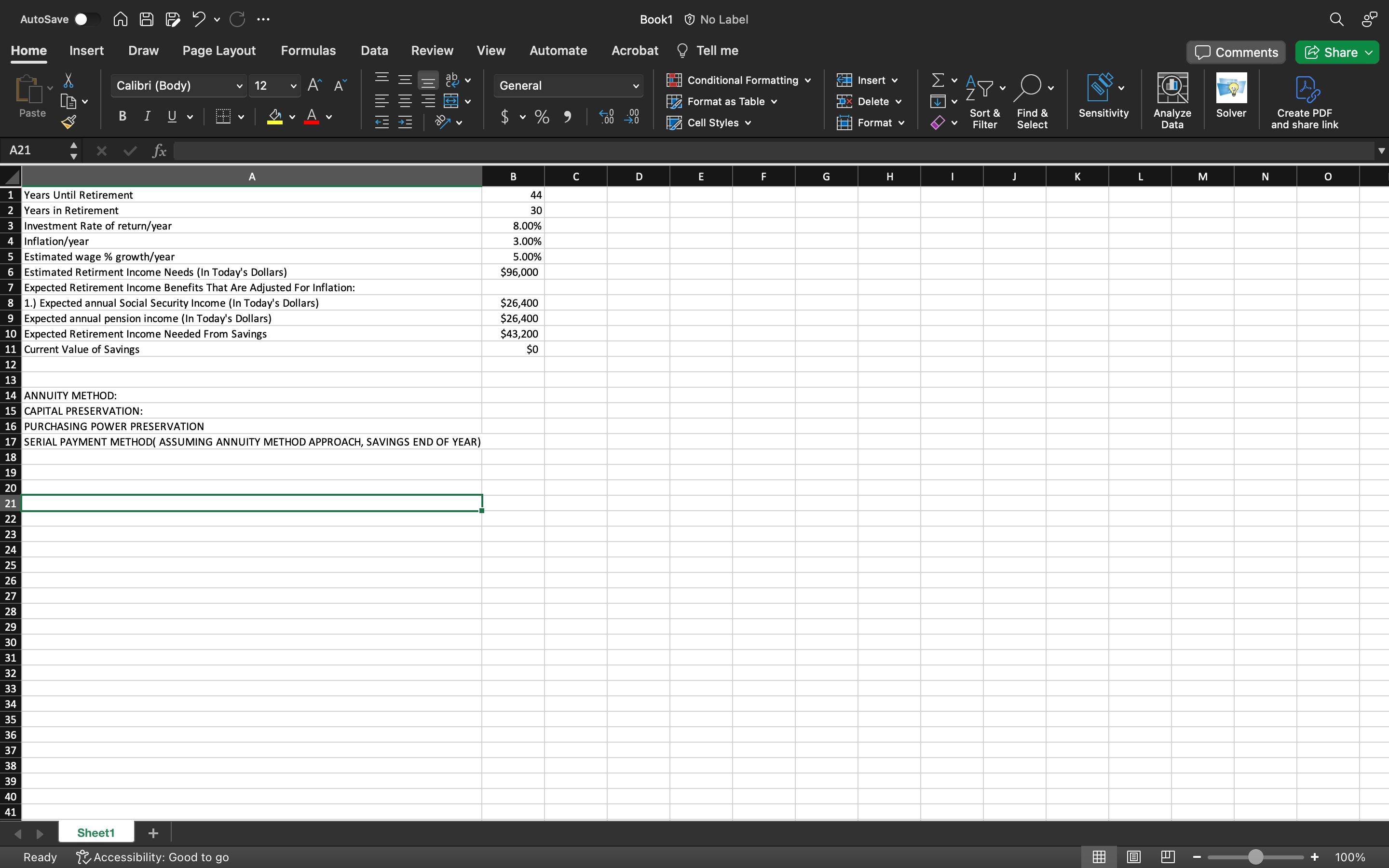

Question: How do I solve this using the Purchasing Power Preservation? Years Until Retirement Years in Retirement Investment Rate of return / year Inflation / year

How do I solve this using the Purchasing Power Preservation?

Years Until Retirement

Years in Retirement

Investment Rate of returnyear

Inflationyear

Estimated wage growthyear

Estimated Retirment Income Needs In Today's Dollars

Expected Retirement Income Benefits That Are Adjusted For Inflation:

Expected annual Social Security Income In Today's Dollars

Expected annual pension income In Today's Dollars

Expected Retirement Income Needed From Savings

Current Value of Savings

How

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock