Question: how do we do this question with excel? can u show the formulas used and steps? 2. Analysis of an expansion project Companies invest in

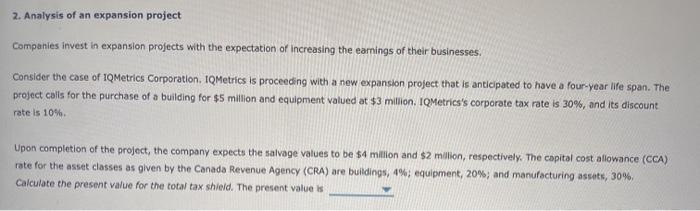

2. Analysis of an expansion project Companies invest in expansion projects with the expectation of increasing the earnings of their businesses, Consider the case of 1QMetrics Corporation. IQMetrics is proceeding with a new expansion project that is anticipated to have a four-year life span. The project calls for the purchase of a building for $5 million and equipment valued at $3 million. IQMetries's corporate tax rate is 30%, and its discount rate is 10% Upon completion of the project, the company expects the salvage values to be $4 million and $2 million, respectively. The capital cost allowance (CCA) rate for the asset classes as given by the Canada Revenue Agency (CRA) are buildings, 4% equipment, 20%, and manufacturing assets, 30% Calculate the present value for the total tax shield. The present value is 2. Analysis of an expansion project Companies invest in expansion projects with the expectation of increasing the earnings of their businesses, Consider the case of 1QMetrics Corporation. IQMetrics is proceeding with a new expansion project that is anticipated to have a four-year life span. The project calls for the purchase of a building for $5 million and equipment valued at $3 million. IQMetries's corporate tax rate is 30%, and its discount rate is 10% Upon completion of the project, the company expects the salvage values to be $4 million and $2 million, respectively. The capital cost allowance (CCA) rate for the asset classes as given by the Canada Revenue Agency (CRA) are buildings, 4% equipment, 20%, and manufacturing assets, 30% Calculate the present value for the total tax shield. The present value is

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts