Question: How do I prepare a closing entry to close my books with this given information? PLEASE HELP Comprehensive Accounting Cycle Review 6 2017, Bonita Industries

How do I prepare a closing entry to close my books with this given information? PLEASE HELP

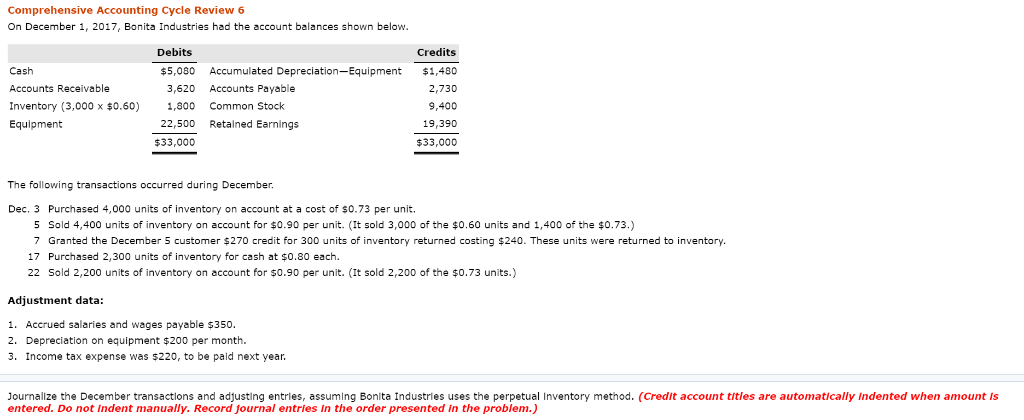

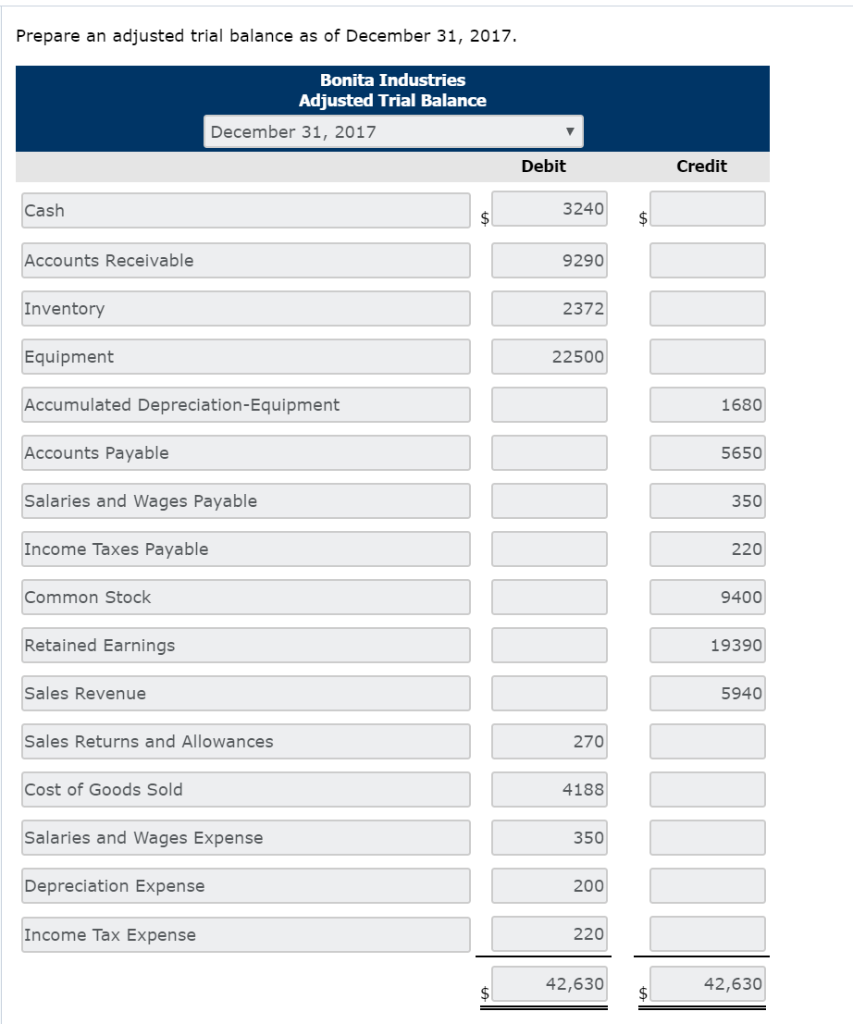

Comprehensive Accounting Cycle Review 6 2017, Bonita Industries had the account balances shown below. On December Debits Credits Accumulated Depreciation-Equipment $1,480 Cash $5,080 Accounts Receivable Accounts Payable 2,730 3.620 Inventory (3,000 x $0.60) 1,800 Common Stock 9,400 Retained Earnings Equipment 22,500 19,390 $33,000 $33,000 The following transactions occurred during December. Dec. 3 Purchased 4,000 units of inventory on account at a cost of $0.73 per unit. Sold 4 400 u sold 3,000 of the $0.60 units and 1,400 of the $0.73.) inventory on ** .. its Finventory returned costing $240 These units were returned to inventory. -270 ventory for t co en.. 22 Sold 2,200 units of inventory on account for $0.90 per unit. (It sold 2,200 of the $0.73 units.) . 17 Purchased 2 300.nit f l each Adjustment data: 1. Accrued salaries and wages payable $350. 2. Depreciation on equipment $200 per month. 3. Income tax expense was $220, to be paid next year Journalize the December transactions and adjusting entries, assuming Bonita Industries uses the perpetual Inventory method. (Credit account titles are automatically Indented when amount Is entered. Do not indent manually. Record fournal entries in the order presented in the problem.) Prepare an adjusted trial balance as of December 31, 2017. Bonita Industries Adjusted Trial Balance December 31, 2017 Debit Credit 3240 Cash $ $ Accounts Receiva ble 9290 Inventory 2372 22500 Equipment Accumulated Depreciation-Equipment 1680 Accounts Payable 5650 Salaries and Wages Payable 350 Income Taxes Payable 220 Common Stock 9400 Retained Earnings 19390 Sales Revenue 5940 Sales Returns and Allowances 270 Cost of Goods Sold 4188 Salaries and Wages Expense 350 200 Depreciation Expense Income Tax Expense 220 42,630 42,630

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts