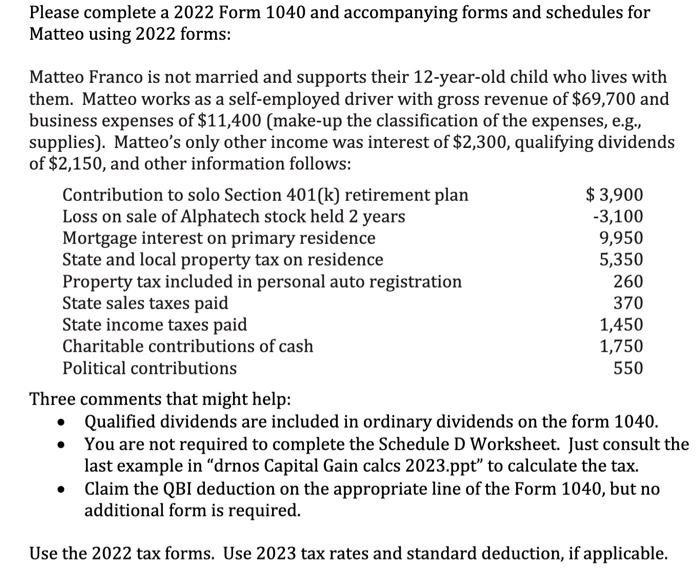

Question: how do i fill out the tax form based on the information? Please complete a 2022 Form 1040 and accompanying forms and schedules for Matteo

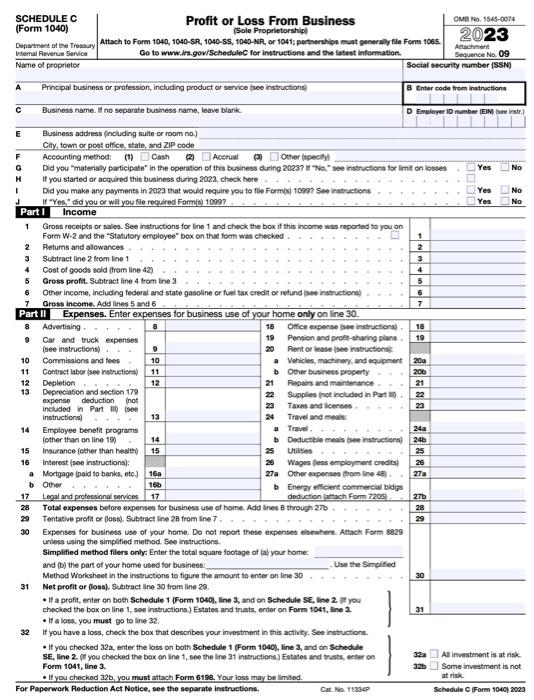

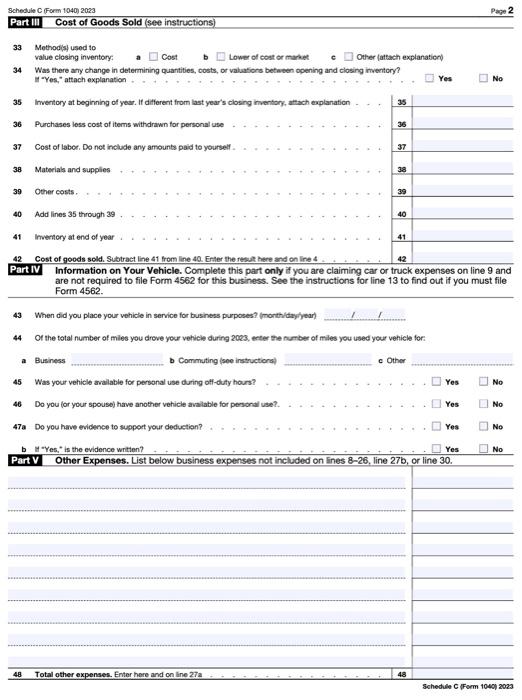

Please complete a 2022 Form 1040 and accompanying forms and schedules for Matteo using 2022 forms: Matteo Franco is not married and supports their 12-year-old child who lives with them. Matteo works as a self-employed driver with gross revenue of $69,700 and business expenses of $11,400 (make-up the classification of the expenses, e.g., supplies). Matteo's only other income was interest of $2,300, qualifying dividends of $ ? 150 and nther information followare. I nree comments tnat mignt nep: - Qualified dividends are included in ordinary dividends on the form 1040. - You are not required to complete the Schedule D Worksheet. Just consult the last example in "drnos Capital Gain calcs 2023.ppt" to calculate the tax. - Claim the QBI deduction on the appropriate line of the Form 1040, but no additional form is required. Use the 2022 tax forms. Use 2023 tax rates and standard deduction, if applicable. artiv Information on Your Vehicle. Complete this part only if you are claiming car or truck expenses on line 9 and are not required to file Form 4562 for this business. See the instructions for line 13 to find out if you must file Form 4562

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts