Question: How do I solve for the incorrect with the equivalent units ? and cost assignment ? Prenare a nondstion cost renort for Ortoher sina the

How do I solve for the incorrect with the equivalent units ? and cost assignment ?

How do I solve for the incorrect with the equivalent units ? and cost assignment ?

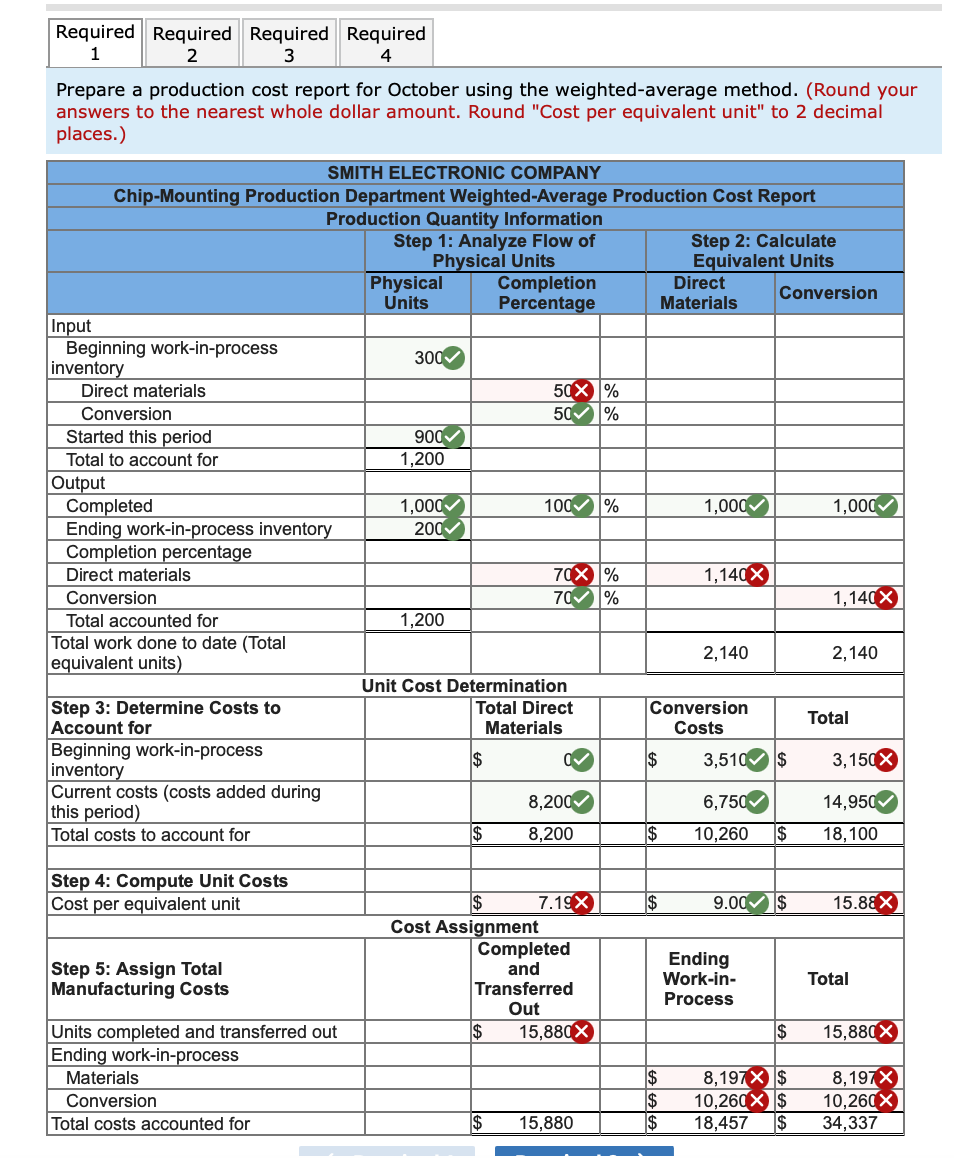

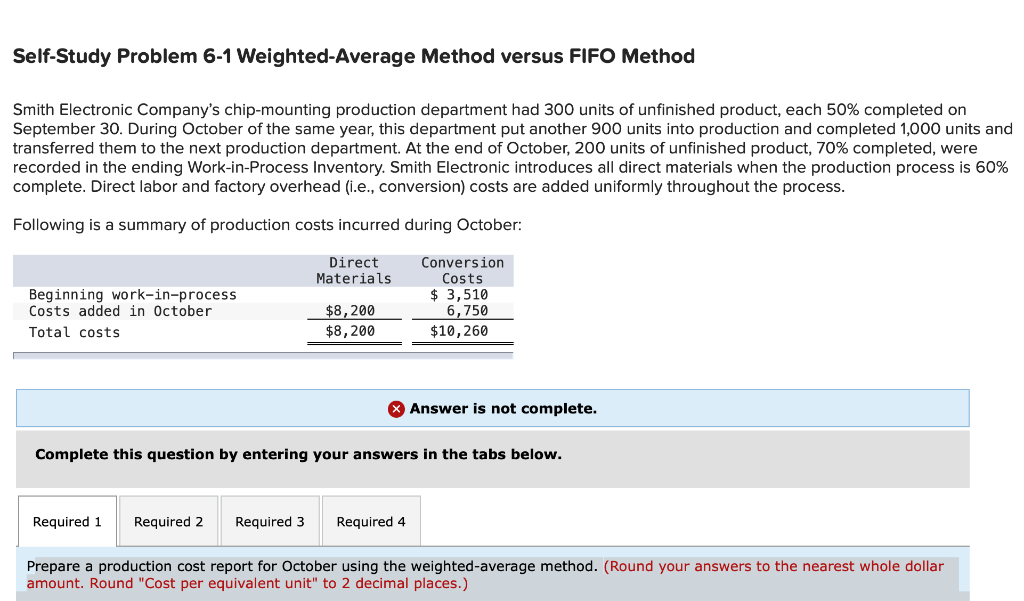

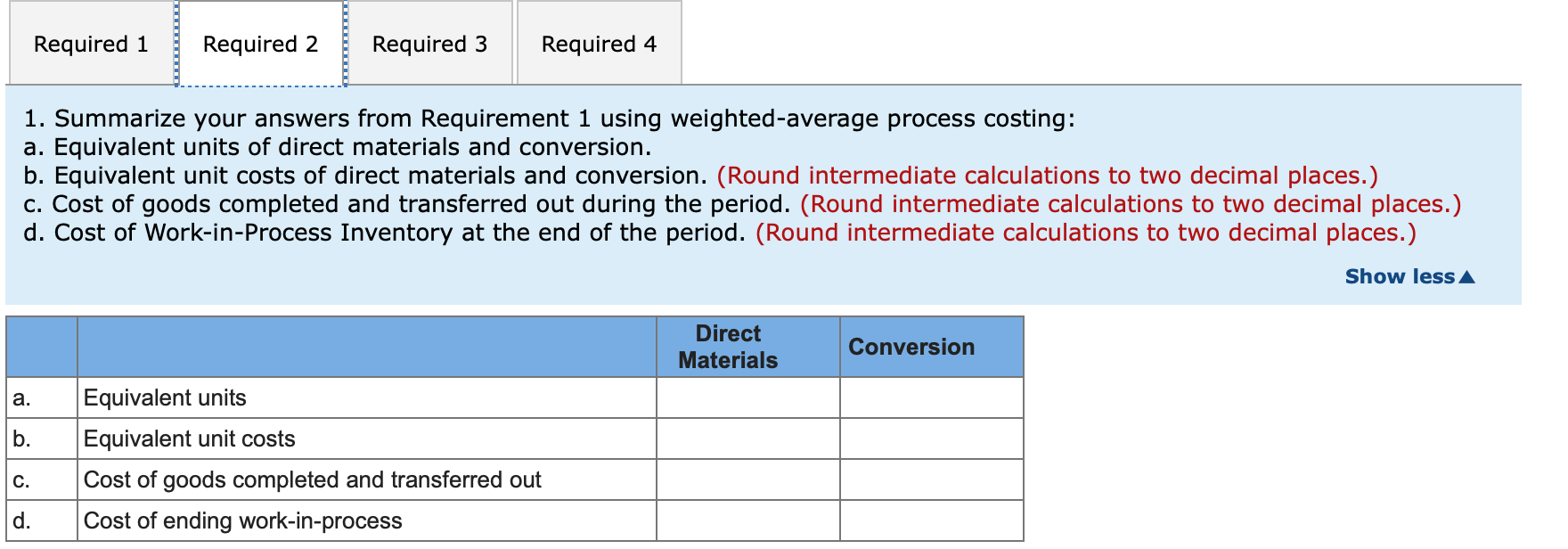

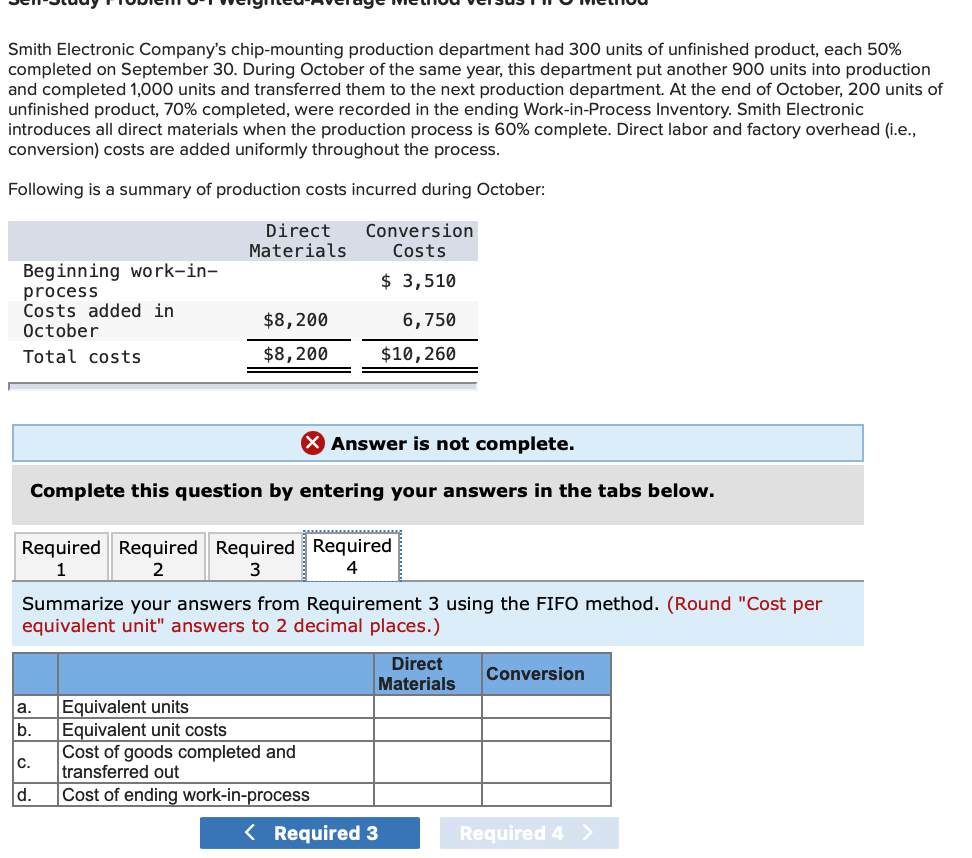

Prenare a nondstion cost renort for Ortoher sina the weiahted-averane method. (Rod vou Self-Study Problem 6-1 Weighted-Average Method versus FIFO Method Smith Electronic Company's chip-mounting production department had 300 units of unfinished product, each 50% completed on September 30. During October of the same year, this department put another 900 units into production and completed 1,000 units and transferred them to the next production department. At the end of October, 200 units of unfinished product, 70% completed, were recorded in the ending Work-in-Process Inventory. Smith Electronic introduces all direct materials when the production process is 60% complete. Direct labor and factory overhead (i.e., conversion) costs are added uniformly throughout the process. Following is a summary of production costs incurred during October: Answer is not complete. Complete this question by entering your answers in the tabs below. Prepare a production cost report for October using the weighted-average method. (Round your answers to the nearest whole dollar amount. Round "Cost per equivalent unit" to 2 decimal places.) 1. Summarize your answers from Requirement 1 using weighted-average process costing: a. Equivalent units of direct materials and conversion. b. Equivalent unit costs of direct materials and conversion. (Round intermediate calculations to two decimal places.) c. Cost of goods completed and transferred out during the period. (Round intermediate calculations to two decimal places.) d. Cost of Work-in-Process Inventory at the end of the period. (Round intermediate calculations to two decimal places.) iole Smith Electronic Company's chip-mounting production department had 300 units of unfinished product, each 50% completed on September 30. During October of the same year, this department put another 900 units into production and completed 1,000 units and transferred them to the next production department. At the end of October, 200 units of unfinished product, 70% completed, were recorded in the ending Work-in-Process Inventory. Smith Electronic introduces all direct materials when the production process is 60% complete. Direct labor and factory overhead (i.e., conversion) costs are added uniformly throughout the process. Following is a summary of production costs incurred during October: Answer is not complete. Complete this question by entering your answers in the tabs below. Summarize your answers from Requirement 3 using the FIFO method. (Round "Cost per equivalent unit" answers to 2 decimal places.) Prenare a nondstion cost renort for Ortoher sina the weiahted-averane method. (Rod vou Self-Study Problem 6-1 Weighted-Average Method versus FIFO Method Smith Electronic Company's chip-mounting production department had 300 units of unfinished product, each 50% completed on September 30. During October of the same year, this department put another 900 units into production and completed 1,000 units and transferred them to the next production department. At the end of October, 200 units of unfinished product, 70% completed, were recorded in the ending Work-in-Process Inventory. Smith Electronic introduces all direct materials when the production process is 60% complete. Direct labor and factory overhead (i.e., conversion) costs are added uniformly throughout the process. Following is a summary of production costs incurred during October: Answer is not complete. Complete this question by entering your answers in the tabs below. Prepare a production cost report for October using the weighted-average method. (Round your answers to the nearest whole dollar amount. Round "Cost per equivalent unit" to 2 decimal places.) 1. Summarize your answers from Requirement 1 using weighted-average process costing: a. Equivalent units of direct materials and conversion. b. Equivalent unit costs of direct materials and conversion. (Round intermediate calculations to two decimal places.) c. Cost of goods completed and transferred out during the period. (Round intermediate calculations to two decimal places.) d. Cost of Work-in-Process Inventory at the end of the period. (Round intermediate calculations to two decimal places.) iole Smith Electronic Company's chip-mounting production department had 300 units of unfinished product, each 50% completed on September 30. During October of the same year, this department put another 900 units into production and completed 1,000 units and transferred them to the next production department. At the end of October, 200 units of unfinished product, 70% completed, were recorded in the ending Work-in-Process Inventory. Smith Electronic introduces all direct materials when the production process is 60% complete. Direct labor and factory overhead (i.e., conversion) costs are added uniformly throughout the process. Following is a summary of production costs incurred during October: Answer is not complete. Complete this question by entering your answers in the tabs below. Summarize your answers from Requirement 3 using the FIFO method. (Round "Cost per equivalent unit" answers to 2 decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts