Question: how do i log these journal entrys please help and explain Required information [The following information applies to the questions displayed below.) Onslow Co, purchased

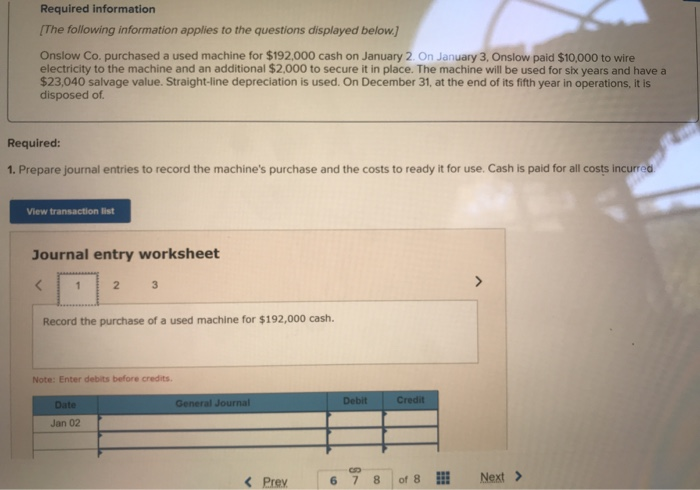

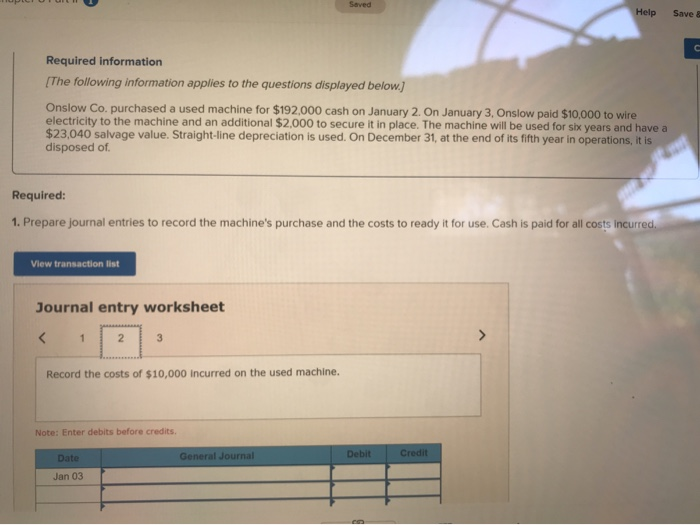

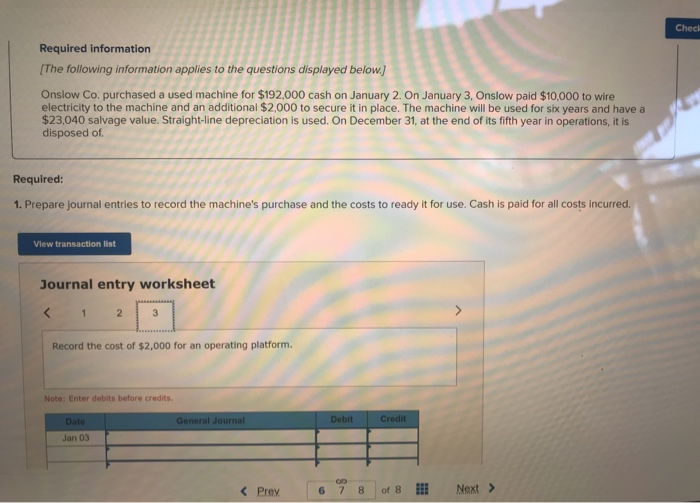

Required information [The following information applies to the questions displayed below.) Onslow Co, purchased a used machine for $192,000 cash on January 2 On January 3, Onslow paid $10,000 to wire electricity to the machine and an additional $2,000 to secure it in place. The machine will be used for six years and have a $23,040 salvage value. Straight-line depreciation is used. On December 31, at the end of its fifth year in operations, it is disposed of. Required: 1. Prepare journal entries to record the machine's purchase and the costs to ready it for use. Cash is paid for all costs incurred View transaction list Journal entry worksheet 1 2 3 Record the purchase of a used machine for $192,000 cash. Note: Enter debits before credits General Journal Debit Credit Date Jan 02 Saved Help Save a Required information The following information applies to the questions displayed below.) Onslow Co. purchased a used machine for $192.000 cash on January 2. On January 3, Onslow paid $10,000 to wire electricity to the machine and an additional $2,000 to secure it in place. The machine will be used for six years and have a $23,040 salvage value. Straight-line depreciation is used. On December 31, at the end of its fifth year in operations, it is disposed of. Required: 1. Prepare journal entries to record the machine's purchase and the costs to ready it for use. Cash is paid for all costs incurred. View transaction list Journal entry worksheet Record the costs of $10,000 incurred on the used machine. Note: Enter debits before credits Date General Journal Debit Credit Jan 03 Chech Required information [The following information applies to the questions displayed below.) Onslow Co, purchased a used machine for $192,000 cash on January 2. On January 3, Onslow paid $10,000 to wire electricity to the machine and an additional $2,000 to secure it in place. The machine will be used for six years and have a $23,040 salvage value. Straight-line depreciation is used. On December 31, at the end of its fifth year in operations, it is disposed of. Required: 1. Prepare journal entries to record the machine's purchase and the costs to ready it for use. Cash is paid for all costs incurred. View transaction list Journal entry worksheet Record the cost of $2,000 for an operating platform. Note: Enter debits before credits. Date General Journal Debit Credit Jan 03

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts