Question: how do i work this?? can you okease explain it to me? Paul Larkin and Jim Smith are the only two employees of Texas Pipe

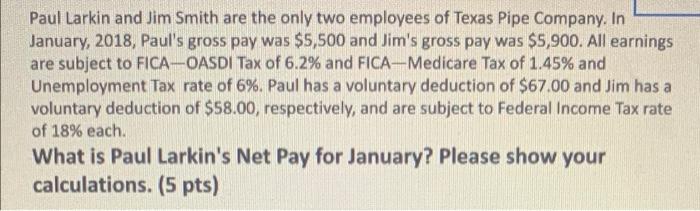

Paul Larkin and Jim Smith are the only two employees of Texas Pipe Company. In January, 2018, Paul's gross pay was $5,500 and Jim's gross pay was $5,900. All earnings are subject to FICA-OASDI Tax of 6.2% and FICA-Medicare Tax of 1.45% and Unemployment Tax rate of 6%. Paul has a voluntary deduction of $67.00 and Jim has a voluntary deduction of $58.00, respectively, and are subject to Federal Income Tax rate of 18% each. What is Paul Larkin's Net Pay for January? Please show your calculations. (5 pts)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts