Question: how do i solve : P-M:6-37. Preparing variable and absorption costing income statements This problem continues the Piedmont Computer Problem situation from Chapter M:5. Piedmont

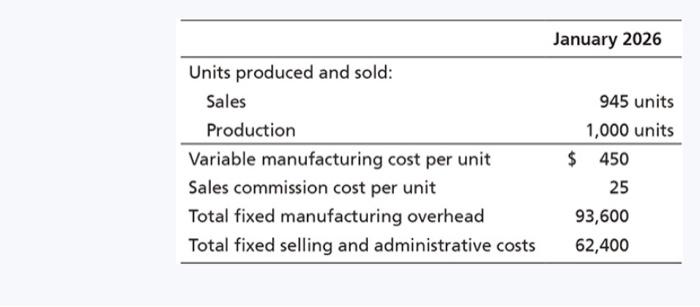

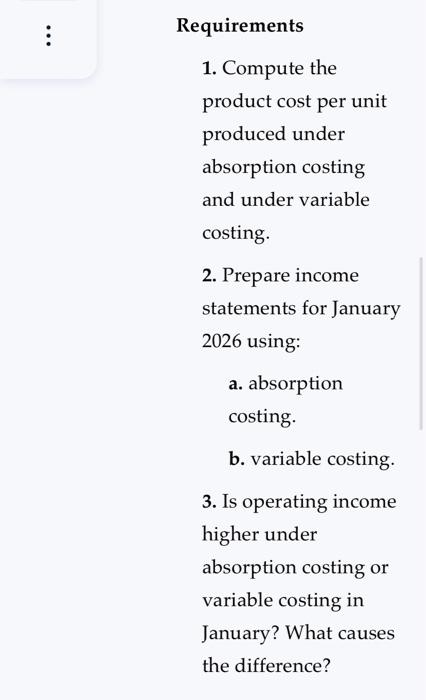

: P-M:6-37. Preparing variable and absorption costing income statements This problem continues the Piedmont Computer Problem situation from Chapter M:5. Piedmont Computer Company manufactures personal computers and tablets. Based on the latest information from the cost accountant, using the current sales mix, the weighted-average sales price per unit is $750, and the weighed-average variable cost per unit is $450. The company does not expect the sales mix to vary for the next year. Assume the beginning balance in Finished Goods Inventory is $0. Additional data for the first month of 2026: January 2026 Units produced and sold: Sales Production Variable manufacturing cost per unit Sales commission cost per unit Total fixed manufacturing overhead Total fixed selling and administrative costs 945 units 1,000 units $ 450 25 93,600 62,400 . Requirements 1. Compute the product cost per unit produced under absorption costing and under variable costing. 2. Prepare income statements for January 2026 using: a. absorption costing. b. variable costing. 3. Is operating income higher under absorption costing or variable costing in January? What causes the difference

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts