Question: How do I solve this? A stock has a required return of 9%, the risk-free rate is 3.5%, and the market risk premium is 4%

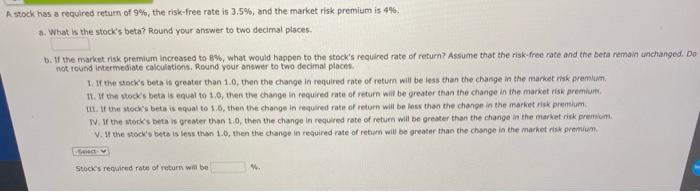

A stock has a required return of 9%, the risk-free rate is 3.5%, and the market risk premium is 4% a. What is the stock's beta? Round your answer to two decimal places. b. If the market risk premium increased to 8%, what would happen to the stock's required rate of return? Assume that the risk free rate and the beta remain unchanged. Do not round Intermediate calculations, Round your answer to two decimal places 1. W the stock's beta is greater than 1.0, then the change in required rate of return will be less than the change in the market rak premium 11. If the Mock's beta is equal to 1.0, then the change in required rate of return will be greater than the change in the market risk premium 1. If the stocks beta is equal to 1.0, then the change in required rate of return will be less than the change in the market risk premium TV. If the stock's beth is greater than 1.0, then the change in required rate of return will be greater than the change in the market risk premium V. the stock's beta is less than 1.0, then the change in required rate of return will be greater than the change in the market is premium . Stock's required rate of return will be w

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts