Question: How do I prepare the bank reconciliation? Data table a. The August 31 bank balance is $6,090. b. The bank statement includes two charges for

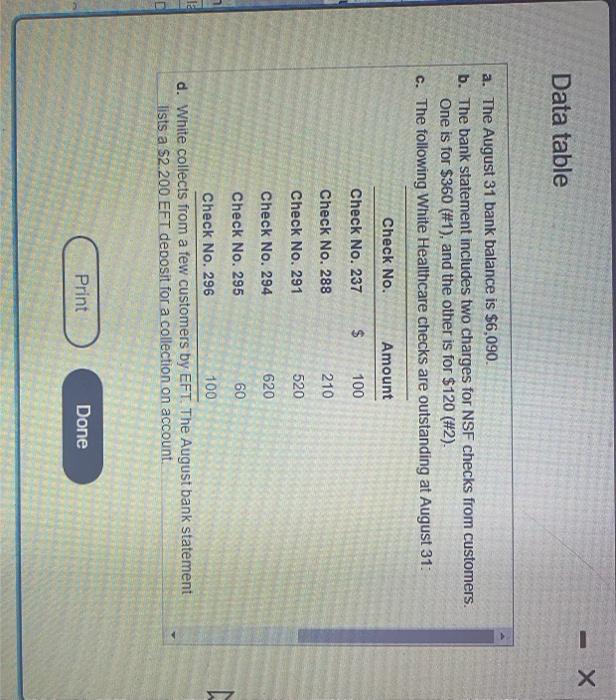

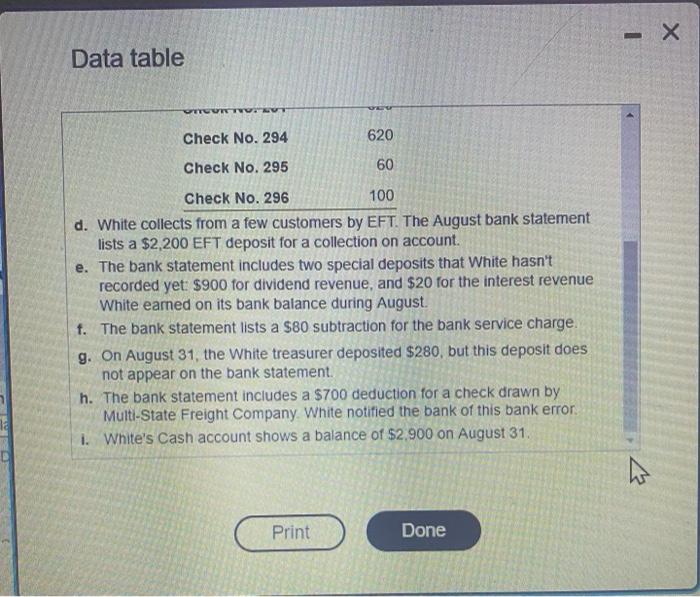

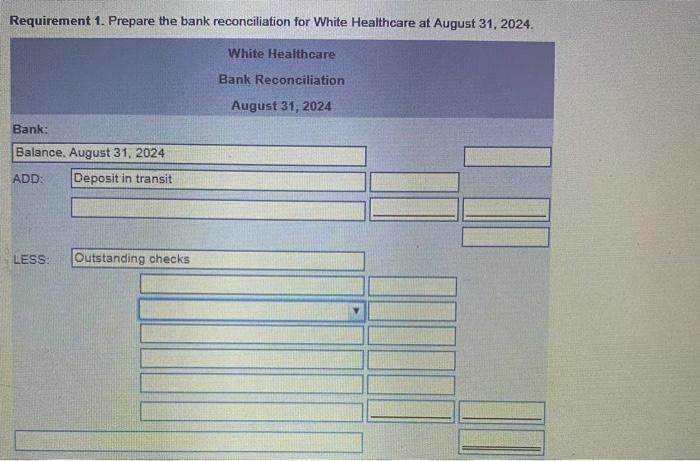

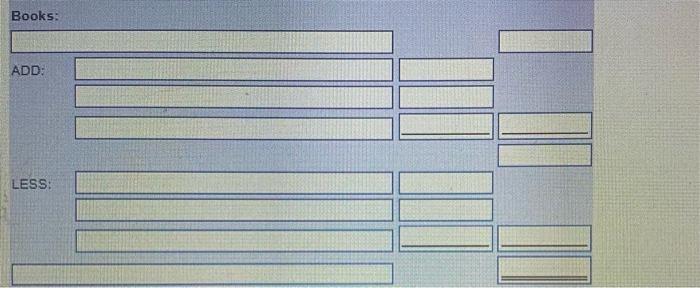

Data table a. The August 31 bank balance is $6,090. b. The bank statement includes two charges for NSF checks from customers. One is for $360(#1), and the other is for $120(#2). c. The following White Healthcare checks are outstanding at August 31 : d. White collects from a few customers by EFT. The August bank statement lists a $2.200 EFT deoosit for a collection on account. Data table d. White collects from a few customers by EFT. The August bank statement lists a \$2,200 EFT deposit for a collection on account. e. The bank statement includes two special deposits that White hasn't recorded yet: $900 for dividend revenue, and $20 for the interest revenue White earned on its bank balance during August. f. The bank statement lists a $80 subtraction for the bank service charge. g. On August 31 , the White treasurer deposited $280, but this deposit does not appear on the bank statement. h. The bank statement includes a $700 deduction for a check drawn by Multi-State Freight Company. White notified the bank of this bank error. 1. White's Cash account shows a balance of $2,900 on August 31 . Reauirement 1 Prenare the hank rennneiliation for Whito Hoalthnara at A wasub of ano Books: ADD: LESS

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts