Question: how do i get to C? For use in problem #9,10,11, and 12 An Indian pharma company is considering a project in Australia. The initial

how do i get to C?

how do i get to C?

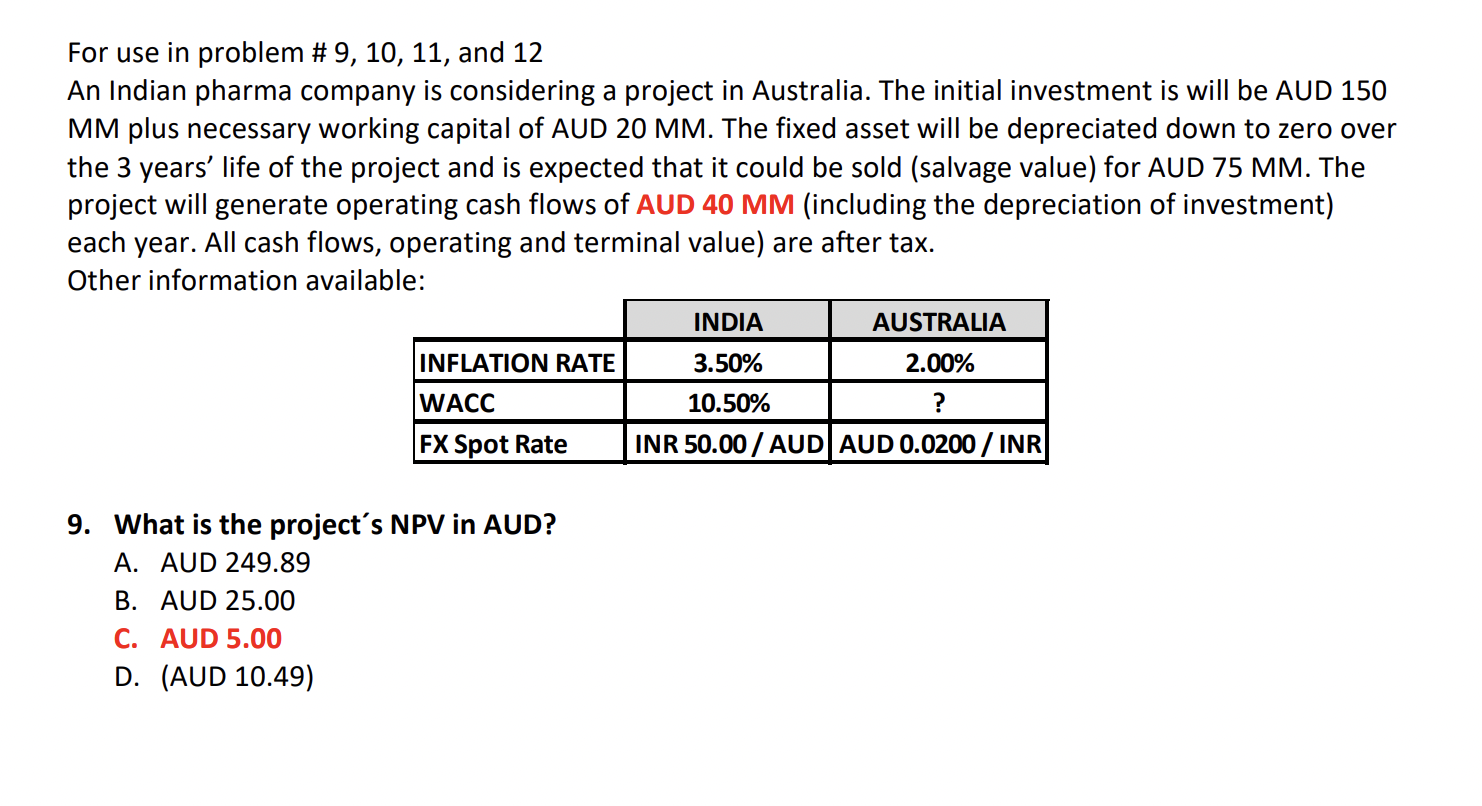

For use in problem #9,10,11, and 12 An Indian pharma company is considering a project in Australia. The initial investment is will be AUD 150 MM plus necessary working capital of AUD 20MM. The fixed asset will be depreciated down to zero over the 3 years' life of the project and is expected that it could be sold (salvage value) for AUD 75 MM. The project will generate operating cash flows of AUD 40 MM (including the depreciation of investment) each year. All cash flows, operating and terminal value) are after tax. Other information available: 9. What is the project's NPV in AUD? A. AUD 249.89 B. AUD 25.00 C. AUD 5.00 D. (AUD 10.49)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts