Question: How do international factors affect decision making? Although the same basic principles of capital budgeting apply to both foreign and domestic operations, there are some

How do international factors affect decision making? Although the same basic principles of capital budgeting apply to both foreign and domestic operations, there are some key differences. For example, cash flows must be converted into the parent company's currency, so they are subject to exchange rate risk. In addition, the cost of capital may be different for a foreign project compared with an equivalent domestic project.

For this Assignment, complete Problem 19-17, Parts a, b, and c on page 680 of your course text. This case examines the effects of exchange rates on net present values and rates of return.

In addition to solving for the rates of return from the U.S. and Swiss points of view, write a paragraph that summarizes your key learning points from this case. Be sure to include your calculations as an appendix.

Submit your Assignment (both your Excel and Word files).

General Guidance on Application Length:

Your Assignment, due by Day 7, will typically be 23 pages in length as a general expectation/estimate. Refer to the rubric for the Week 7 Assignment for grading elements and criteria. Your Instructor will use the rubric to assess your work.

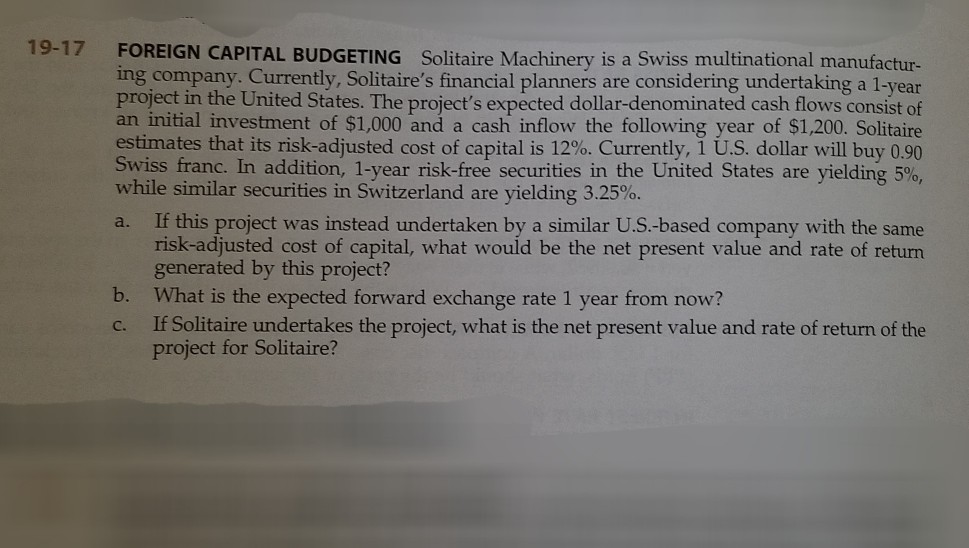

19-17 FOREIGN CAPITAL BUDGETING ing company. Currently, Solitaire's financial planners are considering undertaking a 1-year project in the United States. The project's expected dollar-denominated cash flows consist of an initial investment of $1,000 and a cash inflow the following year of $1,200. Solitaire estimates that its risk-adjusted cost of capital is 12% Currently, 1 US dollar will buy 0.90 Swiss franc. In addition, 1-year risk-free securities in the United States are yielding 5%, while similar securities in Switzerland are yielding 3.25%. Solitaire Machinery is a Swiss multinational manufactur- a. If this project was instead undertaken by a similar U.S.-based company with the same risk-adjusted cost of capital, what would be the net present value and rate of return generated by this project? b. What is the expected forward exchange rate 1 year from now? c. If Solitaire undertakes the project, what is the net present value and rate of return of the project for Solitaire

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts