Question: how do I journalize it Instructions Mar. 2 3 4 Sold merchandise on account to Equinox Co., $20,800, terms FOB destination, 1/10, 1/30. The cost

how do I journalize it

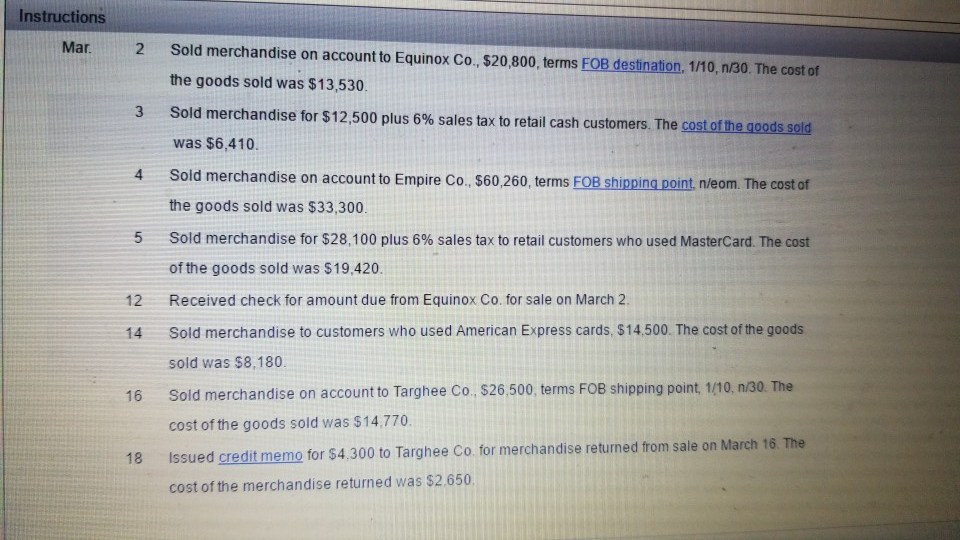

Instructions Mar. 2 3 4 Sold merchandise on account to Equinox Co., $20,800, terms FOB destination, 1/10, 1/30. The cost of the goods sold was $13,530. Sold merchandise for $12,500 plus 6% sales tax to retail cash customers. The cost of the goods sold was $6,410. Sold merchandise on account to Empire Co., $60,260, terms FOB shipping point, n/eom. The cost of the goods sold was $33,300. Sold merchandise for $28,100 plus 6% sales tax to retail customers who used MasterCard. The cost of the goods sold was $19.420. Received check for amount due from Equinox Co. for sale on March 2 Sold merchandise to customers who used American Express cards, $14,500. The cost of the goods 5 12 16 sold was $8.180 Sold merchandise on account to Targhee Co., $26,500, terms FOB shipping point, 1/10,n/30. The cost of the goods sold was $14.770. Issued credit memo for $4,300 to Targhee Co. for merchandise returned from sale on March 16. The cost of the merchandise returned was $2.650

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts