Question: how do i find the net income (loss) Using the expanded accounting equation, calculate and enter the answers for each question. You will need to

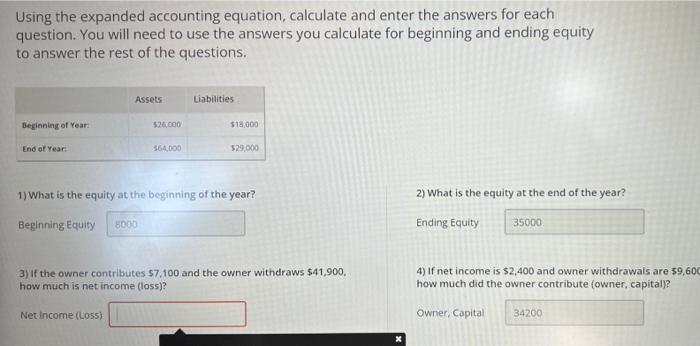

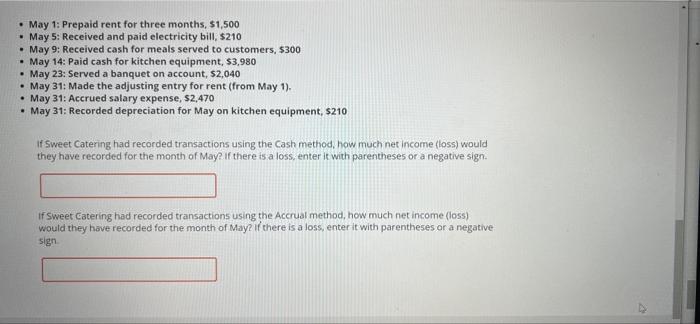

Using the expanded accounting equation, calculate and enter the answers for each question. You will need to use the answers you calculate for beginning and ending equity to answer the rest of the questions. Assets Liabilities Beginning of Year $26.000 $18,000 End of Year 564.000 $29.000 1) What is the equity at the beginning of the year? 2) What is the equity at the end of the year? Beginning Equity 8000 Ending Equity 35000 3) If the owner contributes 57,100 and the owner withdraws $41,900, how much is net income (loss)? 4) If net income is $2,400 and owner withdrawals are 59,600 how much did the owner contribute (owner, capital? Net Income (L055) Owner, Capital 34200 May 1: Prepaid rent for three months, $1,500 . May 5: Received and paid electricity bill, $210 - May 9: Received cash for meals served to customers, $300 - May 14: Paid cash for kitchen equipment, $3,980 May 23: Served a banquet on account, $2,040 . May 31: Made the adjusting entry for rent (from May 1). . May 31: Accrued salary expense, $2,470 . May 31: Recorded depreciation for May on kitchen equipment, 8210 if Sweet Catering had recorded transactions using the Cash method, how much net Income (loss) would they have recorded for the month of May. If there is a loss, enter it with parentheses or a negative sign. if Sweet Catering had recorded transactions using the Accrual method, how much net income (loss) would they have recorded for the month of May? If there is a loss, enter it with parentheses or a negative sign

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts