 31 Post the above entry to the trial balance in the adjustment columns. 33 34 35 36 37 38 39 10 71 42 13

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts