Question: How do we get to the correct answer? Here, we're contemplating a new automatic surveillance system to replace our current contract security system. It will

How do we get to the correct answer?

How do we get to the correct answer?

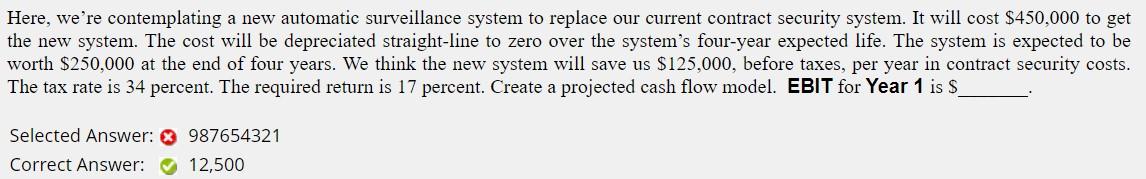

Here, we're contemplating a new automatic surveillance system to replace our current contract security system. It will cost $450,000 to get the new system. The cost will be depreciated straight-line to zero over the system's four-year expected life. The system is expected to be worth $250,000 at the end of four years. We think the new system will save us $125,000, before taxes, per year in contract security costs. The tax rate is 34 percent. The required return is 17 percent. Create a projected cash flow model. EBIT for Year 1 is $ Selected Answer: Correct Answer: 987654321 12,500

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts