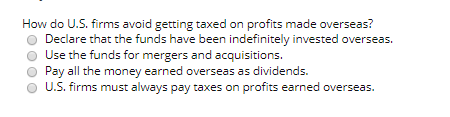

Question: How do U.S. firms avoid getting taxed on profits made overseas? Declare that the funds have been indefinitely invested overseas. Use the funds for mergers

How do U.S. firms avoid getting taxed on profits made overseas? Declare that the funds have been indefinitely invested overseas. Use the funds for mergers and acquisitions. Pay all the money earned overseas as dividends. U.S. firms must always pay taxes on profits earned overseas

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock