Question: How do I solve this question? D Ass de Chi Chi Ch wie X eth + mybusinesscourse.com/platform/mod/quic/attempt.php?attempt=44... ABP Business Course My Subscriptions Question 1 Not

How do I solve this question?

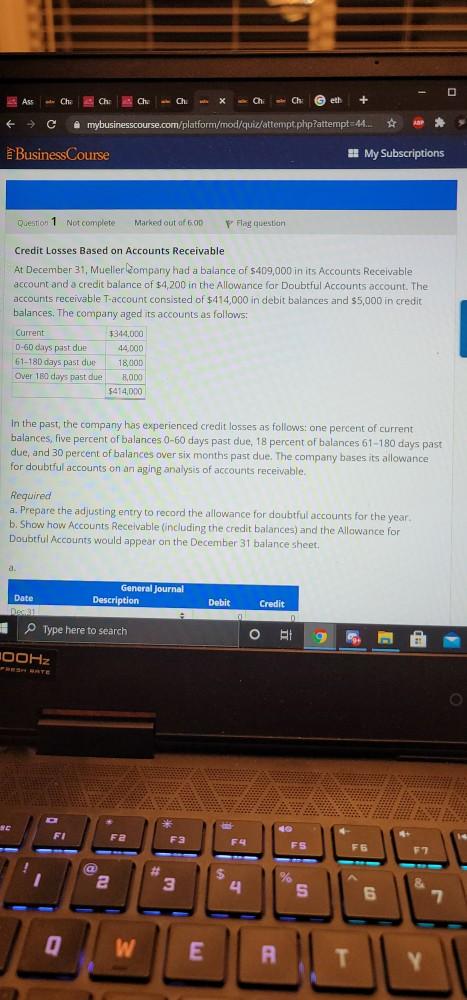

D Ass de Chi Chi Ch wie X eth + mybusinesscourse.com/platform/mod/quic/attempt.php?attempt=44... ABP Business Course My Subscriptions Question 1 Not complete Marked out of 6.00 P Flag question Credit Losses Based on Accounts Receivable At December 31, Mueller company had a balance of $409,000 in its Accounts Receivable account and a credit balance of $4,200 in the Allowance for Doubtful Accounts account. The accounts receivable T-account consisted of $414,000 in debit balances and $5,000 in credit balances. The company aged its accounts as follows: Current 7314,000 D-60 days past due 44.000 61-180 days past due 18,000 Over 150 days past due BODO 5414.000 In the past, the company has experienced credit losses as follows: one percent of current balances, five percent of balances 0-60 days past due, 18 percent of balances 61-180 days past due, and 30 percent of balances over six months past due. The company bases its allowance for doubtful accounts on an aging analysis of accounts receivable. Required a. Prepare the adjusting entry to record the allowance for doubtful accounts for the year b. Show how Accounts Receivable (including the credit balances) and the Allowance for Doubtful Accounts would appear on the December 31 balance sheet. d. General Journal Description Date Dec 31 Debit Credit Type here to search 0 OOHz URTE SC FI Fa F3 Fa FS F6 F7 ( a 3 4 % 5 6 7 Q W E A Y

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts