Question: How do i solve these three questions? need help studying what i did wrong & right. Assume you are a US exporter with an account

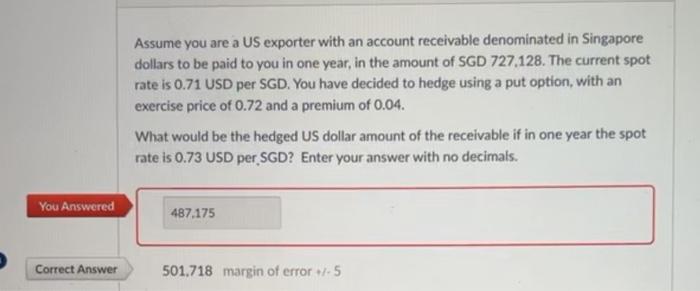

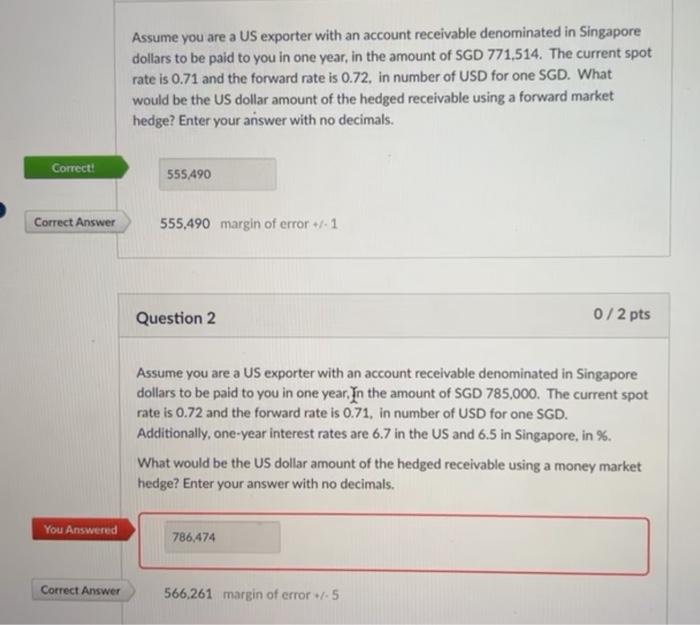

Assume you are a US exporter with an account receivable denominated in Singapore dollars to be paid to you in one year, in the amount of SGD 727.128. The current spot rate is 0.71 USD per SGD. You have decided to hedge using a put option, with an exercise price of 0.72 and a premium of 0.04 . What would be the hedged US dollar amount of the receivable if in one year the spot rate is 0.73 USD per, SGD? Enter your answer with no decimals. Assume you are a US exporter with an account receivable denominated in Singapore dollars to be paid to you in one year, in the amount of SGD 771,514. The current spot rate is 0.71 and the forward rate is 0.72 , in number of USD for one SGD. What would be the US dollar amount of the hedged receivable using a forward market hedge? Enter your aniswer with no decimals. 555,490 margin of error +//1 Question 2 0/2pts Assume you are a US exporter with an account receivable denominated in Singapore dollars to be paid to you in one year. In the amount of SGD 785,000. The current spot rate is 0.72 and the forward rate is 0.71 , in number of USD for one SGD. Additionally, one-year interest rates are 6.7 in the US and 6.5 in Singapore, in \%. What would be the US dollar amount of the hedged receivable using a money market hedge? Enter your answer with no decimals. 566,261 margin of error +/.5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts