Question: How do I make a journal entries for these transactions and define them as a credit or debit December 01 Cash (Cument Account) Increased $30.000;

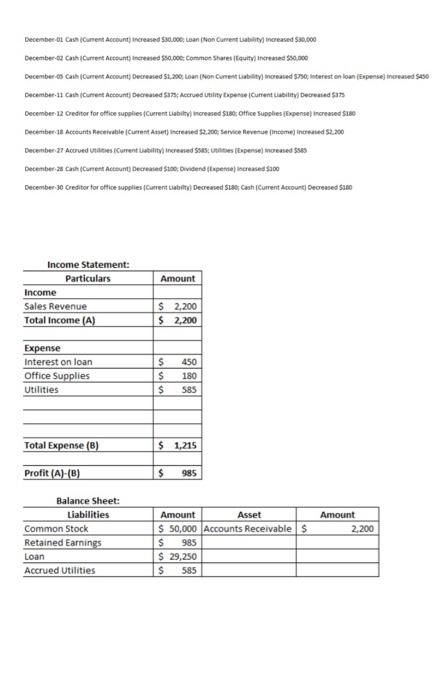

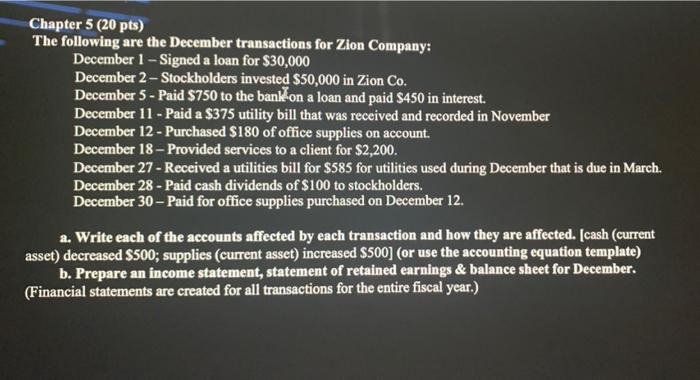

December 01 Cash (Cument Account) Increased $30.000; Loan (Non Current Liability) Increased $30,000 December-02 Cash (Current Account) Increased $50,000; Common Shares (Equity) Increased $50,000 December-05 Cash (Current Account) Decreased $1,200 Loan (Non Current Liability) Increased $750; interest on loan (Expense) Increased $450 December 11 Cash (Current Account) Decreased $375; Accrued Utility Expense (Cument Liability Decreased $375 December 12 Creditor for office supplies (Current Liability) increased $180; Office Supplies (Expense) increased $380 December 18 Accounts Receivable (Current Asset) increased $2.200; Service Revenue (Income) increased $2.200 December 27 Accrued Utilities (Current Liability) Increased $585; Utilities (Expense) increased $585 December 28 Cash (Cument Account) Decreased $100: Dividend (Expense increased $200 December 30 Creditor for office supplies (Current Liability) Decreased $180; Cash (Current Account) Decreased $100 Income Statement: Particulars Income Sales Revenue Total Income (A) Expense Interest on loan Office Supplies Utilities Total Expense (B) Profit (A)-(B) Balance Sheet: Liabilities Common Stock Retained Earnings Loan Accrued Utilities Amount $ 2,200 $ 2,200 450 180 $ 585 SSS $ $ 1,215 $ 985 Amount Asset $50,000 Accounts Receivable $ $ 985 $ 29,250 $ 585 Amount 2,200 Chapter 5 (20 pts) The following are the December transactions for Zion Company: December 1-Signed a loan for $30,000 December 2-Stockholders invested $50,000 in Zion Co. December 5- Paid $750 to the bank on a loan and paid $450 in interest. December 11 - Paid a $375 utility bill that was received and recorded in November December 12 - Purchased $180 of office supplies on account. December 18- Provided services to a client for $2,200. December 27 - Received a utilities bill for $585 for utilities used during December that is due in March. December 28 - Paid cash dividends of $100 to stockholders. December 30- Paid for office supplies purchased on December 12. a. Write each of the accounts affected by each transaction and how they are affected. [cash (current asset) decreased $500; supplies (current asset) increased $500] (or use the accounting equation template) b. Prepare an income statement, statement of retained earnings & balance sheet for December. (Financial statements are created for all transactions for the entire fiscal year.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts