Question: how do I solve for y2 in the first part of the question? The data available on Treasury Bonds in the market is as follows:

how do I solve for y2 in the first part of the question?

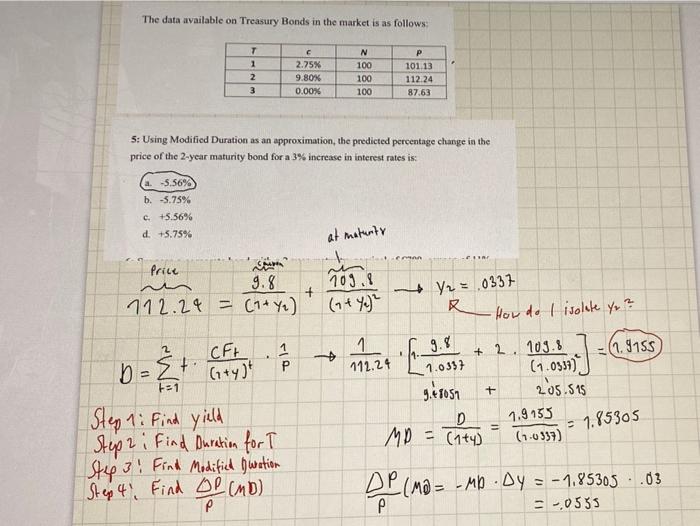

how do I solve for y2 in the first part of the question?The data available on Treasury Bonds in the market is as follows: T 1 2 3 2.75% 9.80% 0.00% N 100 100 100 P 101.13 112 24 87.63 5: Using Modified Duration as an approximation, the predicted percentage change in the price of the 2-year maturity bond for a 3% increase in interest rates is: -5.56% b.5.75% c.+5.56% d. +5.75% at maturity CA -CR Price + 109.8 (7+ yg 112.24 = (1 + Ye) 1 112.24 + y = .0337 R -How do I isolate yo? 9.8 + 2.109.8 (1.9155 1.0357 (1.0934) + 1.9155 7.85305 (1.0337) +31 CFI D - St. 1 / (1+y) Step 1: Find yield Step 2 i Find Duration for Step 3! Find Modified Duration Step 4. Find DP (MD) 205.515 g.47051 D MD = (144) DP (MD = - Mb. Dy = -1.85305 - .03 P P -,0535

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts