Question: how do i formulate these answer in an excel spreadsheet using functions? 4. To purchase a car, an individual agrees to pay $800 at the

how do i formulate these answer in an excel spreadsheet using functions?

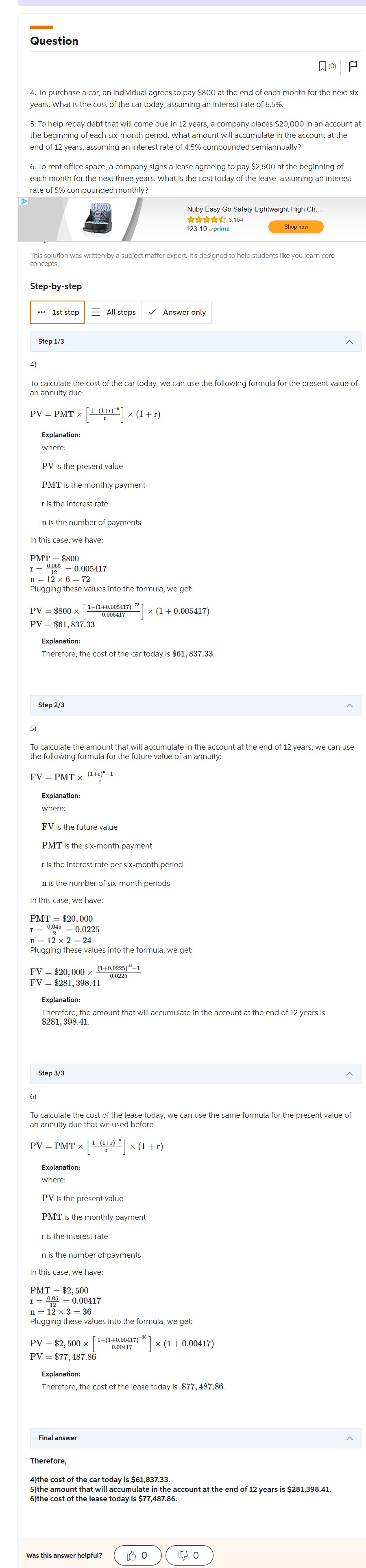

4. To purchase a car, an individual agrees to pay $800 at the end of each month for the next six years. What is the cost of the car today, assuming an interest rate of 6.5%. 5. To help repay debt that will come due in 12 years, a company places $20,000 in an account a the beginning of each six-month period. What amount will accumulate in the account at the end 12 years, assuming an interest rate of 4.5% compounded semiannually? 6. To rent office space, a company signs a lease agreeing to pay $2,500 at the beginning of each month for the next three years. What is the cost today of the lease, assuming an interest rate of 5% compounded monthly? Nuby Easy Go Safety Lightweight High Ch.. s23.10 vprime This solution was written by a subject matter expert. It's designed to help students like you learn core Step-by-step 1ststepAllstepsAnsweronly Step 1/3 4) To calculate the cost of the car today, we can use the following formula for the present value of an annuity due: PV=PMT[r1(1+r)n](1+r) where: PV is the present value PMT is the monthly payment r is the interest rate n is the number of payments In this case, we have: PMT=$800 r=120.065=0.005417 n=126=72 Plugging these values into the formula, we get: PV=$800[0.0054171(1+0.005417)72](1+0.005417) PV=$61,837.33 Explanation: Therefore, the cost of the car today is $61,837.33. Step 2/3 5) To calculate the amount that will accumulate in the account at the end of 12 years, we can use the following formula for the future value of an annuity: FV=PMTr(1+r)n1 Explanation where: FV is the future value PMT is the six-month payment r is the interest rate per six-month period n is the number of six-month periods In this case, we have: PMT=$20,000 r=20.045=0.0225 n=122=24 n=122=24 Plugging these values into the formula, we get: FV=$20,0000.0225(1+0.0225)241 FV=$281,398.41 Explanation: Therefore, the $281,398.41. Step 3/3 6) To calculate the cost of the lease today, we can use the same formula for the present value of an annuity due that we used before PV=PMT[r1(1+r)n](1+r) Explanation: where: PV is the present value PMT is the monthly payment r is the interest rate n is the number of payments In this case, we have: PMT=$2,500 r=120.05=0.00417 n=123=36 Plugging these values into the formula, we get: PV=$2,500[0.004171(1+0.00417)36](1+0.00417) PV=$77,487.86 =$77,487.86 Explanation: Therefore, the cost of the lease today is $77,487.86. Final answer Therefore, 4)the cost of the car today is $61,837.33. 5)the amount that will accumulate in the account at the end of 12 years is $281,398.41. 6)the cost of the lease today is $77,487.86. 6)the cost of the lease today is $77,487.86

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts