Question: how do i insert these in a ti -83? EXAM 2: CH. (5,6,8) FINANCE 3320 FINANCIAL INSTITUTIONS AND MARKETS HOMEWORK Chapter 5 Bonds Prices and

how do i insert these in a ti -83?

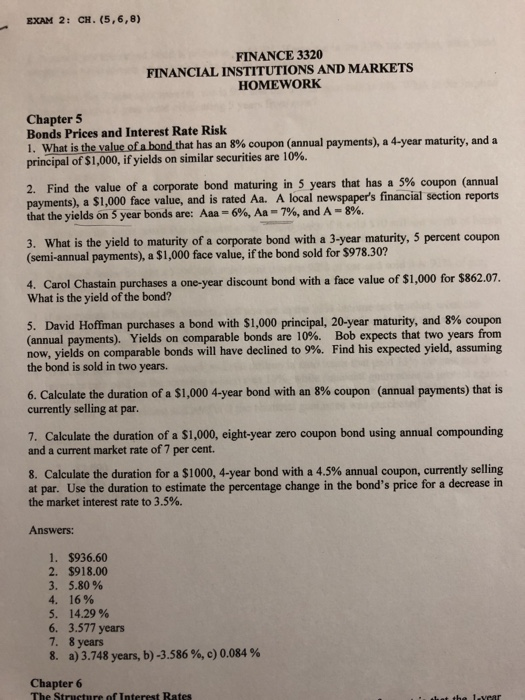

how do i insert these in a ti -83? EXAM 2: CH. (5,6,8) FINANCE 3320 FINANCIAL INSTITUTIONS AND MARKETS HOMEWORK Chapter 5 Bonds Prices and Interest Rate Rislk that has an 8% coupon (annual payments), a 4-year maturity, and a ies are 10%. principal of $1,000, if yields on similar securit 2. Find the value of a corporate bond maturing in 5 years that has a 5% coupon (annual payments), a $1,000 face value, and is rated Aa. A local newspaper's financial section reports that the yields on 5 year bonds are: Aaa-6%, Aa-796, and A-896. 3. What is the yield to maturity of a corporate bond with a 3-year maturity, 5 percent coupon (semi-annual payments), a $1,000 face value, if the bond sold for $978.30? 4. Carol Chastain purchases a one-year discount bond with a face value of $1,000 for $862.07. What is the yield of the bond? 5. David Hoffman purchases a bond with $1,000 principal, 20-year maturity, and 8% coupon (annual payments). Yields on comparable bonds are 10%. Bob expects that two years from now, yields on comparable bonds will have declined to 9%. Find his expected yield, assuming the bond is sold in two years. 6. Calculate the duration of a $1,000 4-year bond with an 8% coupon (annual payments) that is currently selling at par. 7. Calculate the duration of a $1,000, eight-year zero coupon bond using annual compounding and a current market rate of 7 per cent. 8, Calculate the duration for a $1000, 4-year bond with a 4.5% annual coupon, currently selling the market interest rate to 3.5%. Answers: at par. Use the duration to estimate the percentage change in the bond's price for a decrease in 1. $936.60 2. $918.00 3. 5.80 % 4. 16% 5. 14.29% 6. 3.577 years 7. 8 years 8. a) 3.748 years, b)-3.586 %, c) 0.084 % Chapter 6 EXAM 2: CH. (5,6,8) FINANCE 3320 FINANCIAL INSTITUTIONS AND MARKETS HOMEWORK Chapter 5 Bonds Prices and Interest Rate Rislk that has an 8% coupon (annual payments), a 4-year maturity, and a ies are 10%. principal of $1,000, if yields on similar securit 2. Find the value of a corporate bond maturing in 5 years that has a 5% coupon (annual payments), a $1,000 face value, and is rated Aa. A local newspaper's financial section reports that the yields on 5 year bonds are: Aaa-6%, Aa-796, and A-896. 3. What is the yield to maturity of a corporate bond with a 3-year maturity, 5 percent coupon (semi-annual payments), a $1,000 face value, if the bond sold for $978.30? 4. Carol Chastain purchases a one-year discount bond with a face value of $1,000 for $862.07. What is the yield of the bond? 5. David Hoffman purchases a bond with $1,000 principal, 20-year maturity, and 8% coupon (annual payments). Yields on comparable bonds are 10%. Bob expects that two years from now, yields on comparable bonds will have declined to 9%. Find his expected yield, assuming the bond is sold in two years. 6. Calculate the duration of a $1,000 4-year bond with an 8% coupon (annual payments) that is currently selling at par. 7. Calculate the duration of a $1,000, eight-year zero coupon bond using annual compounding and a current market rate of 7 per cent. 8, Calculate the duration for a $1000, 4-year bond with a 4.5% annual coupon, currently selling the market interest rate to 3.5%. Answers: at par. Use the duration to estimate the percentage change in the bond's price for a decrease in 1. $936.60 2. $918.00 3. 5.80 % 4. 16% 5. 14.29% 6. 3.577 years 7. 8 years 8. a) 3.748 years, b)-3.586 %, c) 0.084 % Chapter 6

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts