Question: how do i put this information into a general journal? Considering HST is 13% 20- Mar. 1 Sold paint and supplies, $600, and wallpaper, $500,

how do i put this information into a general journal? Considering HST is 13%

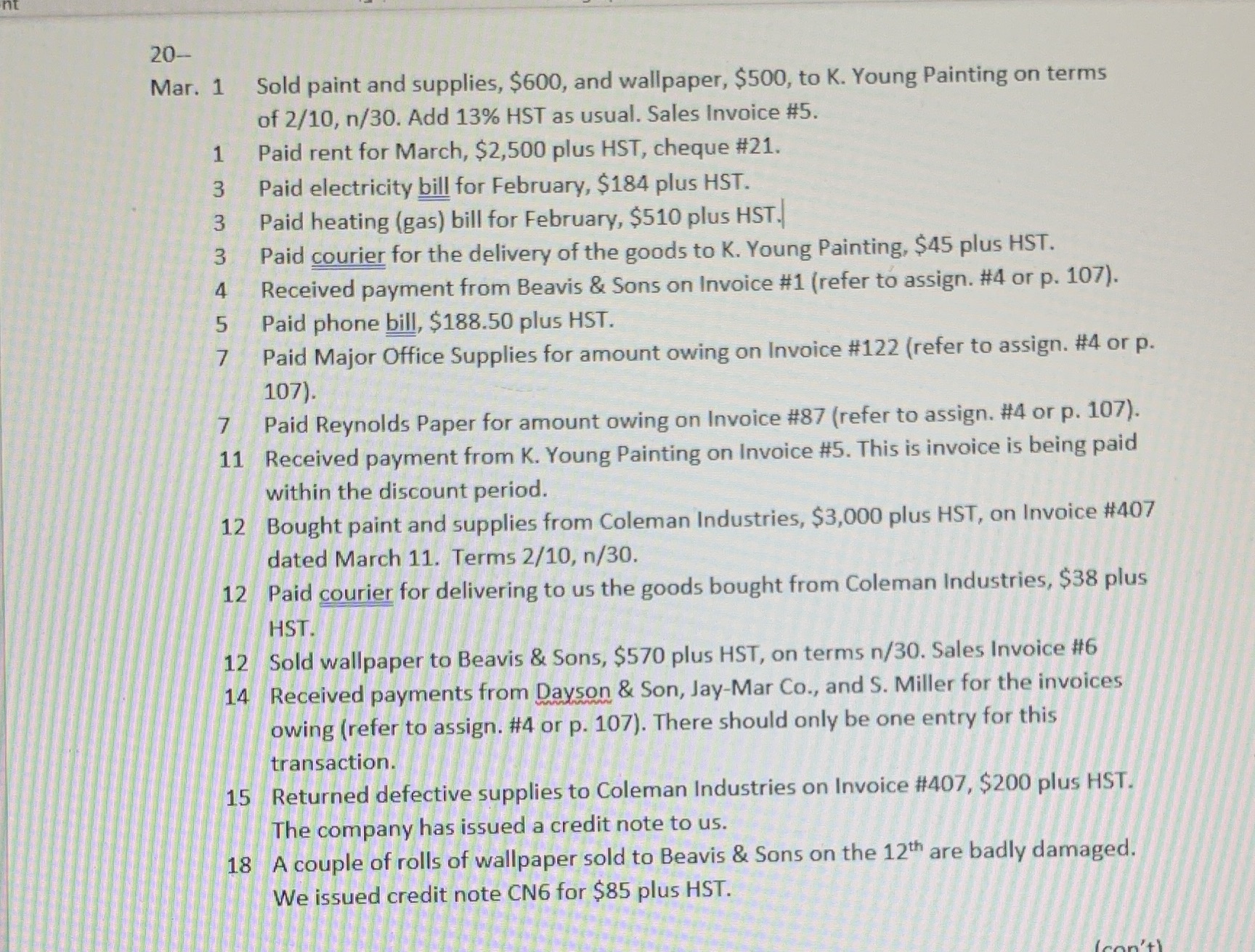

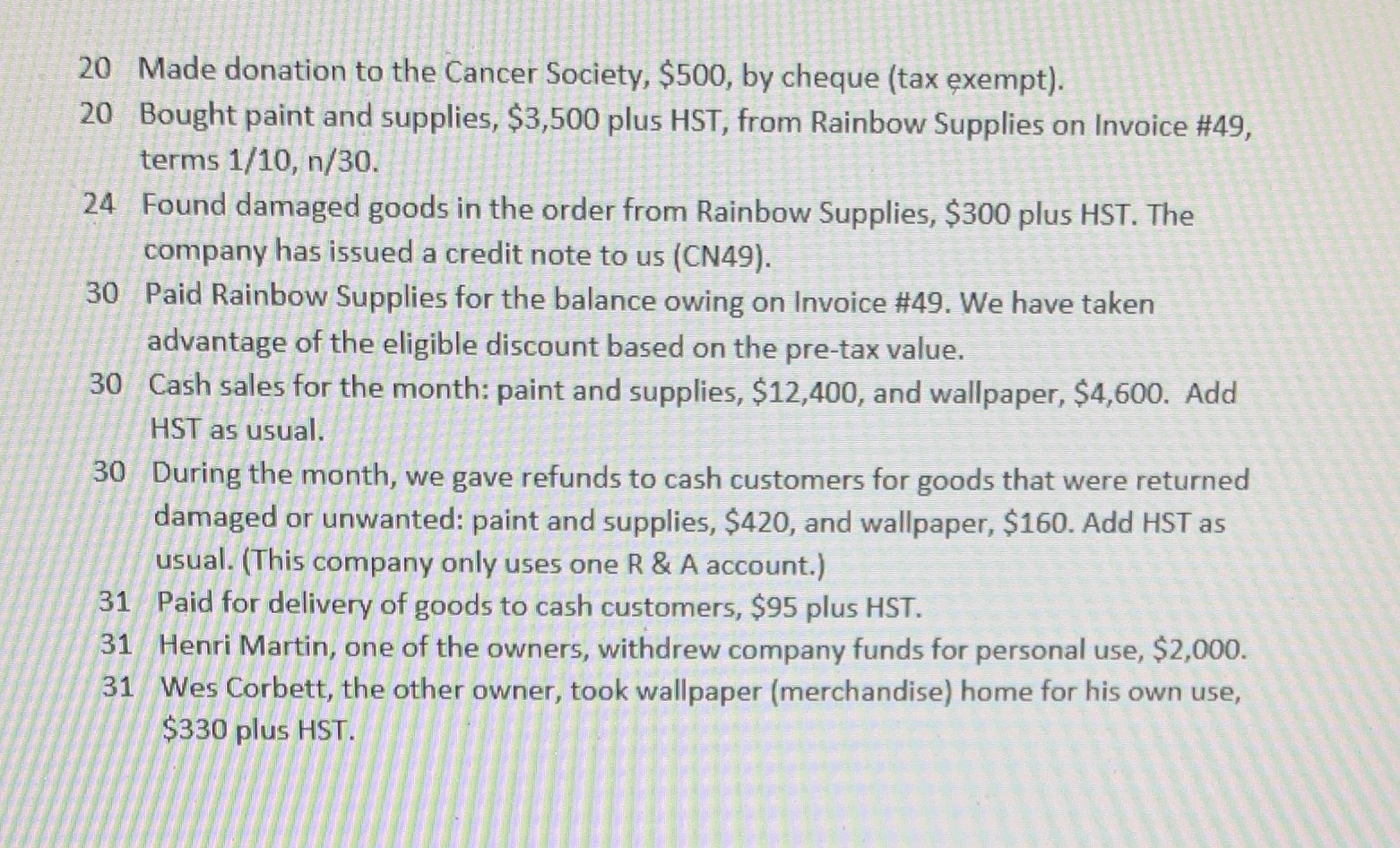

20- Mar. 1 Sold paint and supplies, $600, and wallpaper, $500, to K. Young Painting on terms of 2/10, n/30. Add 13% HST as usual. Sales Invoice #5. Paid rent for March, $2,500 plus HST, cheque #21. Paid electricity bill for February, $184 plus HST. 3 Paid heating (gas) bill for February, $510 plus HST. 3 Paid courier for the delivery of the goods to K. Young Painting, $45 plus HST. 4 Received payment from Beavis & Sons on Invoice #1 (refer to assign. #4 or p. 107). 5 Paid phone bill, $188.50 plus HST. 7 Paid Major Office Supplies for amount owing on Invoice #122 (refer to assign. #4 or p. 107). 7 Paid Reynolds Paper for amount owing on Invoice #87 (refer to assign. #4 or p. 107). 11 Received payment from K. Young Painting on Invoice #5. This is invoice is being paid within the discount period. 12 Bought paint and supplies from Coleman Industries, $3,000 plus HST, on Invoice #407 dated March 11. Terms 2/10, n/30. 12 Paid courier for delivering to us the goods bought from Coleman Industries, $38 plus HST. 12 Sold wallpaper to Beavis & Sons, $570 plus HST, on terms n/30. Sales Invoice #6 14 Received payments from Dayson & Son, Jay-Mar Co., and S. Miller for the invoices owing (refer to assign. #4 or p. 107). There should only be one entry for this transaction. 15 Returned defective supplies to Coleman Industries on Invoice #407, $200 plus HST. The company has issued a credit note to us. 18 A couple of rolls of wallpaper sold to Beavis & Sons on the 12th are badly damaged. We issued credit note CN6 for $85 plus HST.20 Made donation to the Cancer Society, $500, by cheque (tax exempt). 20 Bought paint and supplies, $3,500 plus HST, from Rainbow Supplies on Invoice #49, terms 1/10, n/30. 24 Found damaged goods in the order from Rainbow Supplies, $300 plus HST. The company has issued a credit note to us (CN49). 30 Paid Rainbow Supplies for the balance owing on Invoice #49. We have taken advantage of the eligible discount based on the pre-tax value. 30 Cash sales for the month: paint and supplies, $12,400, and wallpaper, $4,600. Add HST as usual. 30 During the month, we gave refunds to cash customers for goods that were returned damaged or unwanted: paint and supplies, $420, and wallpaper, $160. Add HST as usual. (This company only uses one R & A account.) 31 Paid for delivery of goods to cash customers, $95 plus HST. 31 Henri Martin, one of the owners, withdrew company funds for personal use, $2,000. 31 Wes Corbett, the other owner, took wallpaper (merchandise) home for his own use, $330 plus HST