Question: How do the results compare between years (when available)? Better or worse and why? L1 vi XVfx A B C D E F G H

- How do the results compare between years (when available)? Better or worse and why?

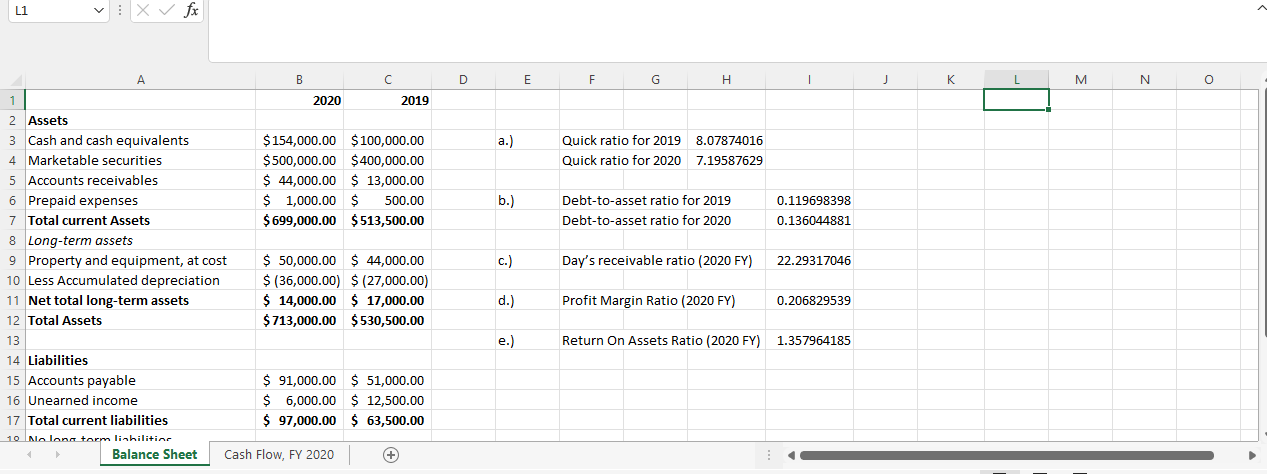

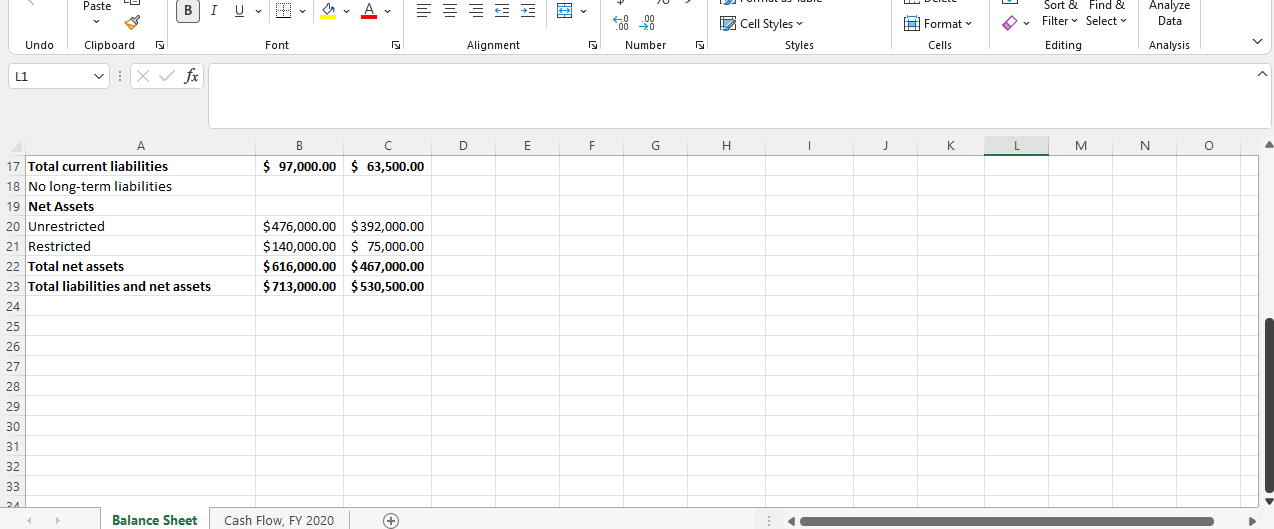

L1 vi XVfx A B C D E F G H J K L M N O 2020 2019 Assets W N Cash and cash equivalents $ 154,000.00 $ 100,000.00 a.) Quick ratio for 2019 8.07874016 Marketable securities $500,000.00 $400,000.00 Quick ratio for 2020 7.19587629 Accounts receivables $ 44,000.00 $ 13,000.00 Prepaid expenses $ 1,000.00 500.00 b.) Debt-to-asset ratio for 2019 0.119698398 Total current Assets $ 699,000.00 $ 513,500.00 Debt-to-asset ratio for 2020 0.136044881 8 Long-term assets Property and equipment, at cost $ 50,000.00 $ 44,000.00 C.) Day's receivable ratio (2020 FY) 22.29317046 10 Less Accumulated depreciation $ (36,000.00) $ (27,000.00) 11 Net total long-term assets $ 14,000.00 $ 17,000.00 d.) Profit Margin Ratio (2020 FY) 0.206829539 12 Total Assets $ 713,000.00 $ 530,500.00 13 e.) Return On Assets Ratio (2020 FY) |1.357964185 14 Liabilities 15 Accounts payable $ 91,000.00 $ 51,000.00 16 Unearned income $ 6,000.00 $ 12,500.00 17 Total current liabilities $ 97,000.00 $ 63,500.00 10 Alo long form lishilition Balance Sheet Cash Flow, FY 2020 (+Paste B IU Y Sort & Find & Analyze .00 Cell Styles ~ Format Filter * Select v Data Undo Clipboard Font Alignment Number Styles Cells Editing Analysis L1 A B C D E F G H I J K L M N O 17 Total current liabilities $ 97,000.00 $ 63,500.00 18 No long-term liabilities 19 Net Assets 20 Unrestricted $476,000.00 $ 392,000.00 21 Restricted $ 140,000.00 $ 75,000.00 22 Total net assets $ 616,000.00 $ 467,000.00 23 Total liabilities and net assets $ 713,000.00 $ 530,500.00 24 25 26 27 28 29 30 31 32 33 Balance Sheet Cash Flow, FY 2020 +

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts