Question: How do we arrive to the answer shown in red for this question? Please describe and show work and steps. Thanks! 5. Minimum Required Return

How do we arrive to the answer shown in red for this question?

Please describe and show work and steps.

Thanks!

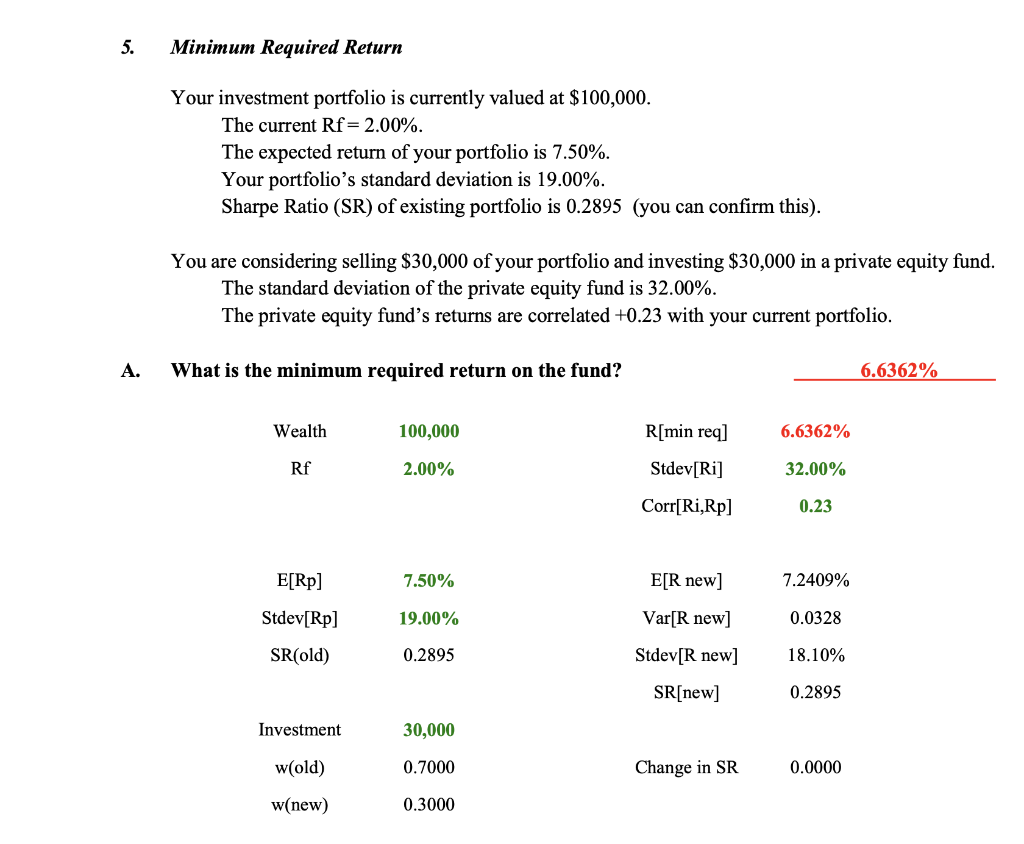

5. Minimum Required Return Your investment portfolio is currently valued at $100,000. The current Rf= 2.00%. The expected return of your portfolio is 7.50%. Your portfolio's standard deviation is 19.00%. Sharpe Ratio (SR) of existing portfolio is 0.2895 (you can confirm this). You are considering selling $30,000 of your portfolio and investing $30,000 in a private equity fund. The standard deviation of the private equity fund is 32.00%. The private equity fund's returns are correlated +0.23 with your current portfolio. A. What is the minimum required return on the fund? 6.6362% Wealth 100,000 6.6362% R[min req] Stdev[Ri] Rf 2.00% 32.00% Corr[Ri,Rp] 0.23 E[Rp] 7.50% E[R new] 7.2409% Stdev[Rp] 19.00% Var[R new] 0.0328 SR(old) 0.2895 Stdev[R new] 18.10% SR[new] 0.2895 Investment 30,000 w(old) 0.7000 Change in SR 0.0000 w(new) 0.3000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts