Question: How do I solve the problems from the given information? Attached is the financial information needed from your sports apparel company, please use this data

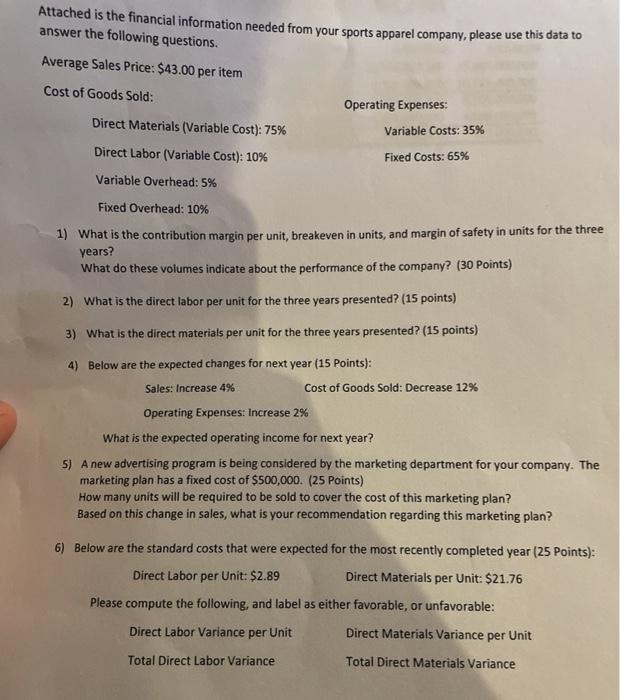

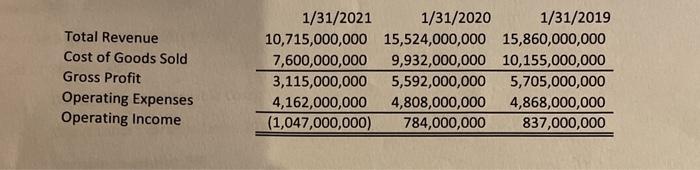

Attached is the financial information needed from your sports apparel company, please use this data to answer the following questions. Average Sales Price: $43.00 per item Cost of Goods Sold: Direct Materials (Variable Cost): 75% Direct Labor (Variable Cost): 10% Operating Expenses: Variable Costs: 35% Fixed Costs: 65% Variable Overhead: 5% Fixed Overhead: 10% 1) What is the contribution margin per unit, breakeven in units, and margin of safety in units for the three years? What do these volumes indicate about the performance of the company? (30 points) 2) What is the direct labor per unit for the three years presented? (15 points) 3) What is the direct materials per unit for the three years presented? (15 points) 4) Below are the expected changes for next year (15 Points): Sales: Increase 4% Cost of Goods Sold: Decrease 12% Operating Expenses: Increase 2% What is the expected operating income for next year? 5) A new advertising program is being considered by the marketing department for your company. The marketing plan has a fixed cost of $500,000. (25 Points) How many units will be required to be sold to cover the cost of this marketing plan? Based on this change in sales, what is your recommendation regarding this marketing plan? 6) Below are the standard costs that were expected for the most recently completed year (25 Points): Direct Labor per Unit: $2.89 Direct Materials per Unit: $21.76 Please compute the following, and label as either favorable, or unfavorable: Direct Labor Variance per Unit Direct Materials Variance per Unit Total Direct Labor Variance Total Direct Materials Variance Total Revenue Cost of Goods Sold Gross Profit Operating Expenses Operating Income 1/31/2021 1/31/2020 1/31/2019 10,715,000,000 15,524,000,000 15,860,000,000 7,600,000,000 9,932,000,000 10,155,000,000 3,115,000,000 5,592,000,000 5,705,000,000 4,162,000,000 4,808,000,000 4,868,000,000 (1,047,000,000) 784,000,000 837,000,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts