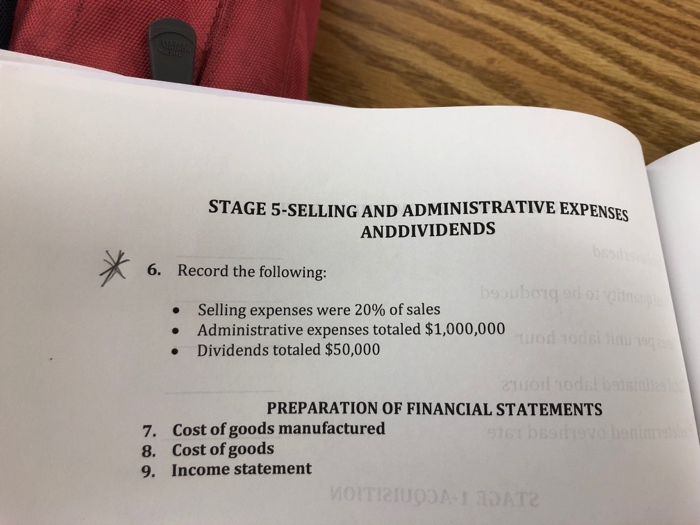

Question: How do i put this into a journal entry ? STAGE 5-SELLING AND ADMINISTRATIVE EXPENSES ANDDIVIDENDS ecord the following: Selling expenses were 20% of sales

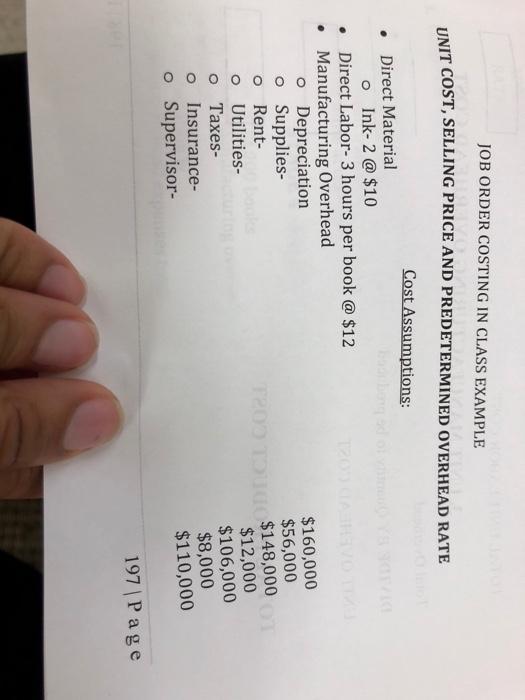

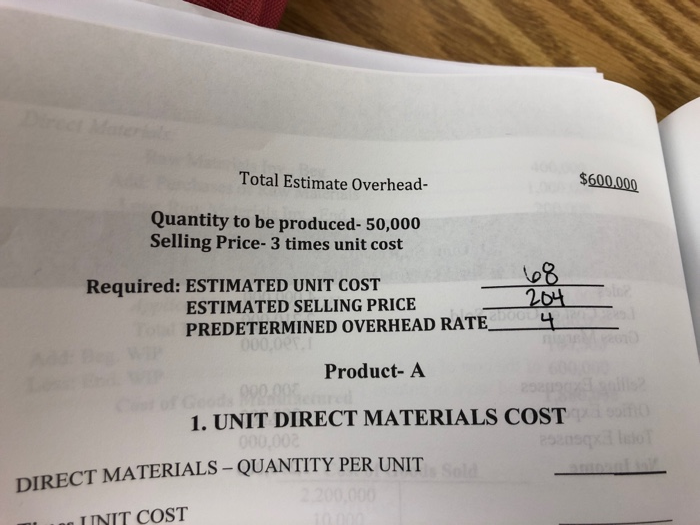

STAGE 5-SELLING AND ADMINISTRATIVE EXPENSES ANDDIVIDENDS ecord the following: Selling expenses were 20% of sales Administrative expenses totaled $1,000,000 Dividends totaled $50,000 PREPARATION OF FINANCIAL STATEMENTS 7. 8. 9. Cost of goods manufactured Cost of goods Income statement JOB ORDER COSTING IN CLASS EXAMPLE UNIT COST, SELLING PRICE AND PREDETERMINED OVERHEAD RATE Cost Assumptions . Direct Material o Ink- 2@ $10 Direct Labor-3 hours per book @ $12 Manufacturing Overhead . . o Depreciation o Supplies- o Rent- o Utilities- o Taxes- o Insurance- o Supervisor- $160,000 $56,000 $148,000 $12,000 $106,000 $8,000 $110,000 197 P a g e Total Estimate Overhead- $600.000 Quantity to be produced- 50,000 Selling Price-3 times unit cost Required: ESTIMATED UNIT COST 201 ESTIMATED SELLING PRICE PREDETERMINED OVERHEAD RATE Product- A 1. UNIT DIRECT MATERIALS COST DIRECT MATERIALS QUANTITY PER UNIT LINIT COST STAGE 5-SELLING AND ADMINISTRATIVE EXPENSES ANDDIVIDENDS ecord the following: Selling expenses were 20% of sales Administrative expenses totaled $1,000,000 Dividends totaled $50,000 PREPARATION OF FINANCIAL STATEMENTS 7. 8. 9. Cost of goods manufactured Cost of goods Income statement JOB ORDER COSTING IN CLASS EXAMPLE UNIT COST, SELLING PRICE AND PREDETERMINED OVERHEAD RATE Cost Assumptions . Direct Material o Ink- 2@ $10 Direct Labor-3 hours per book @ $12 Manufacturing Overhead . . o Depreciation o Supplies- o Rent- o Utilities- o Taxes- o Insurance- o Supervisor- $160,000 $56,000 $148,000 $12,000 $106,000 $8,000 $110,000 197 P a g e Total Estimate Overhead- $600.000 Quantity to be produced- 50,000 Selling Price-3 times unit cost Required: ESTIMATED UNIT COST 201 ESTIMATED SELLING PRICE PREDETERMINED OVERHEAD RATE Product- A 1. UNIT DIRECT MATERIALS COST DIRECT MATERIALS QUANTITY PER UNIT LINIT COST

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts