Question: How do I solve this? Work shown gets upvote Henrie's Drapery Service is investigating the purchase of a new machine for cleaning and blocking drapes.

How do I solve this? Work shown gets upvote

How do I solve this? Work shown gets upvote

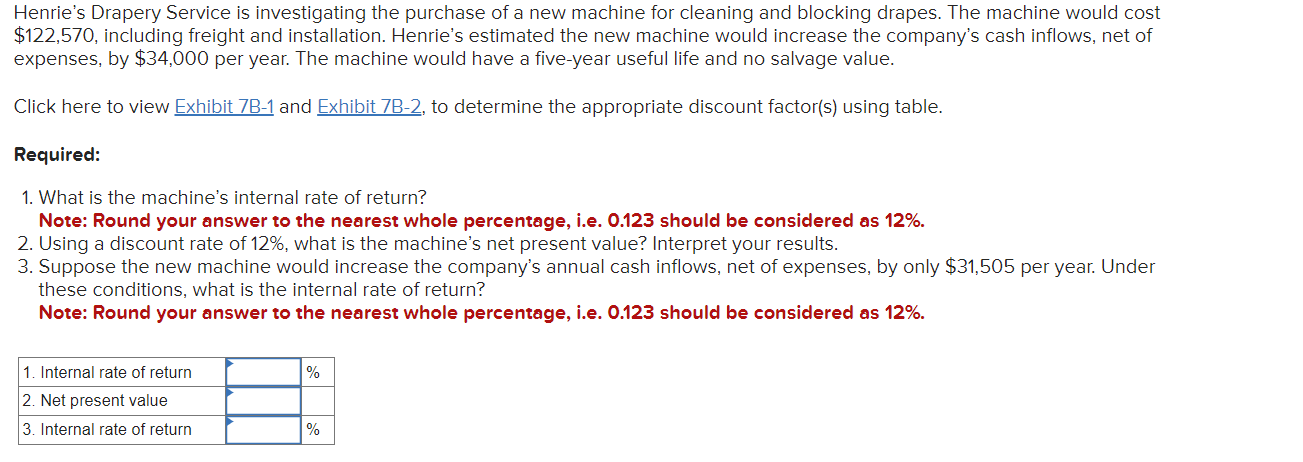

Henrie's Drapery Service is investigating the purchase of a new machine for cleaning and blocking drapes. The machine would cost $122,570, including freight and installation. Henrie's estimated the new machine would increase the company's cash inflows, net of expenses, by $34,000 per year. The machine would have a five-year useful life and no salvage value. Click here to view and to determine the appropriate discount factor(s) using table. Required: 1. What is the machine's internal rate of return? Note: Round your answer to the nearest whole percentage, i.e. 0.123 should be considered as 12%. 2. Using a discount rate of 12%, what is the machine's net present value? Interpret your results. 3. Suppose the new machine would increase the company's annual cash inflows, net of expenses, by only $31,505 per year. Under these conditions, what is the internal rate of return? Note: Round your answer to the nearest whole percentage, i.e. 0.123 should be considered as 12%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts