Question: how do i post these transactions into a T-account? how do i post the following from the general journal into the T-accounts? 18. Recognized the

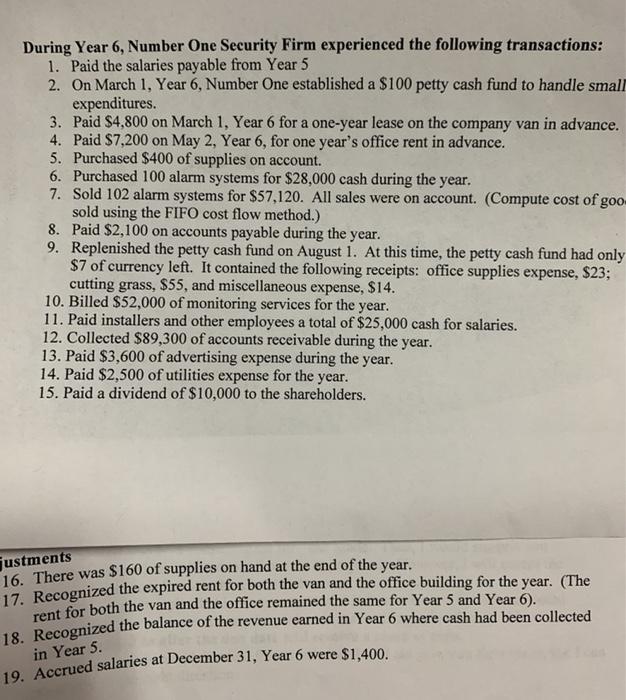

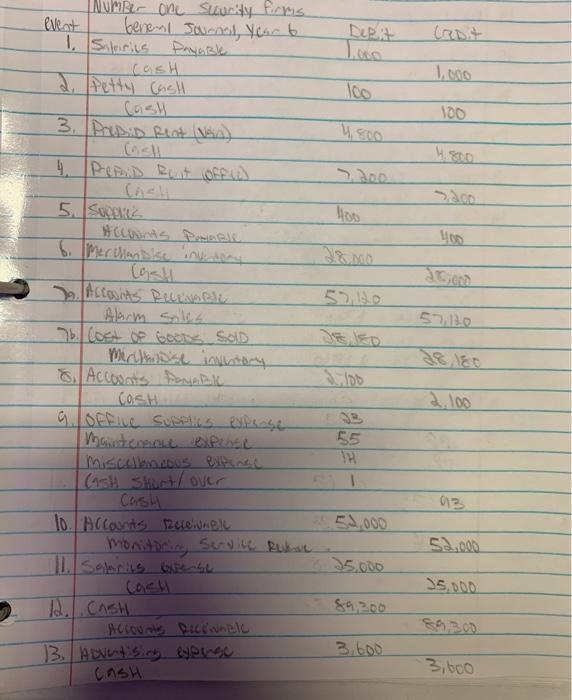

18. Recognized the balance of the revenue earned in Year 6 where cash had been collected 19. Accrued salaries at December 31, Year 6 were $1,400. During Year 6, Number One Security Firm experienced the following transactions: 1. Paid the salaries payable from Year 5 2. On March 1, Year 6, Number One established a $100 petty cash fund to handle small expenditures. 3. Paid $4,800 on March 1, Year 6 for a one-year lease on the company van in advance. 4. Paid $7,200 on May 2, Year 6, for one year's office rent in advance. 5. Purchased $400 of supplies on account. 6. Purchased 100 alarm systems for $28,000 cash during the year. 7. Sold 102 alarm systems for $57,120. All sales were on account. (Compute cost of goo sold using the FIFO cost flow method.) 8. Paid $2,100 on accounts payable during the year. 9. Replenished the petty cash fund on August 1. At this time, the petty cash fund had only $7 of currency left. It contained the following receipts: office supplies expense, $23; cutting grass, $55, and miscellaneous expense, $14. 10. Billed $52,000 of monitoring services for the year. 11. Paid installers and other employees a total of $25,000 cash for salaries. 12. Collected $89,300 of accounts receivable during the year. 13. Paid $3,600 of advertising expense during the year. 14. Paid $2,500 of utilities expense for the year. 15. Paid a dividend of $10,000 to the shareholders. justments 16. There was $160 of supplies on hand at the end of the year. 17. Recognized the expired rent for both the van and the office building for the year. (The rent for both the van and the office remained the same for Year 5 and Year 6). in Year 5. NUMBE on Suurky firms event benenl Journal year b. 1. Salarics Payable cash 1.ooo LO 100 3. PODID Rent (Van) 4.30 5. Supplies 57,120 Alarm siles b. Coa b Gece SD Mirthinse inventory & Accounts Payabi COSH 9. Office Supplies expense Maintenant els miscellaneous extince CASH shoot/ over Cash 1o. Accants receiviele monitoring Service Rene 55 1 03 1.000 52.000 15.000 892.00 12. Cash . Accounts Recennale 13. ADvertising evenec Cash 3,600 3,600 18. Recognized the balance of the revenue earned in Year 6 where cash had been collected 19. Accrued salaries at December 31, Year 6 were $1,400. During Year 6, Number One Security Firm experienced the following transactions: 1. Paid the salaries payable from Year 5 2. On March 1, Year 6, Number One established a $100 petty cash fund to handle small expenditures. 3. Paid $4,800 on March 1, Year 6 for a one-year lease on the company van in advance. 4. Paid $7,200 on May 2, Year 6, for one year's office rent in advance. 5. Purchased $400 of supplies on account. 6. Purchased 100 alarm systems for $28,000 cash during the year. 7. Sold 102 alarm systems for $57,120. All sales were on account. (Compute cost of goo sold using the FIFO cost flow method.) 8. Paid $2,100 on accounts payable during the year. 9. Replenished the petty cash fund on August 1. At this time, the petty cash fund had only $7 of currency left. It contained the following receipts: office supplies expense, $23; cutting grass, $55, and miscellaneous expense, $14. 10. Billed $52,000 of monitoring services for the year. 11. Paid installers and other employees a total of $25,000 cash for salaries. 12. Collected $89,300 of accounts receivable during the year. 13. Paid $3,600 of advertising expense during the year. 14. Paid $2,500 of utilities expense for the year. 15. Paid a dividend of $10,000 to the shareholders. justments 16. There was $160 of supplies on hand at the end of the year. 17. Recognized the expired rent for both the van and the office building for the year. (The rent for both the van and the office remained the same for Year 5 and Year 6). in Year 5. NUMBE on Suurky firms event benenl Journal year b. 1. Salarics Payable cash 1.ooo LO 100 3. PODID Rent (Van) 4.30 5. Supplies 57,120 Alarm siles b. Coa b Gece SD Mirthinse inventory & Accounts Payabi COSH 9. Office Supplies expense Maintenant els miscellaneous extince CASH shoot/ over Cash 1o. Accants receiviele monitoring Service Rene 55 1 03 1.000 52.000 15.000 892.00 12. Cash . Accounts Recennale 13. ADvertising evenec Cash 3,600 3,600

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts