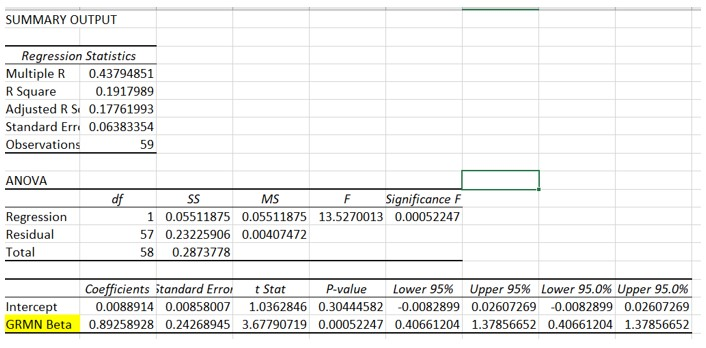

Question: How do I identify the systematic risk in a company looking at beta SUMMARY OUTPUT Regression Statistics Multiple R 0.43794851 R Square 0.1917989 Adjusted R

How do I identify the systematic risk in a company looking at beta

SUMMARY OUTPUT Regression Statistics Multiple R 0.43794851 R Square 0.1917989 Adjusted R S 0.17761993 Standard Erri 0.06383354 Observations 59 ANOVA Regression Residual Total SS MS Significance F 1 0.05511875 0.05511875 13.5270013 0.00052247 57 0.23225906 0.00407472 58 0.2873778 Intercept GRMN Beta Coefficients Standard Erroit Stat P-value Lower 95% Upper 95% Lower 95.0% Upper 95.0% 0.0088914 0.00858007 1.0362846 0.30444582 -0.0082899 0.02607269 -0.0082899 0.02607269 0.89258928 0.24268945 3.67790719 0.00052247 0.40661204 1.37856652 0.40661204 1.37856652

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock