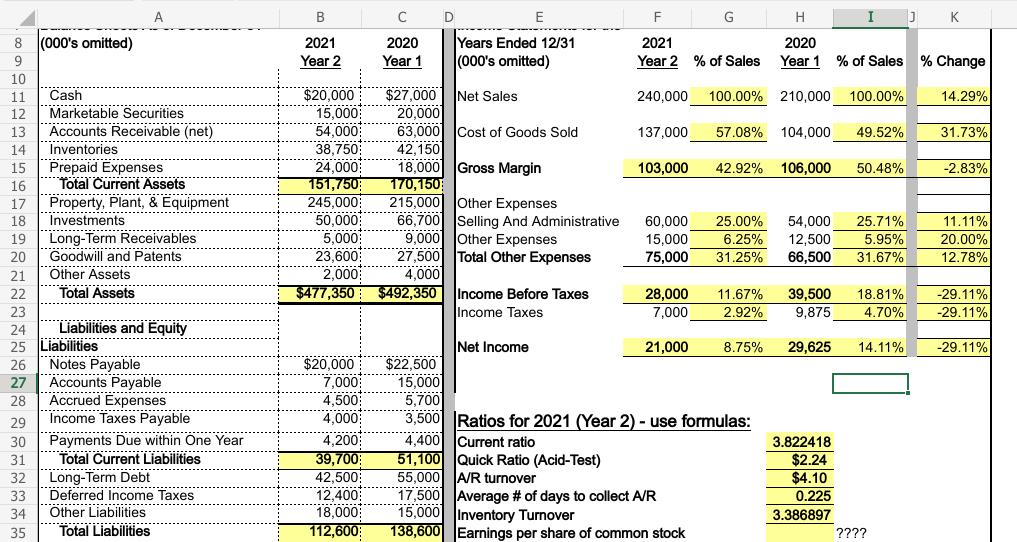

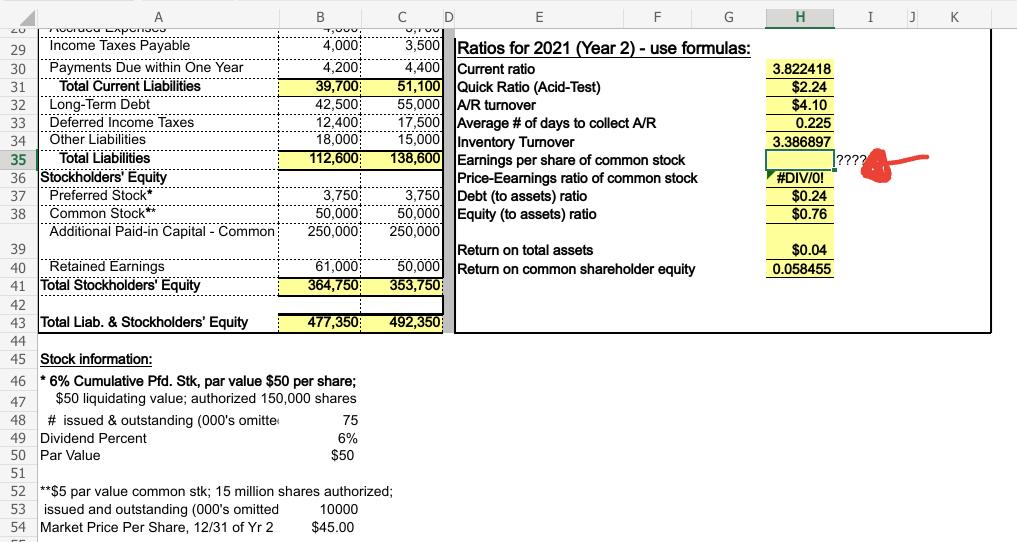

Question: How do I find the weighted average or do I just use the common shares outstanding without the average? BUHARHASSAN 2835 8 9 10 11

BUHARHASSAN 2835 8 9 10 11 Cash Marketable Securities 13 Accounts Receivable (net) Inventories 14 12 15 16 20 17 Property, Plant, & Equipment 18. Investments 21 22 19 Long-Term Receivables Goodwill and Patents 23 24 25 26 (000's omitted) 28 31 Prepaid Expenses Total Current Assets 33 34 ........... Other Assets Total Assets 27 Accounts Payable Accrued Expenses Income Taxes Payable Liabilities and Equity Liabilities Notes Payable 29 30 Payments Due within One Year Total Current Liabilities Long-Term Debt Deferred Income Taxes Other Liabilities Total Liabilities B 2021 Year 2 Years Ended 12/31 (000's omitted) $27,000 Net Sales 20,000 63,000 Cost of Goods Sold 42,150 18,000 Gross Margin 170,150 215,000 Other Expenses 50,000 66,700 5,000 9,000 23,600 27,500 2,000 4,000 $477,350 $492,350 $20,000 15,000 54,000 38,750 24,000 151,750 245,000 $20,000 7,000 4,500 4,000 C 2020 Year 1 4,200 39,700 42,500 12,400 18,000 112,600 Selling And Administrative Other Expenses Total Other Expenses Income Before Taxes Income Taxes Net Income F 2021 Year 2 % of Sales G 240,000 100.00% 210,000 100.00% 60,000 15,000 75,000 137,000 57.08% 104,000 49.52% 42.92% 106,000 50.48% 103,000 17,500 Average # of days to collect A/R 15,000 Inventory Turnover 138,600 H 2020 Year 1 % of Sales 28,000 11.67% 39,500 7,000 2.92% 9,875 21,000 Earnings per share of common stock 25.00% 54,000 25.71% 6.25% 12,500 5.95% 31.25% 66,500 31.67% $22,500 15,000 5,700 3,500 Ratios for 2021 (Year 2) - use formulas: 4,400 Current ratio 51,100 Quick Ratio (Acid-Test) 55,000 A/R turnover 8.75% 18.81% 4.70% 29,625 14.11% 3.822418 $2.24 $4.10 0.225 3.386897 ???? K % Change 14.29% 31.73% -2.83% 11.11% 20.00% 12.78% -29.11% -29.11% -29.11%

Step by Step Solution

3.37 Rating (163 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts