Question: how do I figure these out. please give step by step details Required: 1. Compute the cost of each machine. 2. Prepare the journal entry

how do I figure these out. please give step by step details

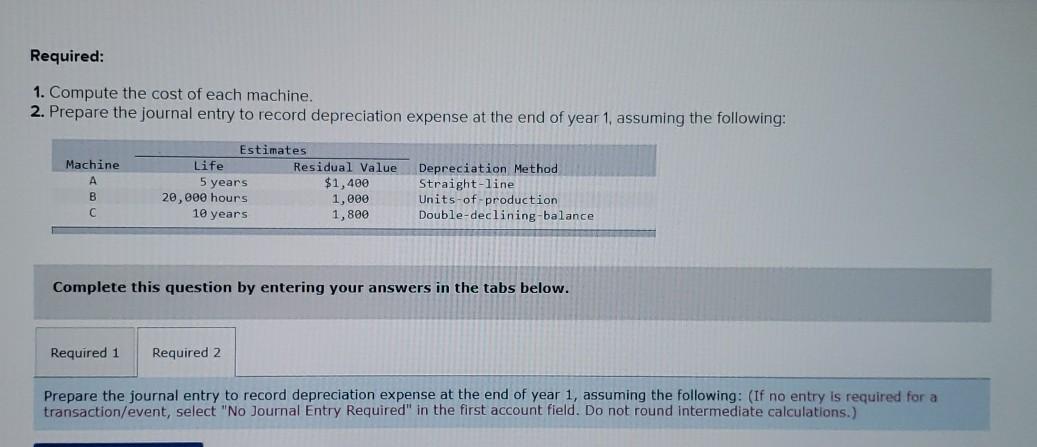

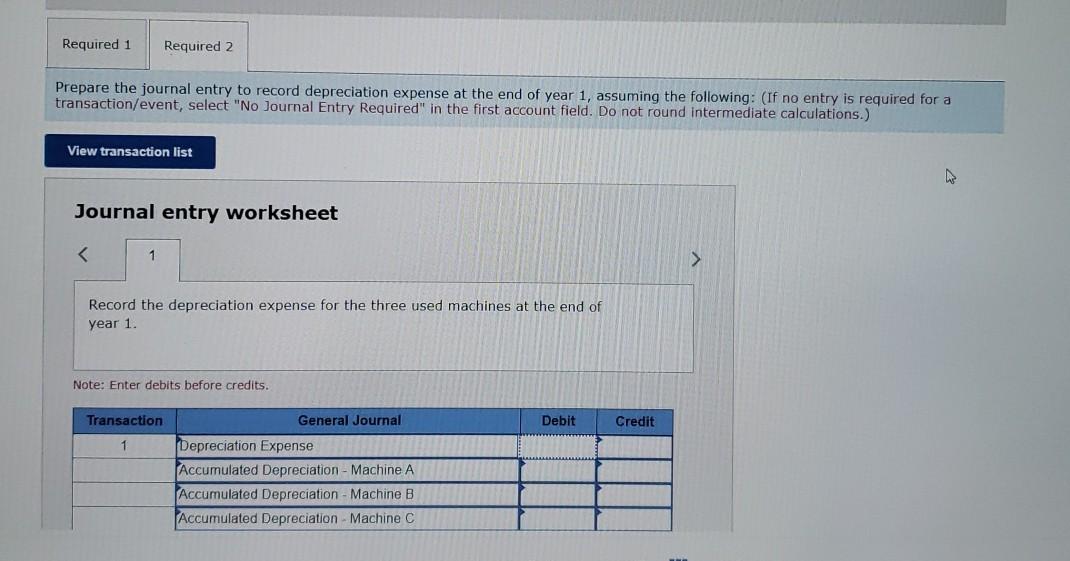

Required: 1. Compute the cost of each machine. 2. Prepare the journal entry to record depreciation expense at the end of year 1, assuming the following: Machine A B C Estimates Life Residual Value 5 years $1,400 20,000 hours 1,000 10 years 1,800 Depreciation Method Straight-line Units-of-production Double-declining-balance Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare the journal entry to record depreciation expense at the end of year 1, assuming the following: (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field. Do not round intermediate calculations.) Required 1 Required 2 Prepare the journal entry to record depreciation expense at the end of year 1, assuming the following: (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field. Do not round intermediate calculations.) View transaction list Journal entry worksheet Record the depreciation expense for the three used machines at the end of year 1. Note: Enter debits before credits. Transaction General Journal Debit Credit 1 Depreciation Expense Accumulated Depreciation - Machine A Accumulated Depreciation - Machine B Accumulated Depreciation Machine C Required: 1. Compute the cost of each machine. 2. Prepare the journal entry to record depreciation expense at the end of year 1, assuming the following: Machine A B C Estimates Life Residual Value 5 years $1,400 20,000 hours 1,000 10 years 1,800 Depreciation Method Straight-line Units-of-production Double-declining-balance Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare the journal entry to record depreciation expense at the end of year 1, assuming the following: (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field. Do not round intermediate calculations.) Required 1 Required 2 Prepare the journal entry to record depreciation expense at the end of year 1, assuming the following: (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field. Do not round intermediate calculations.) View transaction list Journal entry worksheet Record the depreciation expense for the three used machines at the end of year 1. Note: Enter debits before credits. Transaction General Journal Debit Credit 1 Depreciation Expense Accumulated Depreciation - Machine A Accumulated Depreciation - Machine B Accumulated Depreciation Machine C

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts