Question: How do I forecast a balance sheet? (b.) Forecast the 2017 balance sheet for Whole Foods using the following forecast assumptions ($ in millions). Accounts

How do I forecast a balance sheet?

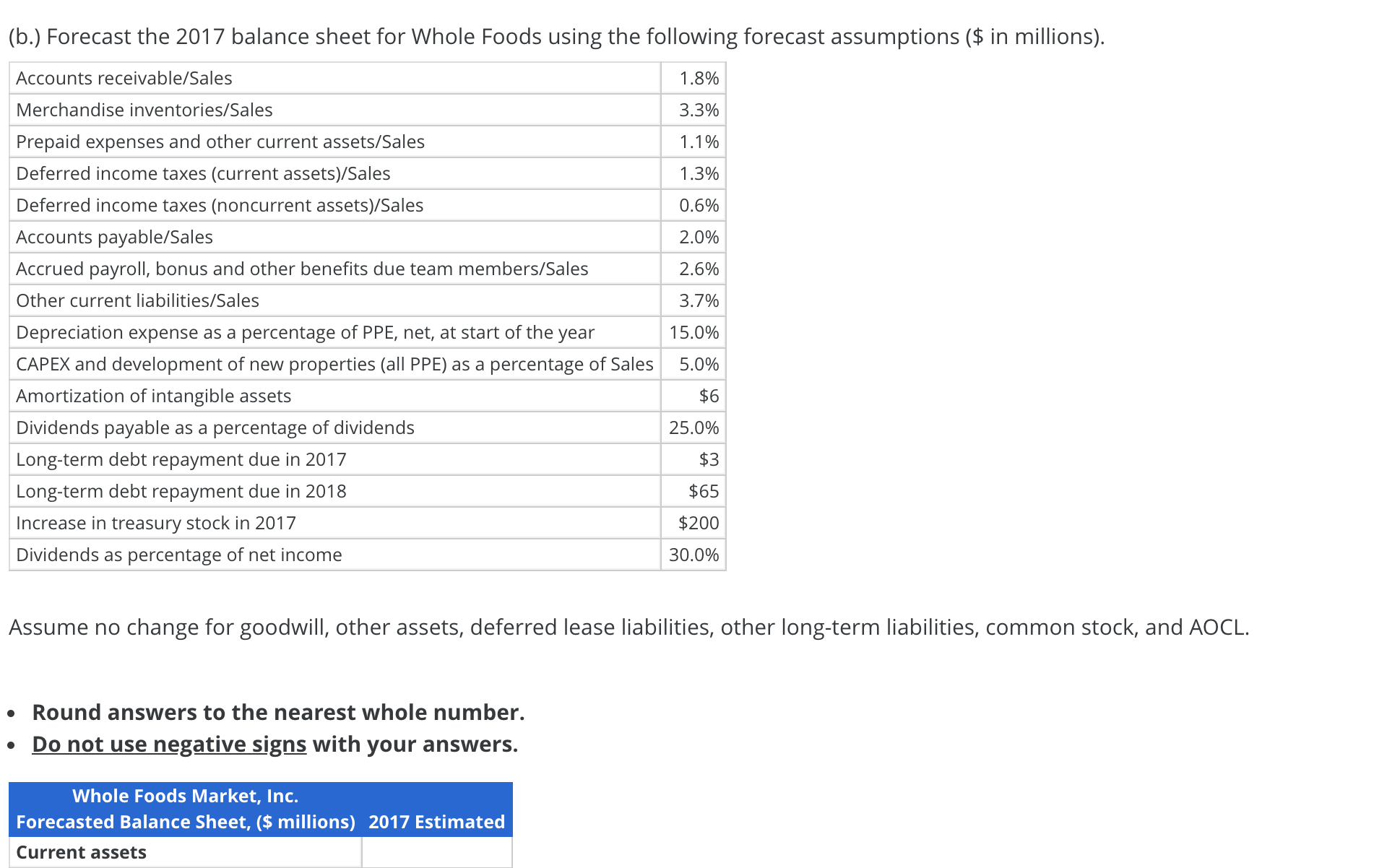

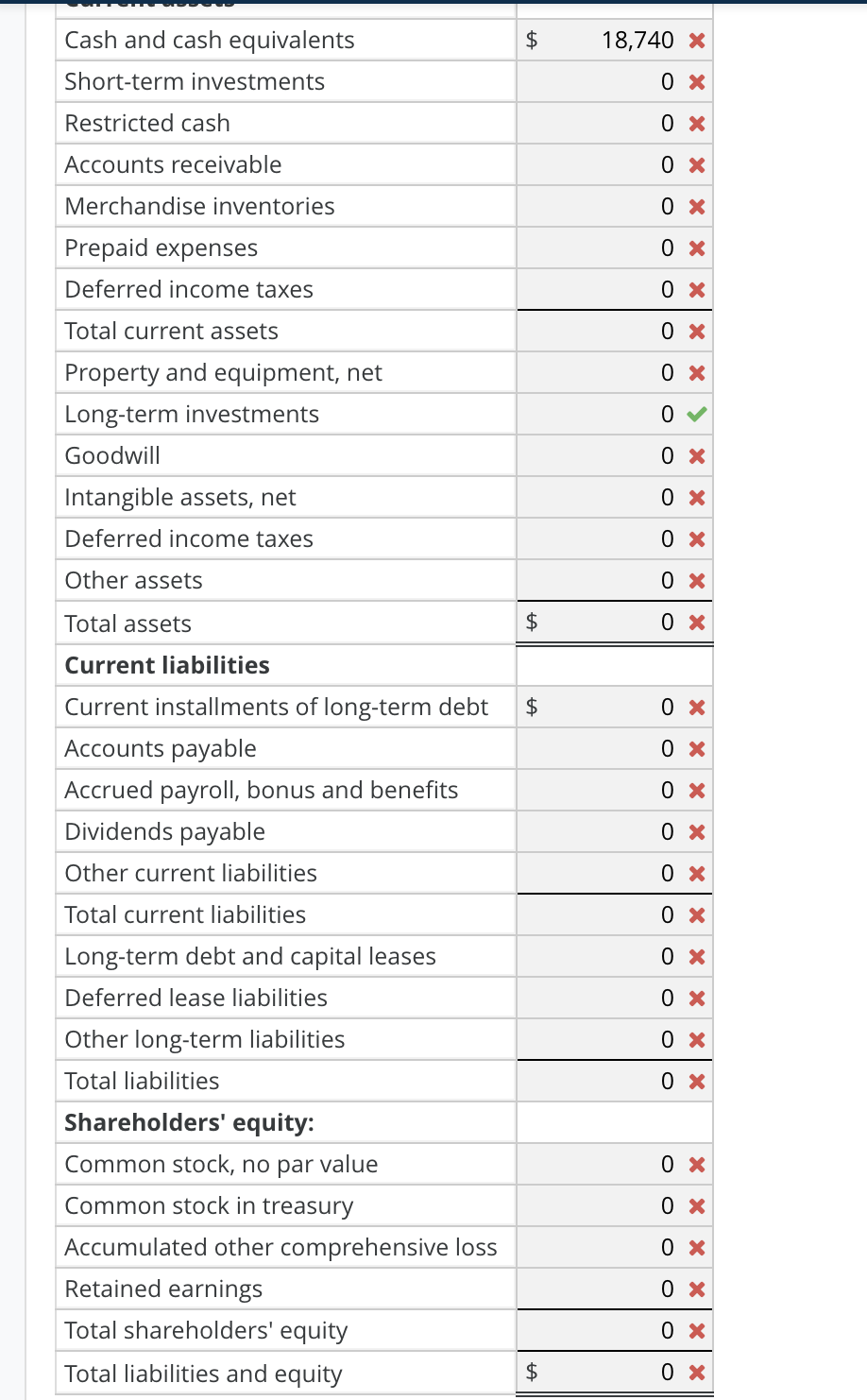

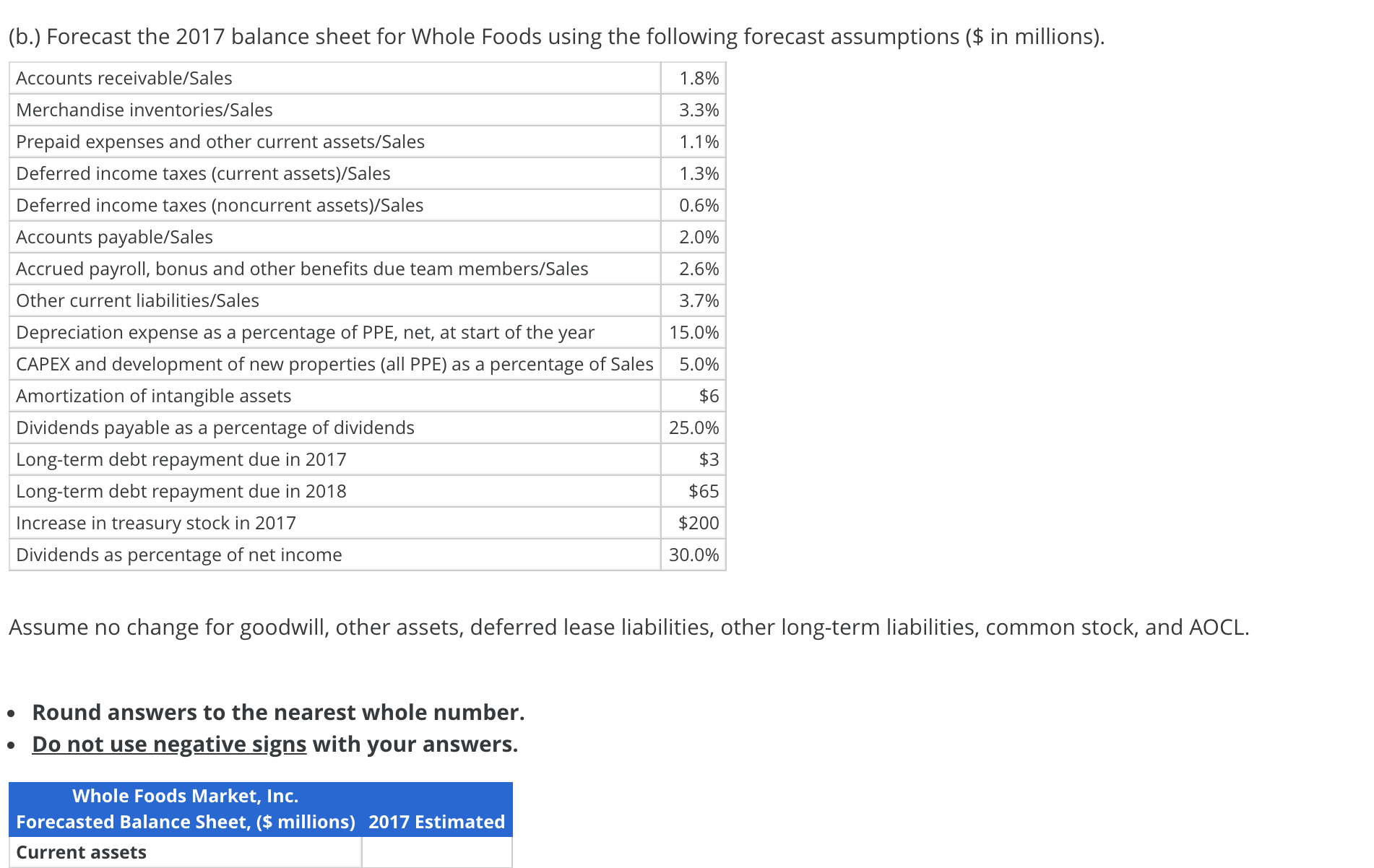

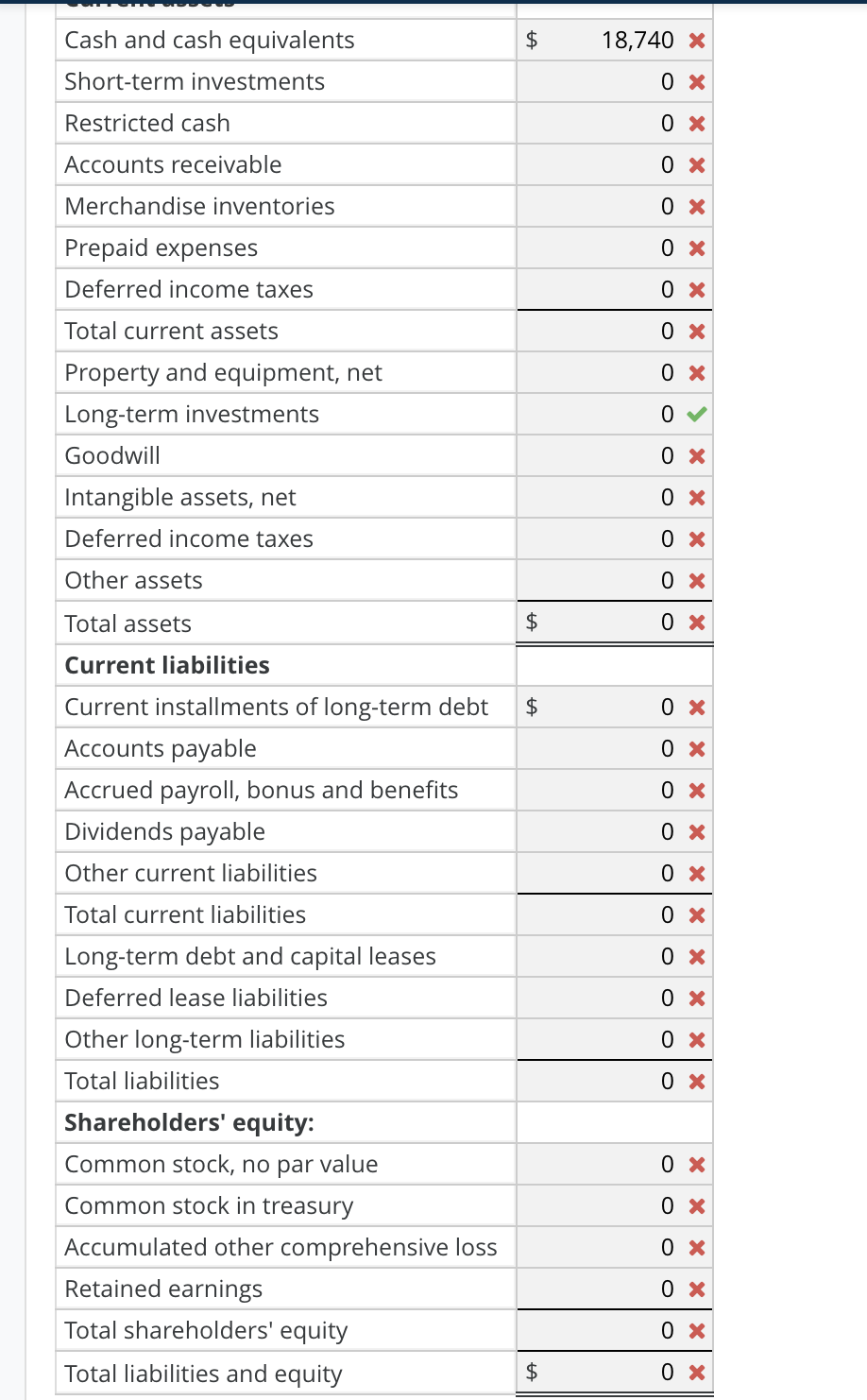

(b.) Forecast the 2017 balance sheet for Whole Foods using the following forecast assumptions ($ in millions). Accounts receivable/Sales 1.8% Merchandise inventories/Sales 3.3% Prepaid expenses and other current assets/Sales 1.1% Deferred income taxes (current assets)/Sales 1.3% Deferred income taxes (noncurrent assets)/Sales 0.6% Accounts payable/Sales 2.0% Accrued payroll, bonus and other benets due team members/Sales 2.6% Other current liabilities/Sales 3.7% Depreciation expense as a percentage of PPE, net, at start of the year 15.0% CAPEX and development of new properties (all PPE) as a percentage of Sales 5.0% Amortization of intangible assets $6 Dividends payable as a percentage of dividends 25.0% Long-term debt repayment clue in 2017 $3 Long-term debt repayment due in 2018 $65 Increase in treasury stock in 2017 $200 Dividends as percentage of net income 30.0% Assume no change for goodwill, other assets, deferred lease liabilities, other longterm liabilities, common stock, and AOCL. - Round answers to the nearest whole number. - Do not use negative sigr with your answers. Whole Foods Market, Inc. Forecasted Balance Sheet, ($ millions) 2017 Estimated Current assets Cash and cash equivalents Short-term investments Restricted cash Accounts receivable Merchandise inventories Prepaid expenses Deferred income taxes Total current assets Property and equipment, net Long-term investments Goodwill Intangible assets, net Deferred income taxes Other assets Total assets Current liabilities Current installments of long-term debt Accounts payable Accrued payroll, bonus and benefits Dividends payable Other current liabilities Total current liabilities Long-term debt and capital leases Deferred lease liabilities Other long-term liabilities Total liabilities Shareholders' equity: Common stock, no par value Common stock in treasury Accumulated other comprehensive loss Retained earnings Total shareholders' equity Total liabilities and equity $ 18,740 X o

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts