Question: How Do i go by doing this? Recall that when you first made the decision to reduce your price risk and you entered the futures

How Do i go by doing this?

How Do i go by doing this?

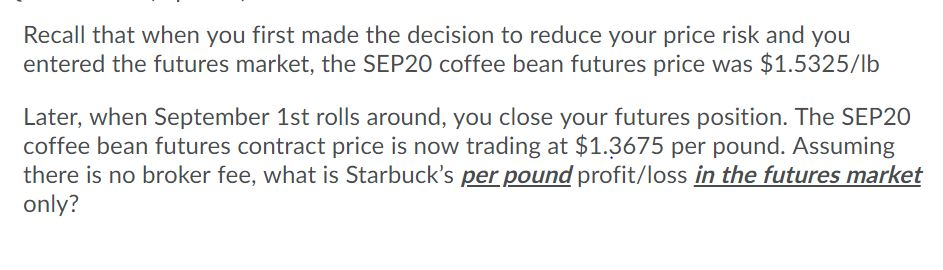

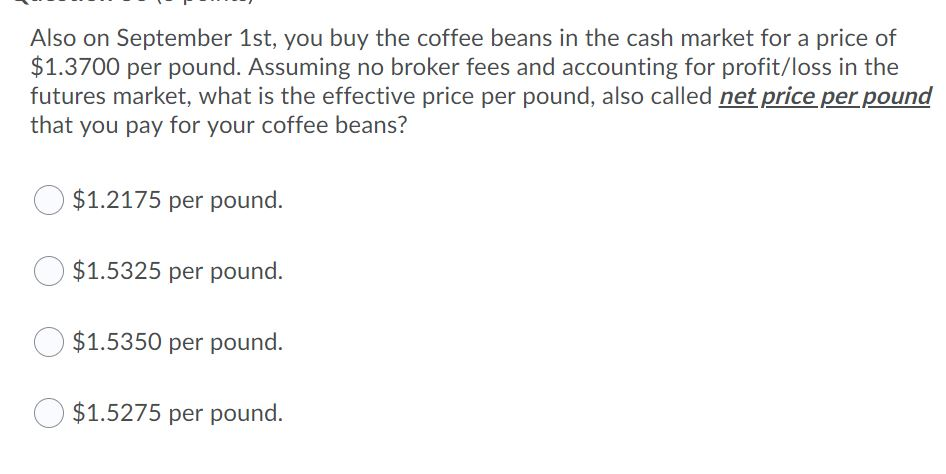

Recall that when you first made the decision to reduce your price risk and you entered the futures market, the SEP20 coffee bean futures price was $1.5325/lb Later, when September 1st rolls around, you close your futures position. The SEP20 coffee bean futures contract price is now trading at $1.3675 per pound. Assuming there is no broker fee, what is Starbuck's per pound profit/loss in the futures market only? Also on September 1st, you buy the coffee beans in the cash market for a price of $1.3700 per pound. Assuming no broker fees and accounting for profit/loss in the futures market, what is the effective price per pound, also called net price per pound that you pay for your coffee beans? $1.2175 per pound. O $1.5325 per pound. $1.5350 per pound. $1.5275 per pound

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts