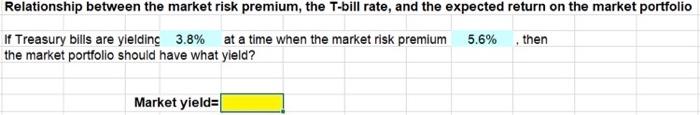

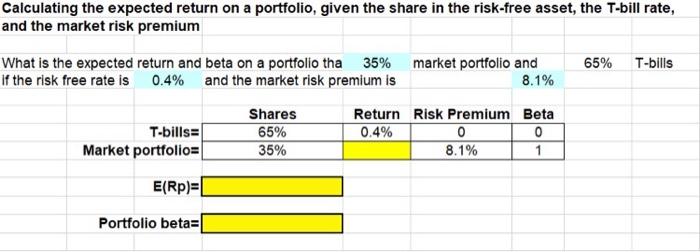

Question: how do I solve this in Excel? Please show what you enter in excel formula bar. Relationship between the market risk premium, the T-bill rate,

Relationship between the market risk premium, the T-bill rate, and the expected return on the market portfolio If Treasury bills are yielding 3.8% at a time when the market risk premium 5.6% the market portfolio should have what yield? then Market yields Calculating the expected return on a portfolio, given the share in the risk-free asset, the T-bill rate, and the market risk premium 65% T-bills What is the expected return and beta on a portfolio tha 35% market portfolio and If the risk free rate is 0.4% and the market risk premium is 8.1% T-bills Market portfolio Shares 65% 35% Return Risk Premium Beta 0.4% 0 0 8.1% 1 E(Rp)= Portfolio beta=

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts