Question: How do i solve part B? a) Prepare the journal entries for the years 2020-2022 to record income taxes payable (refundable), income tax expense (benefit),

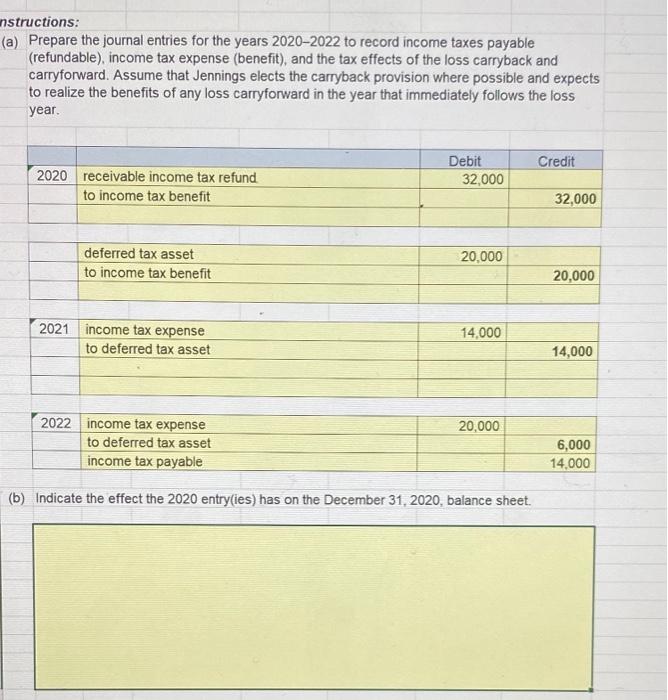

a) Prepare the journal entries for the years 2020-2022 to record income taxes payable (refundable), income tax expense (benefit), and the tax effects of the loss carryback and carryforward. Assume that Jennings elects the carryback provision where possible and expects to realize the benefits of any loss carryforward in the year that immediately follows the loss year. (b) Indicate the effect the 2020 entry(ies) has on the December 31,2020 , balance sheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts