Question: how do i punch this in on a normal calulator (not financial) 9:55 AM Mon Dec 9 9%D Semiannual Coupons Example 7.1 A $1.000 face

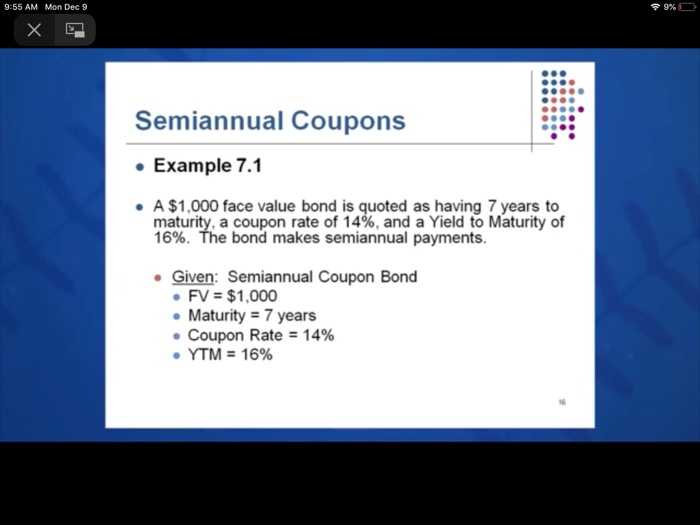

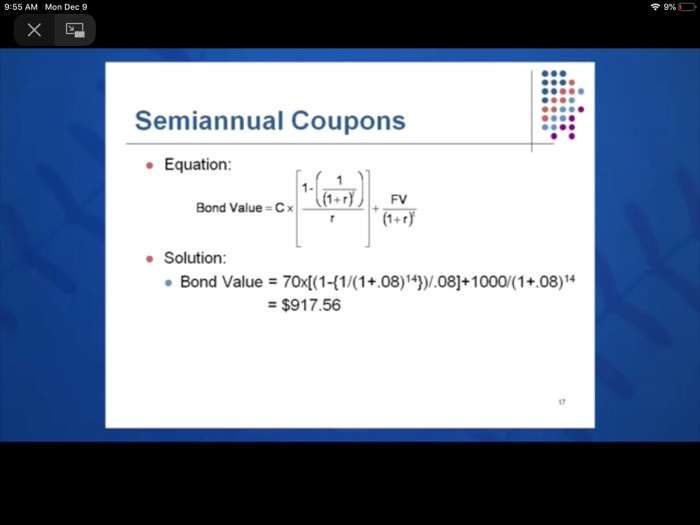

9:55 AM Mon Dec 9 9%D Semiannual Coupons Example 7.1 A $1.000 face value bond is quoted as having 7 years to maturity, a coupon rate of 14%, and a Yield to Maturity of 16%. The bond makes semiannual payments. Given: Semiannual Coupon Bond FV = $1,000 Maturity = 7 years Coupon Rate = 14% YTM = 16% 9:55 AM Mon Dec 9 9%D Semiannual Coupons Equation: 1 Bond Value=Cx Solution: Bond Value = 70x[(1-1/(1+.08)4}}/.08]+1000/(1+08)14 = $917.56

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts