Question: How do I solve this? please explain. Complete a horizontal analysis for Brown Company (Negative answers should be indicated by a minus sign. Leave no

How do I solve this? please explain.

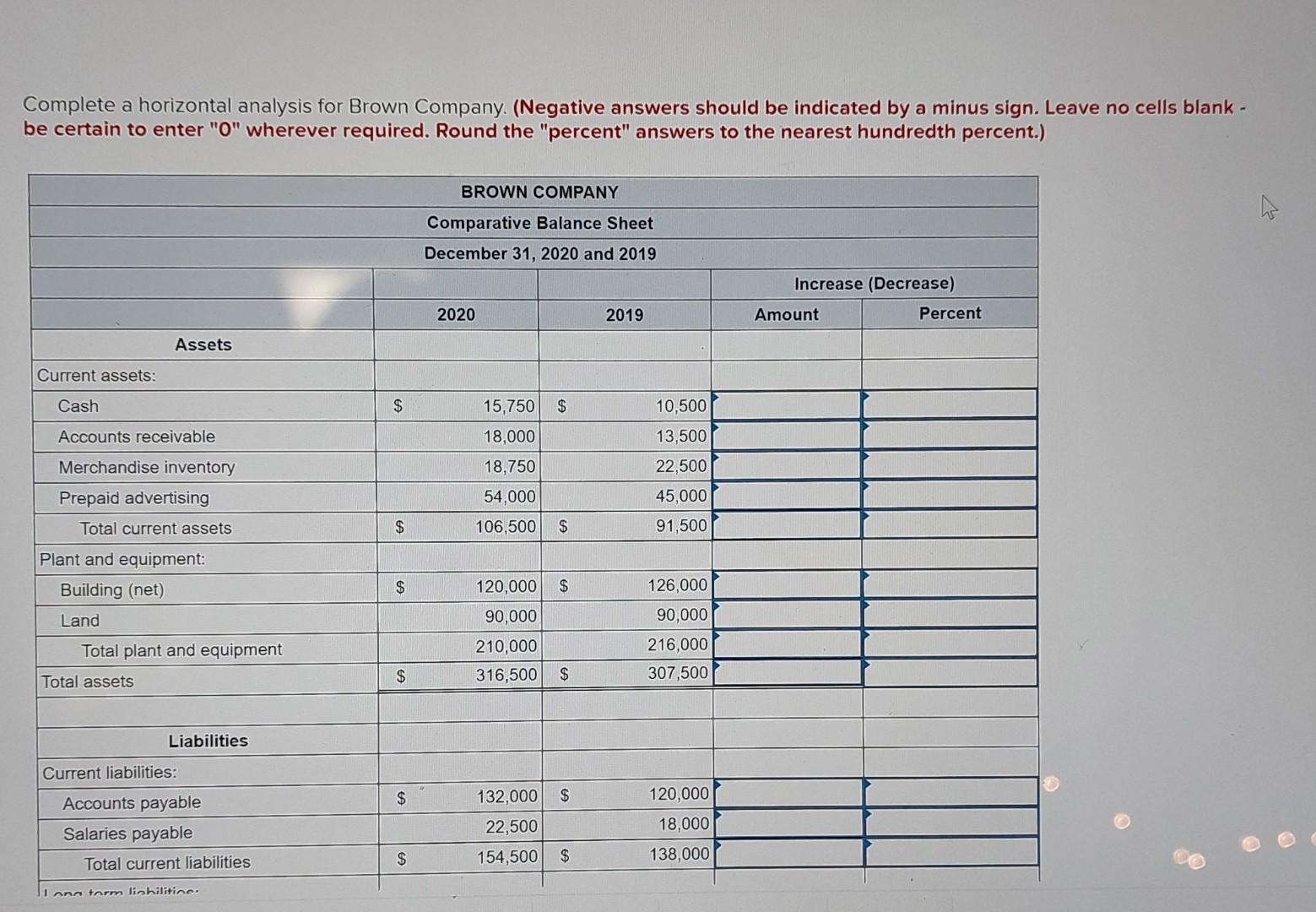

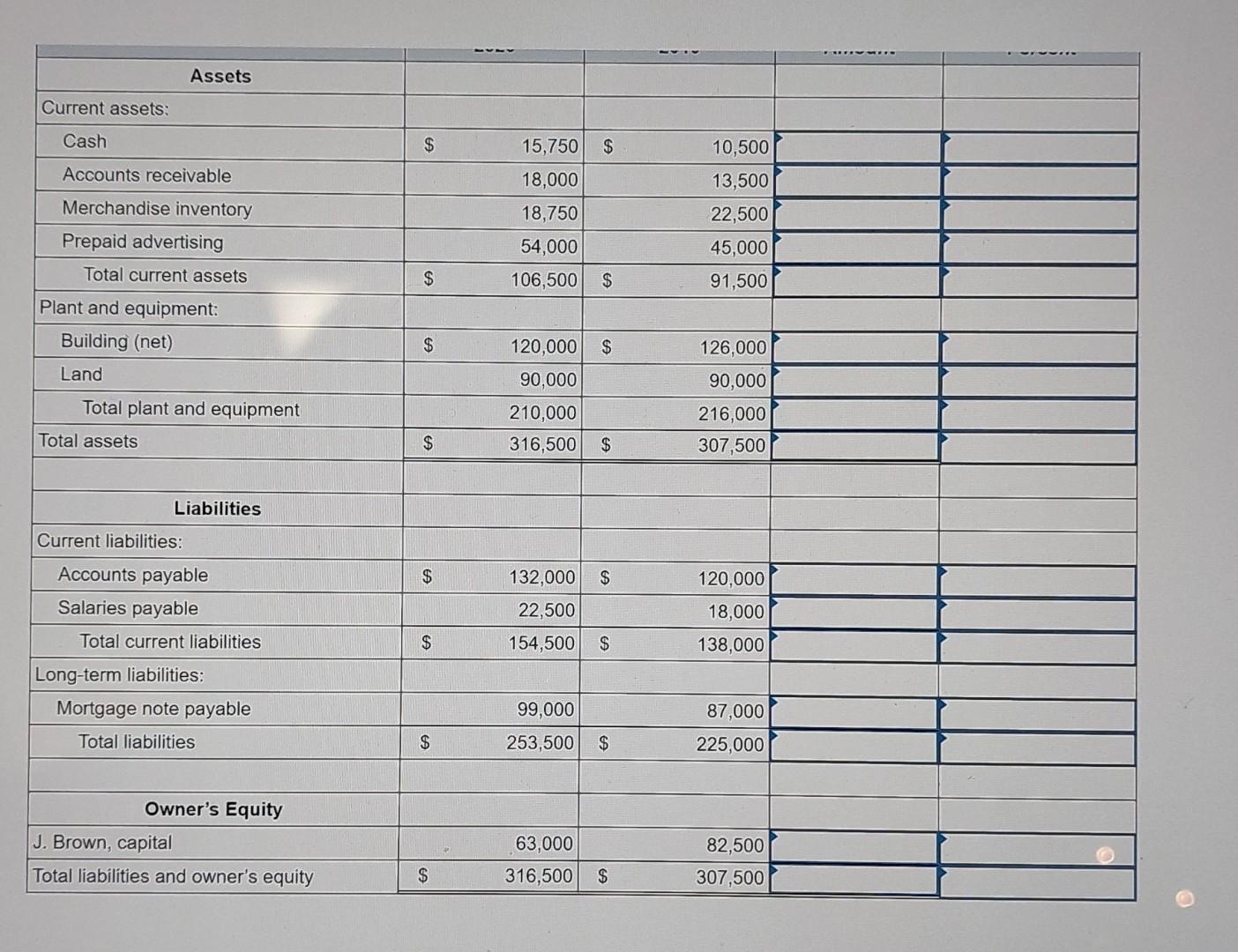

Complete a horizontal analysis for Brown Company (Negative answers should be indicated by a minus sign. Leave no cells blank - be certain to enter "0" wherever required. Round the "percent" answers to the nearest hundredth percent.) BROWN COMPANY Comparative Balance Sheet December 31, 2020 and 2019 Increase (Decrease) Amount Percent 2020 2019 Assets Current assets: Cash $ $ 15,750 18,000 18,750 10,500 13,500 Accounts receivable Merchandise inventory Prepaid advertising 54,000 106,500 22,500 45,000 91,500 Total current assets $ $ Plant and equipment: Building (net) $ 120,000 $ 126,000 Land 90,000 90,000 Total plant and equipment 210,000 316,500 216,000 307,500 $ Total assets $ Liabilities Current liabilities: $ 132,000 $ 120,000 Accounts payable Salaries payable Total current liabilities 22,500 18,000 138,000 $ 154,500 $ Ilona torm lizhilitine. Assets Current assets: Cash $ 15,750 $ 10,500 18,000 13,500 Accounts receivable Merchandise inventory Prepaid advertising 18,750 54,000 22,500 45,000 91,500 Total current assets $ 106,500 $ Plant and equipment: Building (net) $ 120,000 $ Land 90,000 Total plant and equipment 126,000 90,000 216,000 307,500 210,000 316,500 Total assets $ $ Liabilities Current liabilities: $ 132,000 $ 120.000 Accounts payable Salaries payable Total current liabilities 22,500 18,000 $ 154,500 $ 138,000 Long-term liabilities: Mortgage note payable 99,000 87,000 Total liabilities $ 253,500 $ 225,000 Owner's Equity J. Brown, capital Total liabilities and owner's equity 63,000 82,500 $ 316,500 $ 307,500

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts