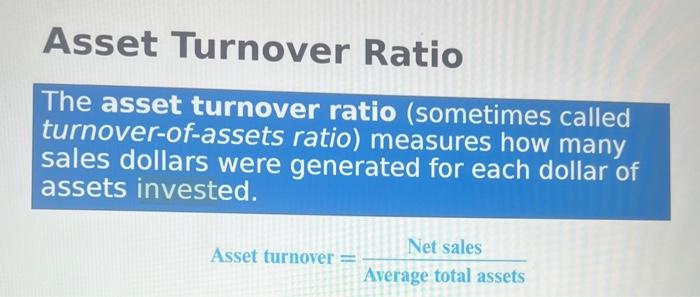

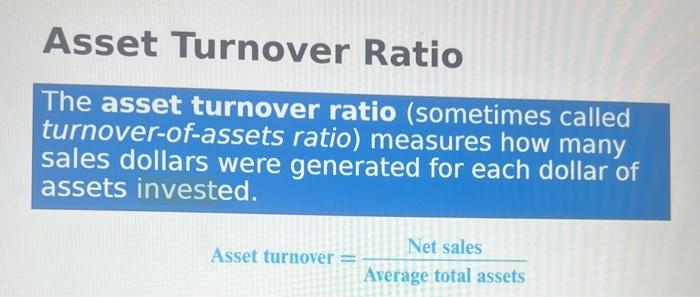

Question: How do I solve for asset turnover ratio using this information? Asset Turnover Ratio The asset turnover ratio (sometimes called turnover-of-assets ratio) measures how many

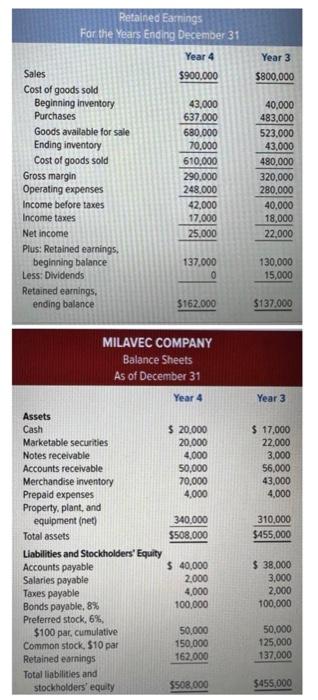

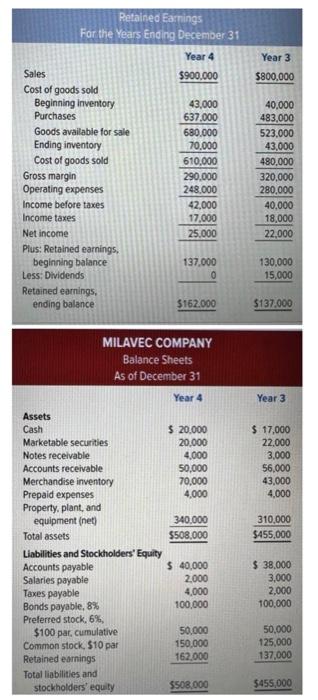

Asset Turnover Ratio The asset turnover ratio (sometimes called turnover-of-assets ratio) measures how many sales dollars were generated for each dollar of assets invested. Net sales Asset turnover = Average total assets Year 3 $800,000 Retained Earnings For the Years Ending December 31 Year 4 Sales $900.000 Cost of goods sold Beginning inventory 43,000 Purchases 637,000 Goods available for sale 680.000 Ending inventory 70.000 Cost of goods sold 610.000 Gross margin 290.000 Operating expenses 248.000 Income before taxes 42,000 Income taxes 17,000 Net income 25.000 Plus: Retained earnings. beginning balance 137.000 Less: Dividends 0 Retained earnings. ending balance $162.000 40.000 483,000 523.000 43,000 480.000 320,000 280,000 40.000 18,000 22,000 130,000 15,000 $137.000 Year 3 $ 17,000 22.000 3,000 56,000 43,000 4,000 MILAVEC COMPANY Balance Sheets As of December 31 Year 4 Assets Cash $ 20,000 Marketable securities 20,000 Notes receivable 4,000 Accounts receivable 50,000 Merchandise inventory 70.000 Prepaid expenses 4,000 Property, plant, and equipment (net) 340.000 Total assets $508,000 Liabilities and Stockholders' Equity Accounts payable $ 40,000 Salaries payable 2.000 Taxes payable 4,000 Bonds payable, 8% 100,000 Preferred stock,6% $100 par, cumulative 50,000 Common stock, $10 par 150,000 Retained earnings 162.000 Total liabilities and stockholders' equity $508,000 310,000 $455,000 $ 38,000 3,000 2,000 100,000 50.000 125.000 137,000 $455,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts