Question: how do i solve this Example - For the next questions use the following assumptions: the risk-free rate is .14%. The expected market premium is

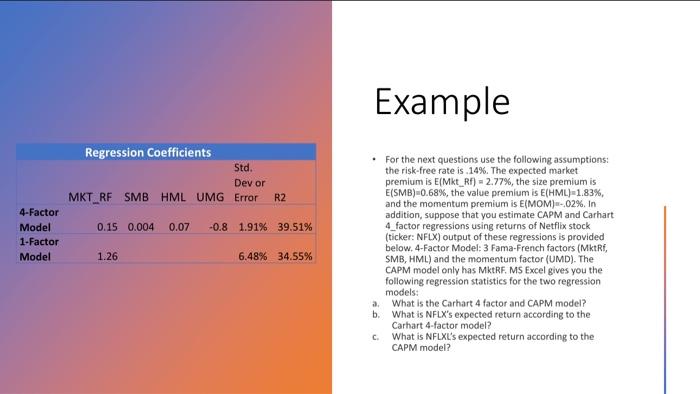

Example - For the next questions use the following assumptions: the risk-free rate is .14\%. The expected market premium is E(Mkt_Rf)=2.77%, the size premium is E(SMB)=0.68%, the value premium is E(HML)=1.83%, and the momentum premium is E(MOM)=,02%. In addition, suppose that you estimate CAPM and Carhart 4 _factor regressions using returns of Netflix stock (ticker: NF(X) output of these regressions is provided below, 4-Factor Model: 3 Fama-French factors (MktRf, SMB, HML) and the momentum factor (UMD). The CAPM model only has MktRF, MS Excel gives you the following regression statistics for the two regression models: a. What is the Carhart 4 factor and CAPM model? b. What is NFLX's expected return according to the Carhart 4-factor model? c. What is NFLXI's expected return according to the CAPM model

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts