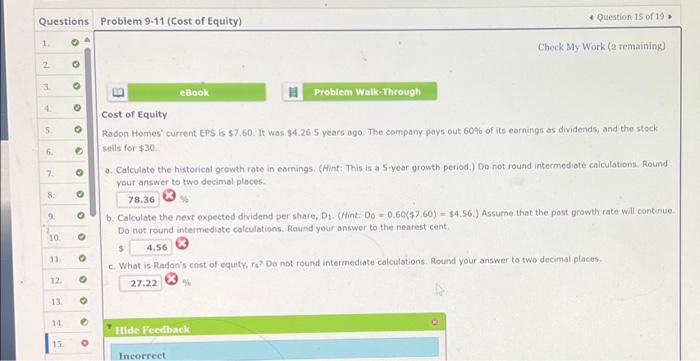

Question: How do I solve this and what is the correct answer? Check My Work (2 remaining) Cost of Equity Radon Homes' current EPS is $7.60.

Check My Work (2 remaining) Cost of Equity Radon Homes' current EPS is $7.60. It was $4.265 years ago. The company pays out 6096 of its earnings as dividends, and the stock sells for $30. a. Calculate the historical growth rate in earnings. (Hint: This is a S-year groweh period.) Do not found intermediate calculations. Round your answer to two decimal places. 8 \% b. Calculate the next expected dividend per share, D1. (Hint: D0=0.60(57.60)=$4.56.) Assume that the post growth rate will continue. Do not round intermediate calculations. Round your answer to the nearest cent. c. What is Radon's cost of equity, re? Do not round intermediate calculations. Round your answer to two decimal places: %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts