Question: How do I solve this question? Applied vs. Actual Manufacturing Overhead Davis Manufacturing Corporation applies manufacturing overhead on the basis of 140% of direct labor

How do I solve this question?

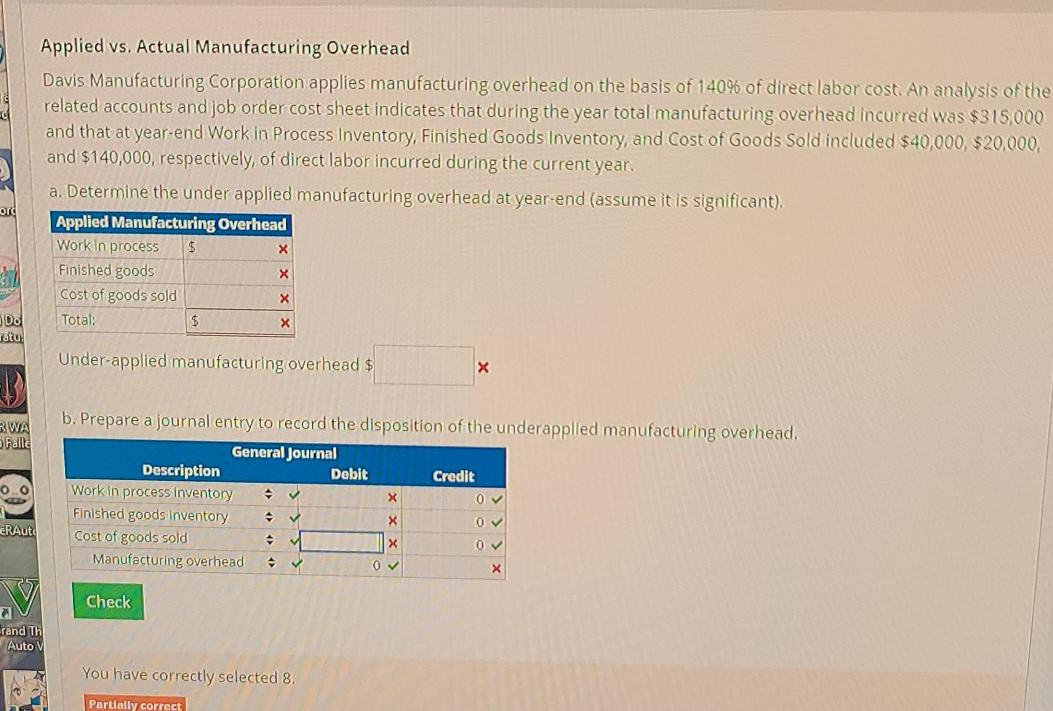

Applied vs. Actual Manufacturing Overhead Davis Manufacturing Corporation applies manufacturing overhead on the basis of 140% of direct labor cost. An analysis of the related accounts and job order cost sheet indicates that during the year total manufacturing overhead incurred was $315,000 and that at year-end Work in Process Inventory, Finished Goods Inventory, and Cost of Goods Sold included $40,000, $20,000, and $140,000, respectively, of direct labor incurred during the current year. a. Determine the under applied manufacturing overhead at year-end (assume it is significant). Applied Manufacturing Overhead Work in process Finished goods Cost of goods sold Total: $ ord $ X x X X DO latu, Under-applied manufacturing overhead $ RWA Falle 0.0 b. Prepare a journal entry to record the disposition of the underapplied manufacturing overhead. General Journal Description Debit Credit Work in process inventory 0 Finished goods inventory X 0 Cost of goods sold X Manufacturing overhead 0 X ERAuto + 0 X Check rand Th Auto V You have correctly selected 8. Partially correct

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts