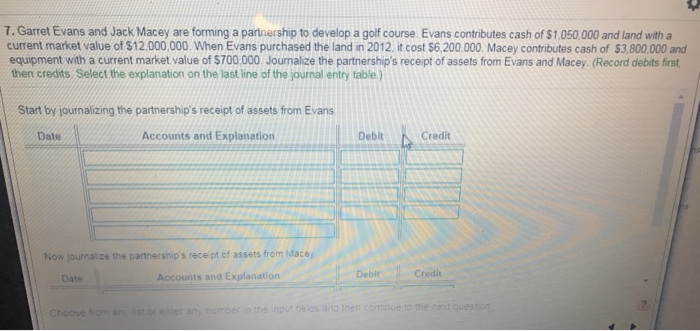

Question: how do i journalize this 7. Garret Evans and Jack Macey are forming a partnership to develop a golf course Evans contributes cash of $1,050,000

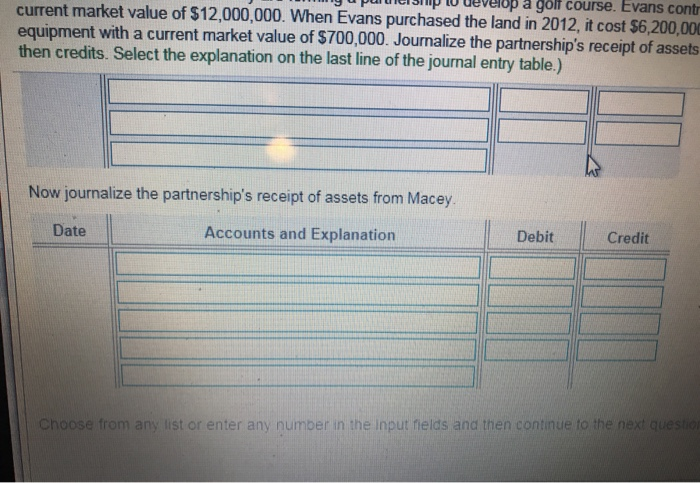

7. Garret Evans and Jack Macey are forming a partnership to develop a golf course Evans contributes cash of $1,050,000 and land with a current market value of $12,000,000 When Evans purchased the land in 2012. it cost $6.200.000. Macey contributes cash of $3,800,000 and equipment with a current market value of $700.000. Journalize the partnership's receipt of assets from Evans and Macey (Record debits first then credits. Select the explanation on the last line of the journal entry table.) Start by journalizing the partnership's receipt of assets from Evans Date Accounts and Explanation Debit Credit Non journalize the partnership's receipt of assets from Macey Accounts and Explanation Debit Credit e en Choose --- Pull U LIOPeyul LOUIS. Lval 15 LUTTU current market value of $12,000,000. When Evans purchased the land in 2012, it cost $6,200,00 equipment with a current market value of $700,000. Journalize the partnership's receipt of assets then credits. Select the explanation on the last line of the journal entry table.) Now journalize the partnership's receipt of assets from Macey. Date Accounts and Explanation Debit Credit Choose from any list or enter any number in the input nelds and then continue to the next que 7. Garret Evans and Jack Macey are forming a partnership to develop a golf course Evans contributes cash of $1,050,000 and land with a current market value of $12,000,000 When Evans purchased the land in 2012. it cost $6.200.000. Macey contributes cash of $3,800,000 and equipment with a current market value of $700.000. Journalize the partnership's receipt of assets from Evans and Macey (Record debits first then credits. Select the explanation on the last line of the journal entry table.) Start by journalizing the partnership's receipt of assets from Evans Date Accounts and Explanation Debit Credit Non journalize the partnership's receipt of assets from Macey Accounts and Explanation Debit Credit e en Choose --- Pull U LIOPeyul LOUIS. Lval 15 LUTTU current market value of $12,000,000. When Evans purchased the land in 2012, it cost $6,200,00 equipment with a current market value of $700,000. Journalize the partnership's receipt of assets then credits. Select the explanation on the last line of the journal entry table.) Now journalize the partnership's receipt of assets from Macey. Date Accounts and Explanation Debit Credit Choose from any list or enter any number in the input nelds and then continue to the next que

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts