Question: How do I solve this ? QS 4-20 (Algo) Preparing a multiple-step income statement LO P4 Save-the-Earth Company reports the following income statement accounts for

How do I solve this ?

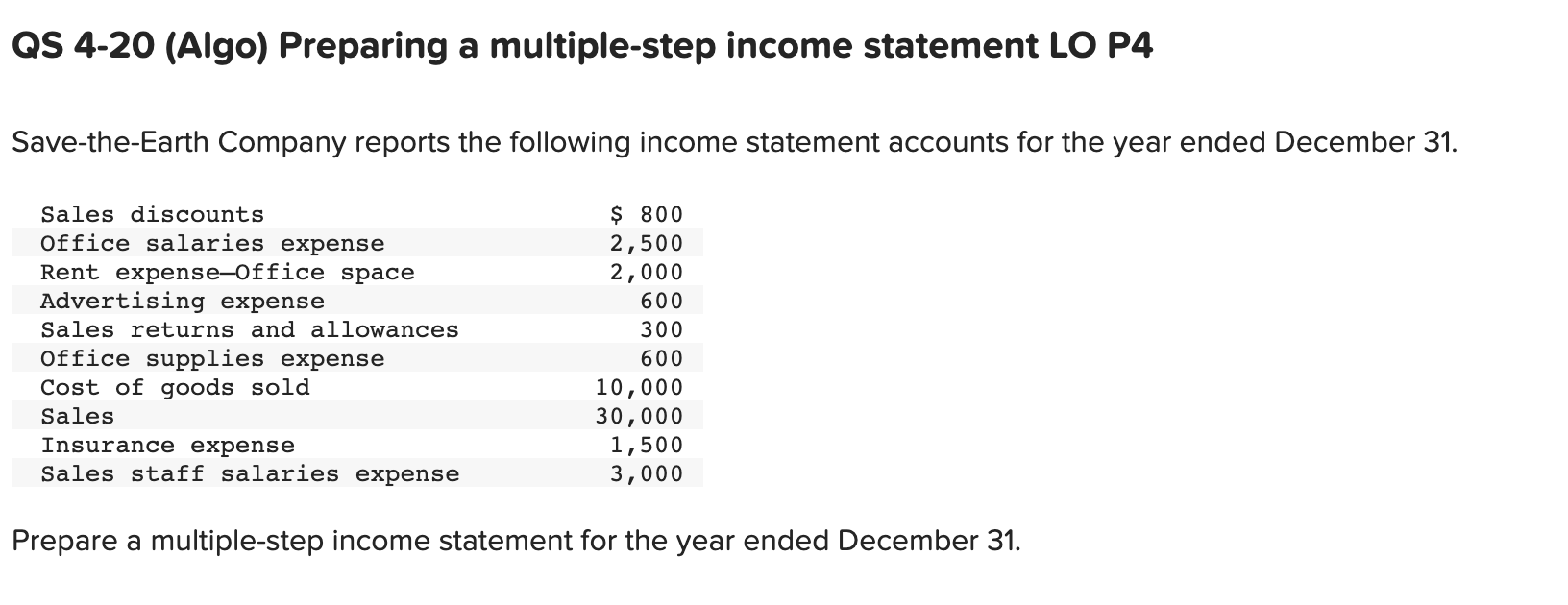

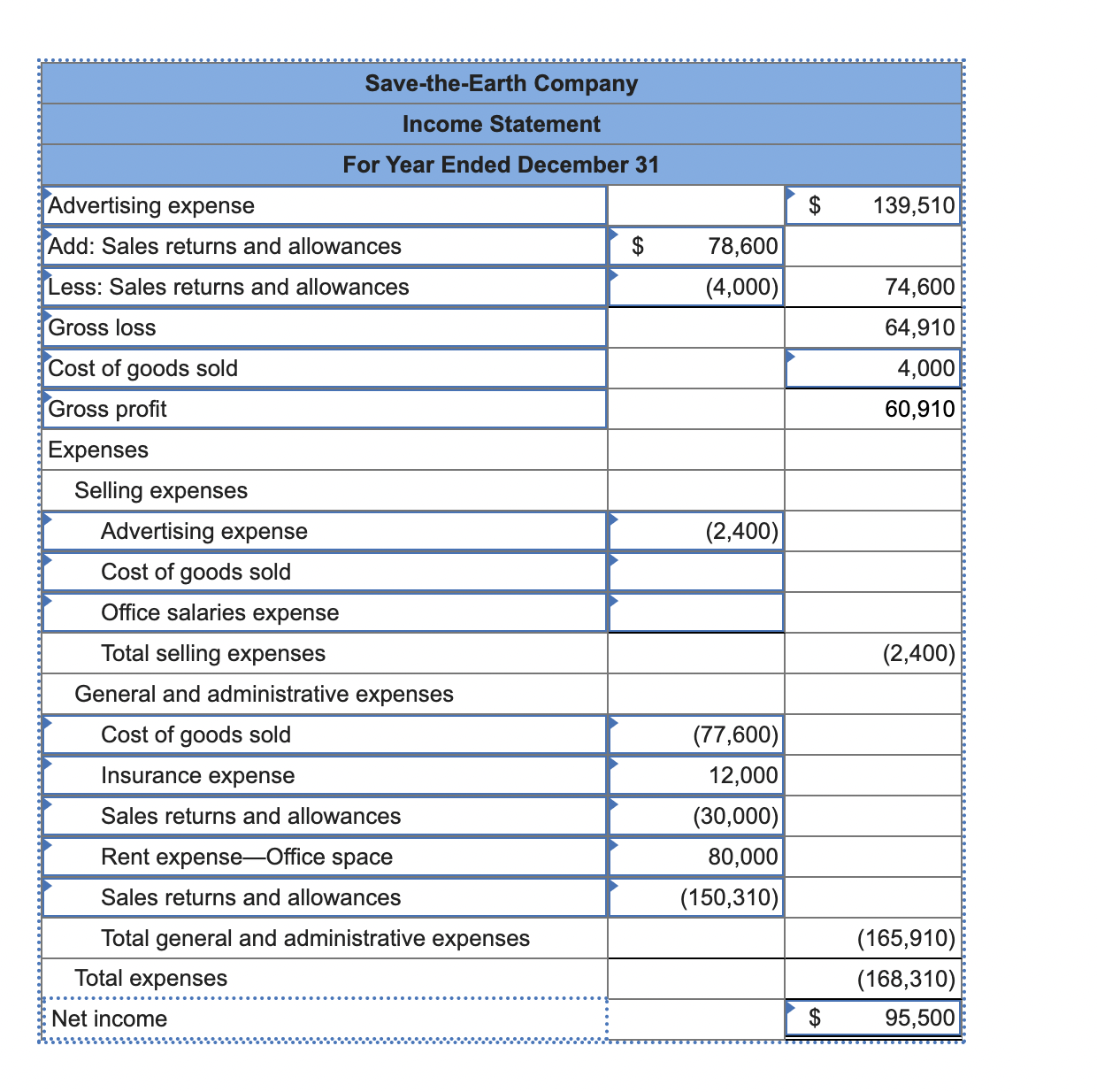

QS 4-20 (Algo) Preparing a multiple-step income statement LO P4 Save-the-Earth Company reports the following income statement accounts for the year ended December 31. Prepare a multiple-step income statement for the year ended December 31. \begin{tabular}{|c|c|c|c|} \hline \multicolumn{4}{|c|}{ Save-the-Earth Company } \\ \hline \multicolumn{4}{|c|}{ Income Statement } \\ \hline \multicolumn{4}{|c|}{ For Year Ended December 31} \\ \hline Advertising expense & & $ & 139,510 \\ \hline Add: Sales returns and allowances & 78,600 & & \\ \hline Less: Sales returns and allowances & (4,000) & & 74,600 \\ \hline Gross loss & & & 64,910 \\ \hline Cost of goods sold & & & 4,000 \\ \hline Gross profit & & & 60,910 \\ \hline \multicolumn{4}{|l|}{ Expenses } \\ \hline \multicolumn{4}{|l|}{ Selling expenses } \\ \hline Advertising expense & (2,400) & & \\ \hline \multicolumn{4}{|l|}{ Cost of goods sold } \\ \hline \multicolumn{4}{|l|}{ Office salaries expense } \\ \hline Total selling expenses & & & (2,400) \\ \hline \multicolumn{4}{|l|}{ General and administrative expenses } \\ \hline Cost of goods sold & (77,600) & & \\ \hline Insurance expense & 12,000 & & \\ \hline Sales returns and allowances & (30,000) & & \\ \hline Rent expense-Office space & 80,000 & & \\ \hline Sales returns and allowances & (150,310) & & \\ \hline Total general and administrative expenses & & & (165,910) \\ \hline Total expenses & & & (168,310) \\ \hline Net income & & $ & 95,500 \\ \hline \end{tabular} QS 4-20 (Algo) Preparing a multiple-step income statement LO P4 Save-the-Earth Company reports the following income statement accounts for the year ended December 31. Prepare a multiple-step income statement for the year ended December 31. \begin{tabular}{|c|c|c|c|} \hline \multicolumn{4}{|c|}{ Save-the-Earth Company } \\ \hline \multicolumn{4}{|c|}{ Income Statement } \\ \hline \multicolumn{4}{|c|}{ For Year Ended December 31} \\ \hline Advertising expense & & $ & 139,510 \\ \hline Add: Sales returns and allowances & 78,600 & & \\ \hline Less: Sales returns and allowances & (4,000) & & 74,600 \\ \hline Gross loss & & & 64,910 \\ \hline Cost of goods sold & & & 4,000 \\ \hline Gross profit & & & 60,910 \\ \hline \multicolumn{4}{|l|}{ Expenses } \\ \hline \multicolumn{4}{|l|}{ Selling expenses } \\ \hline Advertising expense & (2,400) & & \\ \hline \multicolumn{4}{|l|}{ Cost of goods sold } \\ \hline \multicolumn{4}{|l|}{ Office salaries expense } \\ \hline Total selling expenses & & & (2,400) \\ \hline \multicolumn{4}{|l|}{ General and administrative expenses } \\ \hline Cost of goods sold & (77,600) & & \\ \hline Insurance expense & 12,000 & & \\ \hline Sales returns and allowances & (30,000) & & \\ \hline Rent expense-Office space & 80,000 & & \\ \hline Sales returns and allowances & (150,310) & & \\ \hline Total general and administrative expenses & & & (165,910) \\ \hline Total expenses & & & (168,310) \\ \hline Net income & & $ & 95,500 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts