Question: How do I solve this problem? Question 8 Two rms compete in a homogeneous product market where the inverse demand function is P = 10

How do I solve this problem?

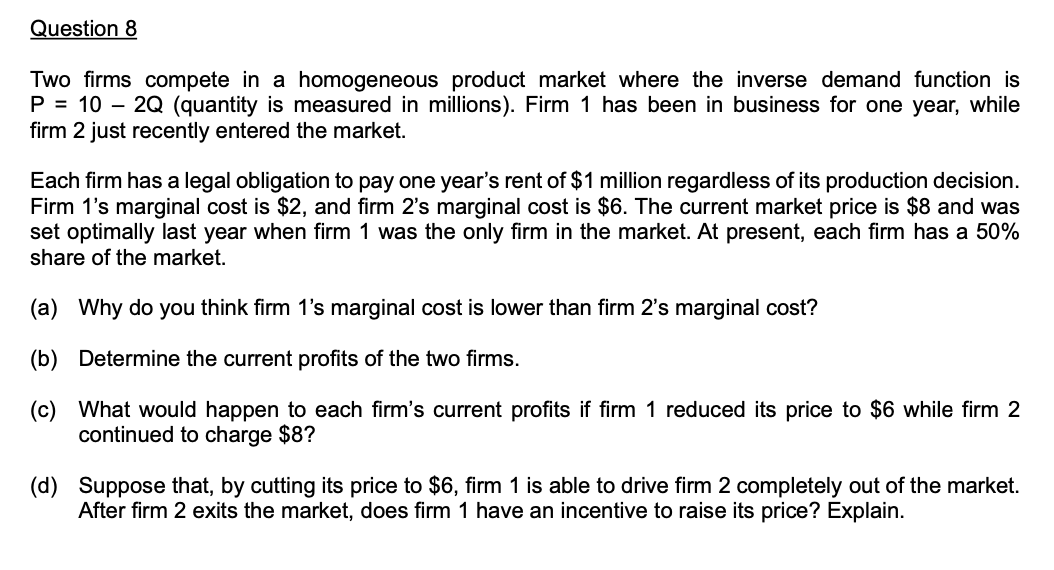

Question 8 Two rms compete in a homogeneous product market where the inverse demand function is P = 10 2Q (quantity is measured in millions). Firm 1 has been in business for one year, while firm 2 just recently entered the market. Each rm has a legal obligation to pay one year's rent of $1 million regardless of its production decision. Firm 1's marginal cost is $2, and rm 2's marginal cost is $6. The current market price is $8 and was set optimally last year when firm 1 was the only rm in the market. At present, each rm has a 50% share of the market. (a) Why do you think rm 1's marginal cost is lower than firm 2's marginal cost? (b) Determine the current prots of the two rms. (0) What would happen to each rm's current prots if rm 1 reduced its price to $6 while firm 2 continued to charge $8? (d) Suppose that, by cutting its price to $6, rm 1 is able to drive firm 2 completely out of the market. After rm 2 exits the market, does rm 1 have an incentive to raise its price? Explain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts