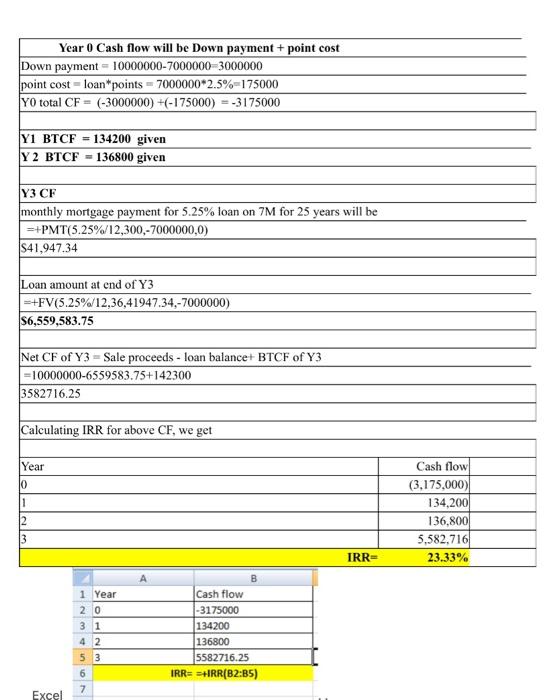

Question: How do I get 5,582,716? Year 0 Cash flow will be Down payment + point cost Down payment - 10000000-7000000-3000000 point cost-loanpoints = 7000000*2.5%-175000 YO

Year 0 Cash flow will be Down payment + point cost Down payment - 10000000-7000000-3000000 point cost-loanpoints = 7000000*2.5%-175000 YO total CF = (-3000000) +(-175000) = -3175000 Y1 BTCF = 134200 given Y 2 BTCF - 136800 given Y3 CF monthly mortgage payment for 5.25% loan on 7M for 25 years will be =+PMT(5.25%/12,300,-7000000,0) |$41,947.34 Loan amount at end of Y3 =+FV(5.25%/12,36,41947.34,-7000000) $6,559,583.75 Net CF of Y3 = Sale proceeds - loan balance+ BTCF of Y3 =10000000-6559583.75+142300 3582716.25 Calculating IRR for above CF, we get Year 0 1 2 Cash flow (3.175,000) 134,200 136,800 5,582,716 23.33% 3 IRRE 1 Year 20 31 42 53 B Cash flow -3175000 134200 136800 5582716.25 IRR= =+IRR(B2:35) 6 7 Excel Commercial Loan Underwriting Three Year Hold (Value of project 10,000,000; Partially Amortizing Loan Amount = 7,000,000; Interest Rate = 5.25%; Amortization Peric 25 years: Torm 3 years; Points 2.5; NOI = 650,000 BTCF1= 134,200; BTCF2 - 136,800; BTCF3 = 142,300; Net Sale Price 12,000,000) What is the IRR for this nvestment? Answers: 23.33% 7,000,000 Commercial Loan Underwriting Three Year Hold (Value of project 10,000,000; Partially Amortizing Loan Amount = 7,000,000; Interest Rate = 5.25%; Amortization P 25 years; Torm 3 years; Points=2.5; NOI = 650,000 BTCF1=134,200; BTCF2 - 136,800, BTCF3 = 142,300; Net Sale Price 12,000,000) What is the IRR for this investment? Answers: 23.33% 7,000,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts